Which Banks Are Not Covered Under Dicgc

All commercial banks including branches of foreign banks functioning in India local area banks and regional rural banks are insured by the DICGC. In case of more than one account in the same bank whether its a combination of savings and fixed deposit account or the same type of accounts the insurance coverage will be paid a total of Rs.

Dicgc Increases Insurance Coverage Bank Deposits To 5 Lakhs Guide Faq

Besides Only primary cooperative societies are not insured by the DICGC.

Which banks are not covered under dicgc. However government and inter-bank deposits are not covered. The corporation covers all commercial and co-operative banks except in Meghalaya Chandigarh Lakshadweep and Dadra and Nagar Haveli. No Primary Co-operative societies bank is covered under DICGC schemes.

The deposit insurance scheme is mandatory for all banks. All Regional Rural Bank which is functioning in India also be covered under DICGC. 1 Deposits of a foreign government.

As per the report the number of registered insured banks stood at 2058 as on March 31 2021. 5 lakh and not. Deposits of CentralState Governments.

It was established on 15 July 1978 under the Deposit Insurance and Credit Guarantee Corporation Act 1961 for the purpose of providing insurance of deposits and guaranteeing of credit facilities. What is covered under DICGC. According to the DICGC Act if the funds are under various forms of possession or are placed in different banks they will be individually insured.

Except the following types of deposits. DICGC insures all bank deposits such as saving fixed current recurring deposit for up to the limit of Rs. Ownership here means bank accounts opened as individual as a partner of a firm as guardian for someone as director of a company jointly etc.

It also include Indian Banks which is functioning outside India will also be covered under this Act. Primary co-operative societies are not covered. About 92 per cent of deposit accounts of the entire banking system are fully protected under DICGC involving 28 per cent of the entire deposit amount of 120 lakh crore.

All State Central and Primary cooperative banks also called urban cooperative banks functioning in States Union Territories which have amended the local Cooperative Societies Act empowering the Reserve Bank of. 2 Deposits of Central or State Government. 100000 of each deposits in a bank.

5 lakh for your deposits in Kotak Mahindra Bank. Currently all co-operative banks are insured by DICGC. Banks covered by Deposit Insurance Scheme are.

One of the most important functions of DICGC is to provide insurance to the deposits in banks. Please note that the primary cooperative societies are not insured by the DICGC. All Deposits such as savings fixed current recurring etc are normally insured by DICGC except for the deposits which are specifically mentioned below.

DICGC will pay you Rs. It also covers the insurance of foreign banks which is running in India also be covered under DICGC. All commercial banks including branches of foreign banks functioning in India local area banks and regional rural banks are insured by the DICGC.

Which banks are insured by the DICGC. Deposits of foreign Governments. District Central Co-op banks.

DICGC insures all bank deposits such as saving fixed current recurring etc. Read Compare Best Fixed Deposit Rate By Banks. Government and inter-bank deposits are not covered.

45 lakh for your deposits in Yes Bank and Rs. What if there is more than one account in the same bank. 11 rows Public Sector Banks.

500000 of each depositor in a bank. Deposit insurance provided by the DICGC covers all insured commercial banks including LABs PBs SFBs RRBs and co-operative banks. DICGC insures all bank deposits such as saving fixed current recurring deposit for up to the limit of Rs.

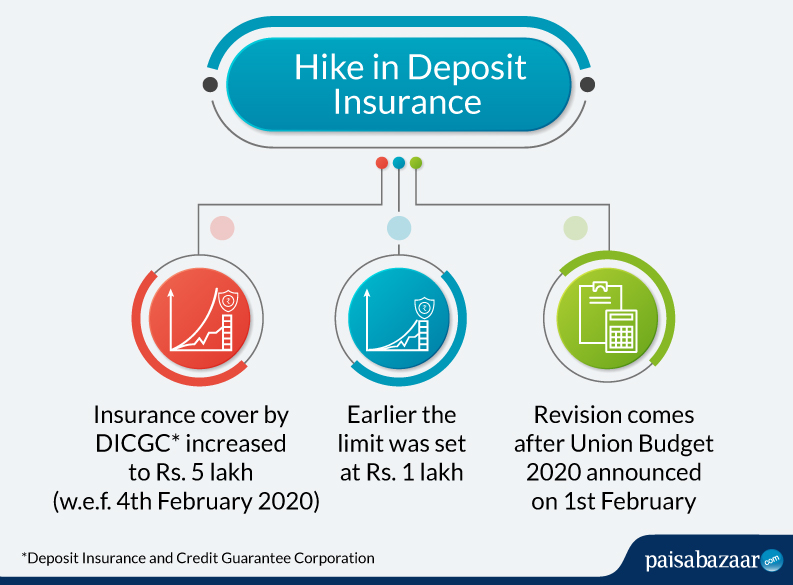

Cooperative banks from Meghalaya Chandigarh Lakshadweep Dadra Nagar Haveli. How is Ownership of Accounts determined. With a view to providing a greater measure of protection to depositors in banks the DICGC raised the limit of insurance cover for depositors in insured banks from the present level of Rs 1 lakh to Rs 5 lakh per depositor with effect from 4 th February 2020 with the approval of Government of India.

All types of deposits like savings deposits term deposits and RDs are covered by DICGC. There is a few exception which is listed below Primary Agricultural Credit Society. RBI data shows that all bank accounts are covered under DICGC only 28 of the total number of bank deposits are covered under deposit insurance.

DICGC covers all deposits made under savings Ac current ac FD ac and RD ac except the following. Deposits of the State Land Development Banks with the State co-operative banks. List of banks insured by the DICGC.

At present all the co-operative banks other than those from the Union Territories of Chandigarh Lakshadweep the State of Meghalaya and Dadra and Nagar Haveli. Banks Insured by DICGC. No insured banks can withdraw themselves from the DICGC coverage.

At present all co-operative banks are covered by the DICGC. Only Primary Cooperative Societies are not covered under DICGC. Primary Agricultural Credit Society Cooperative banks from Meghalaya Chandigarh Lakshadweep Dadra Nagar Haveli are some of the exception which are not covered by DICGC.

Types of Deposits Covered. It also covers the insurance of Indian Banks which is functioning outside India. Currently as per the RBI guidelines deposits with all commercial banks and cooperative banks are insured under the Deposit Insurance and Credit Guarantee Corporation DICGC.

Also deposits of the state land development banks with the state co-operative bank are not covered. What exactly does DICGC insure.

Dicgc To Settle Claims If Bank Under Moratorium

Deposit Insurance Dicgc How Far Your Fixed Deposits Are Safe

Dicgc To Pay Up To 5 Lakh To Account Holders Of 21 Insured Banks

Deposit Insurance And Credit Guarantee Corporation Dicgc Fundstiger Fast Loans For India

Dicgc Asks 21 Stressed Cooperative Banks To Prepare List Of Account Holders As Mandate Under New Rule

Dicgc Asks 21 Stressed Cooperative Banks To Prepare List Of Account Holders The New Indian Express

Are You Aware That Banks Are Insured Under Dicgc Here Are 5 Things To Know The Financial Express

Depositors To Get Up To Rs 5 Lakh Within 90 Days If Bank Under Moratorium Business Standard News

Explainer What Is The Insurance Cover On Your Bank Deposits

Dicgc Deposit Insurance Coverage Increased To Rs 5 Lakh I Paisabazaar

Dicgc A Depositor S Confidence

Deposit Insurance And Credit Guarantee Corporation Dicgc

If A Bank Closes What Happens To The Deposits Dicgc Getmoneyrich

6 Features Of New Dicgc Bill Faceless Compliance

Depositors In Stressed Banks To Get Insurance Money Within 90 Days Of Moratorium Business News

Dicgc To Pay Upto Rs 5 Lakh To These Account Holders Check Full List Of Banks Last Date To File Claim The Financial Express

Posting Komentar untuk "Which Banks Are Not Covered Under Dicgc"