General Coverage Insurance Definition

It doesnt cover employees and contractors of your business who are generally covered by Workers Compensation insurance. Top advantages of general insurance plans.

Insurance Definitions Features

If a complaint goes to court your insurance benefits would pay for your legal fees and for damages awarded to the plaintiff.

General coverage insurance definition. Personal lines commercial lines and London market. The defined terms and coverage provisions in your policy or certificate of insurance such as Reasonable and Customary may be. In the United Kingdom insurance is broadly divided into three areas.

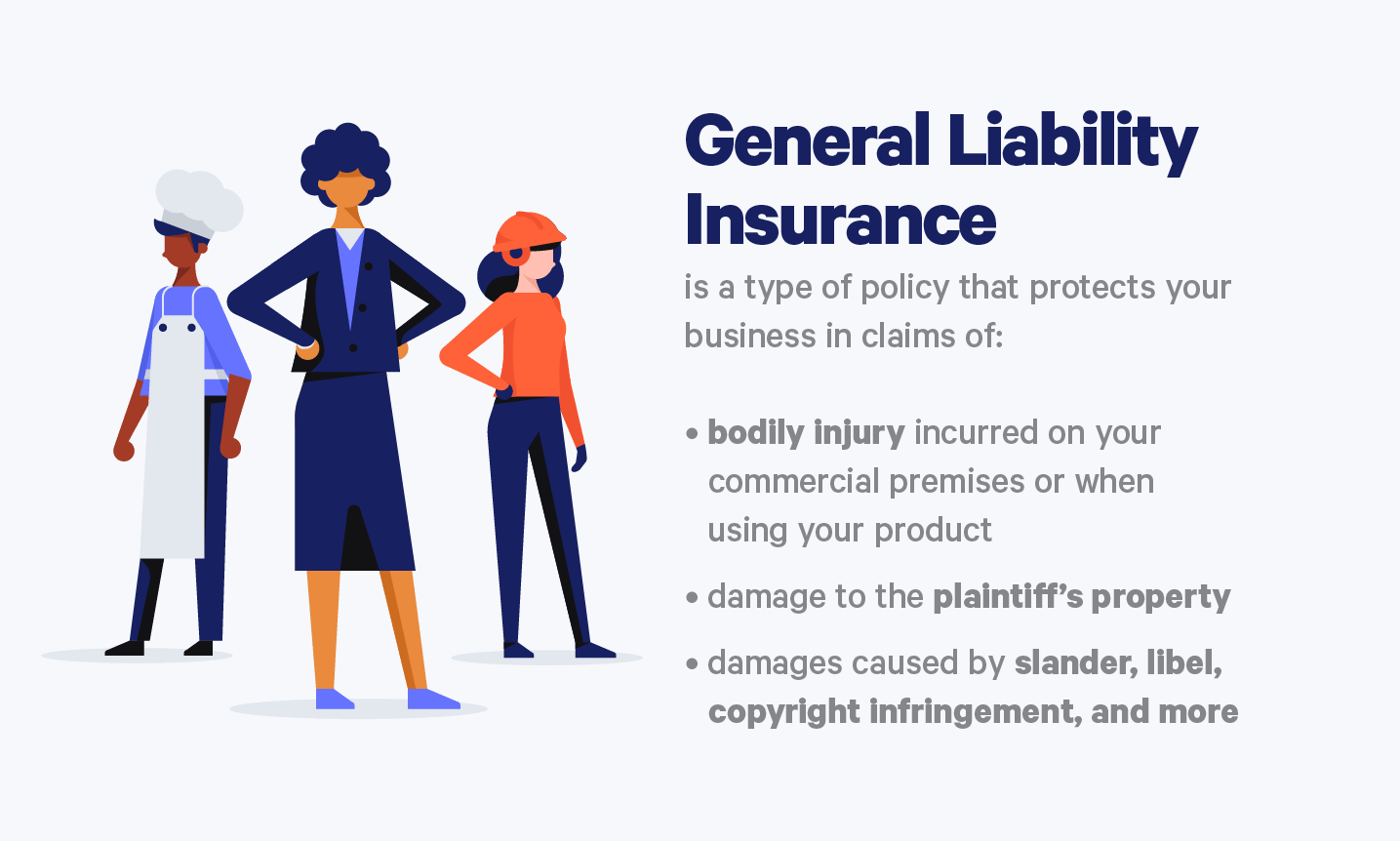

A policy or agreement between the policyholder and the insurer which is considered only after realization of the premium. Commercial general liability CGL is a form of comprehensive insurance that offers coverage in case of damage or injury caused by a businesss operations or products or on its premises. General liability insurance is defined as insurance protection for third-party property damage or personal advertising injuries allegedly caused by you or an employee.

General liability exclusions. Also called small business liability insurance or commercial liability insurance general liability insurance protects your business against claims. General Liability insurance covers you against third-party lawsuits brought against you by anyone who is a third-party.

Primary Insurance Insurance that must be maintained as a condition of. The general liability insurance definition refers to a plan that insures your business against lawsuits due to bodily injury personal injury property loss or advertising injury. This coverage is also known as commercial general liability insurance CGL.

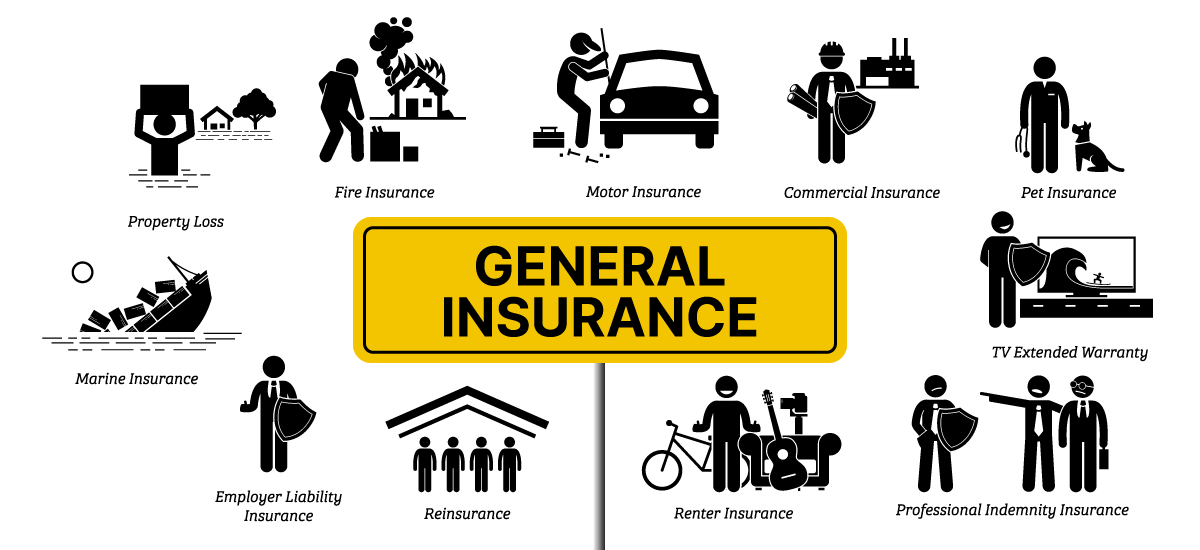

The different forms of general insurance are fire marine motor accident and other miscellaneous non-life insurance. If due to a contingency which is covered under the plan there is an economic loss the loss is compensated by general insurance policies. A general insurance compensates you for financial loss due to liabilities related to your house car bike health travel etc.

Definition of General Insurance Definition. It is called property and casualty insurance in the United States and Canada and non-life insurance in Continental Europe. Please refer to your policy or certificate of insurance for exact definitions of terms and coverage provisions.

The price of the insurance policy that the insured pays in exchange for insurance coverage. A general insurance is a contract that offers financial compensation on any loss other than death. Whether youre interested in homeowners insurance flood insurance or jewelry insurance this guide provides all the knowledge you need to begin comprehending all the important details written in your contract.

Group health insurancea coverage plan offered by an employer or other organization that covers the individuals in that group and their dependents under a single policy. What Does General Liability Insurance Cover. What is a General Insurance.

Basically in India insurance business has been categorized as Life Insurance business General Insurance Business. The truth is liability insurance is an essential part of an insurance plan. General liability insurance coverage is.

An insurance policy that provides coverage for an employers two key exposures arising out of injuries sustained by employees. Other names for this coverage include commercial general liability insurance CGL and business liability insurance. When shopping for insurance understanding insurance policy terms and definitions is invaluable to guarantee youre making the right decision when it comes to your coverage needs.

General insurance is typically defined as any insurance that is not determined to be life insurance. A wool growers floater is a type of inland marine. Coverage or more specifically insurance coverage is the amount of protection in terms of a sum of money that an insurance company provides to an insured person whereby in the event of risk or risks insured against take place such as death or accident the policyholder or a designated beneficiary or beneficiaries shall receive an indemnification or payment up to the extent of the loss.

What is general insurance. General liability insurance is a type of business insurance that helps cover claims that your company caused. The insurer will protect the insured from the financial liability in case of loss.

General insurance is the insurance of assets financial assets included. The premium is paid by the insurer who has a financial interest in the asset covered. A type of insurance policy that provides coverage for sheep owners and to warehouse owners who store and transport wool.

Part One of the policy covers the employers statutory liabilities under workers compensation laws and Part Two of the policy covers liability arising out of employees work-related injuries that do not fall under the workers compensation statute. General liability insurance secures your businesss financial assets when you are involved in litigation due to an. The policy pays on behalf of the insured notice it does not say named insured Coverage applies only when the insured is legally obligated for damage or injury.

Under the standard commercial general liability CGL policy such coverage is limited to liability assumed in any of a number of specifically defined insured contracts or to liability that the. The policy pays only for injury and damage claims to which the insurance applies. Health Maintenance Organization HMO plan a health care financing and delivery system that provides comprehensive health care services for enrollees in a particular geographic area.

Insurance that covers life of human is known as life insurance where as everything under they sky that is insured by General insura. General liability insurance GLI can help cover claims that your business caused bodily injury or property damage. Insurance contracts that do not come under the ambit of life insurance are called general insurance.

It insures everything apart from life. These general definitions are provided for educational purposes. Insurance that covers liability of the insured assumed in a contract.

And they dont just want to know what it is they want to know if they need it. How commercial general liability insurance protects your business.

Workers Compensation For Self Employed Contractors The Hartford

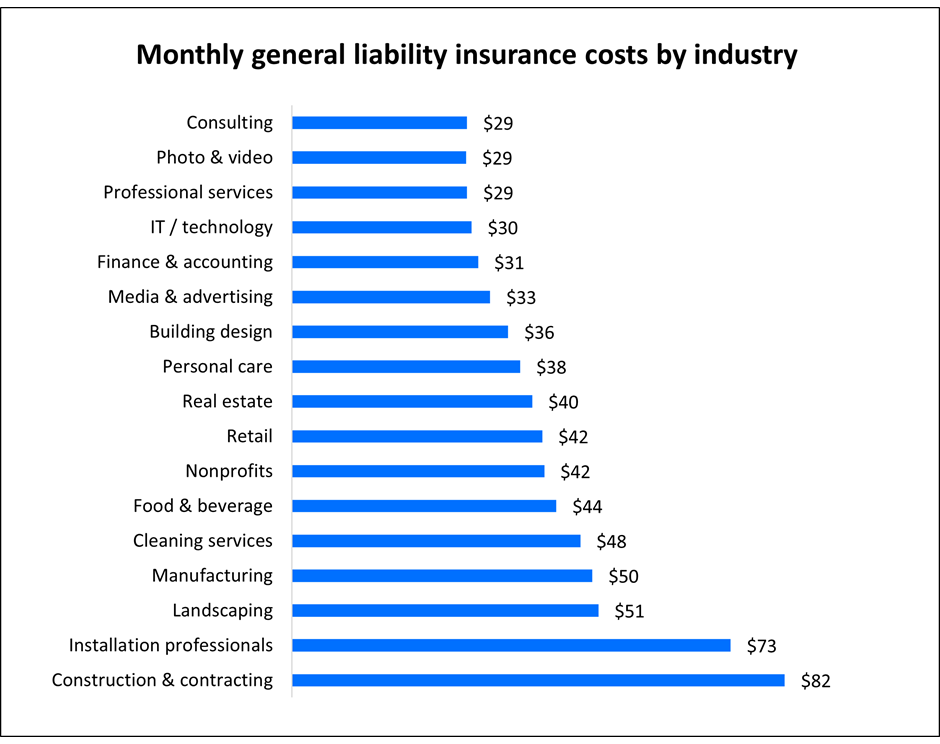

General Liability Insurance Cost Insureon

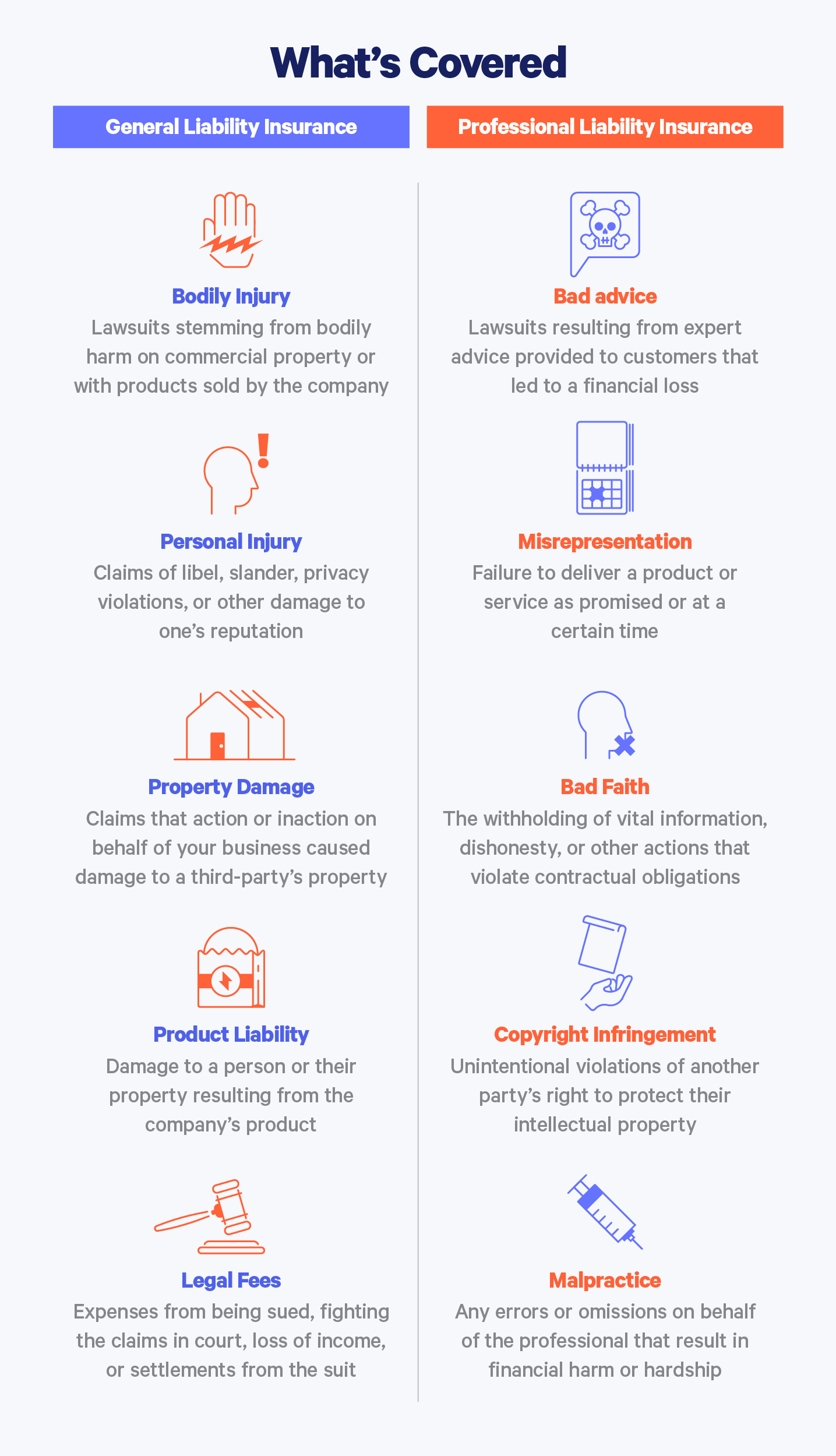

General Liability Vs Professional Liability Insurance Coverage Embroker

Non Life Insurance Policy Types Features And Benefits

Get In Touch With Us For Professionalliabilityinsurance That Will Help All The Professionals Includi Business Insurance General Liability Liability Insurance

How Public Liability Insurance Differs From General Liability Insurance U S Risk

What Is Od Tp Comprehensive Zero Depth Motor Insurance Sgi

Commercial General Liability Quotes Quotesgram

Comprehensive General Liability Insurance What Is It Insureon

General Liability Vs Professional Liability Insurance Coverage Embroker

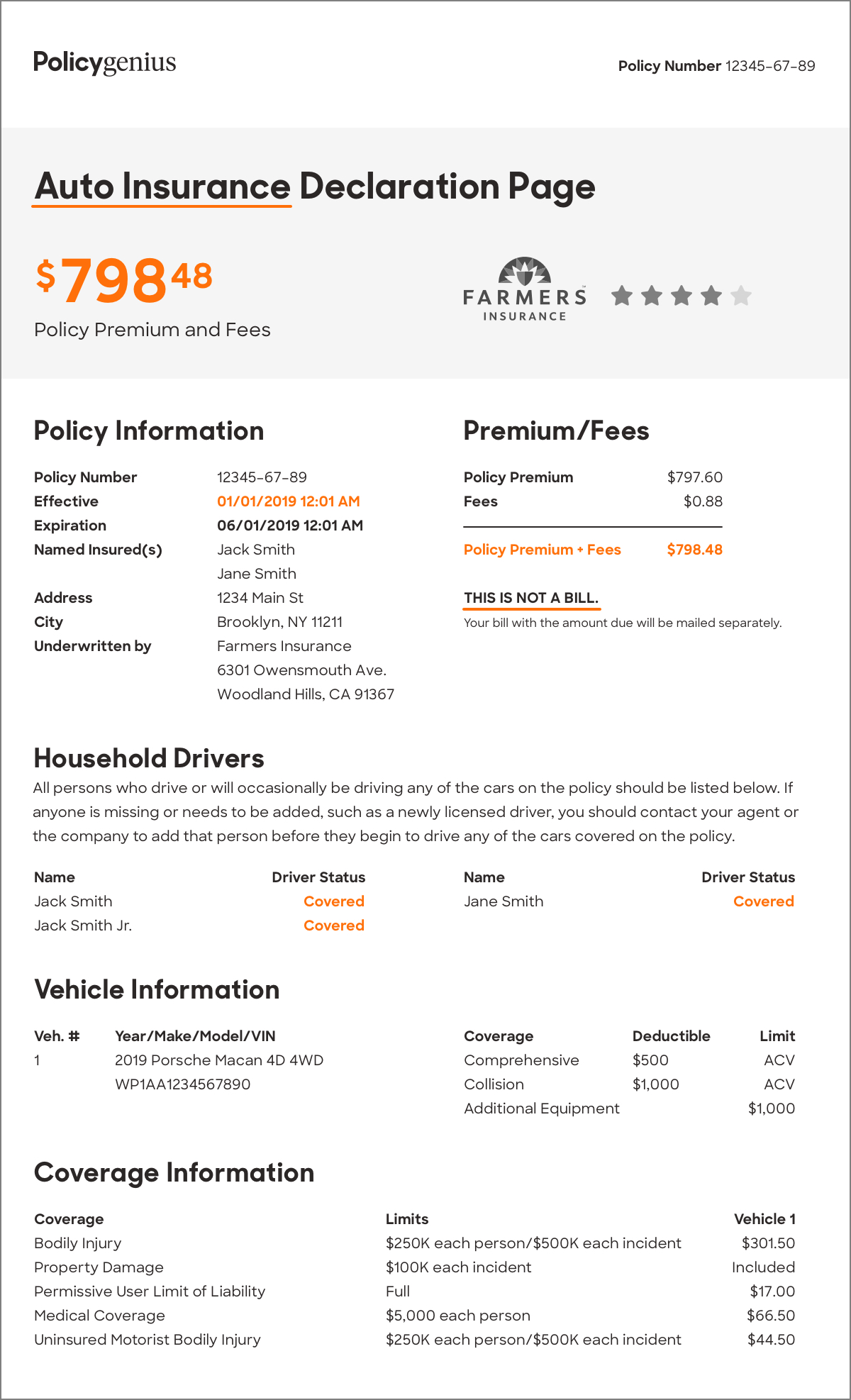

Understanding Your Car Insurance Declarations Page Policygenius

What Is General Liability Insurance Nationwide

What Does General Liability Insurance Cover The Hartford

What Does General Liability Insurance Cover The Hartford

General Liability Vs Professional Liability Insurance Coverage Embroker

General Liability Vs Professional Liability Insurance Coverage Embroker

What Is Dwelling Coverage Insuropedia By Lemonade

/GettyImages-1141164585-a0d6f756cc6646f79638989d4fbbe59e.jpg)

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

Posting Komentar untuk "General Coverage Insurance Definition"