Does Normal Insurance Cover Covid 19

All this comes as Covid-19 uncertainty continues to make travel insurance an essential when going abroad. Health insurance policies cover all kinds of respiratory diseases which means they cover coronavirus provided the affected person does not have COVID-19 at the time of the purchasing the policy.

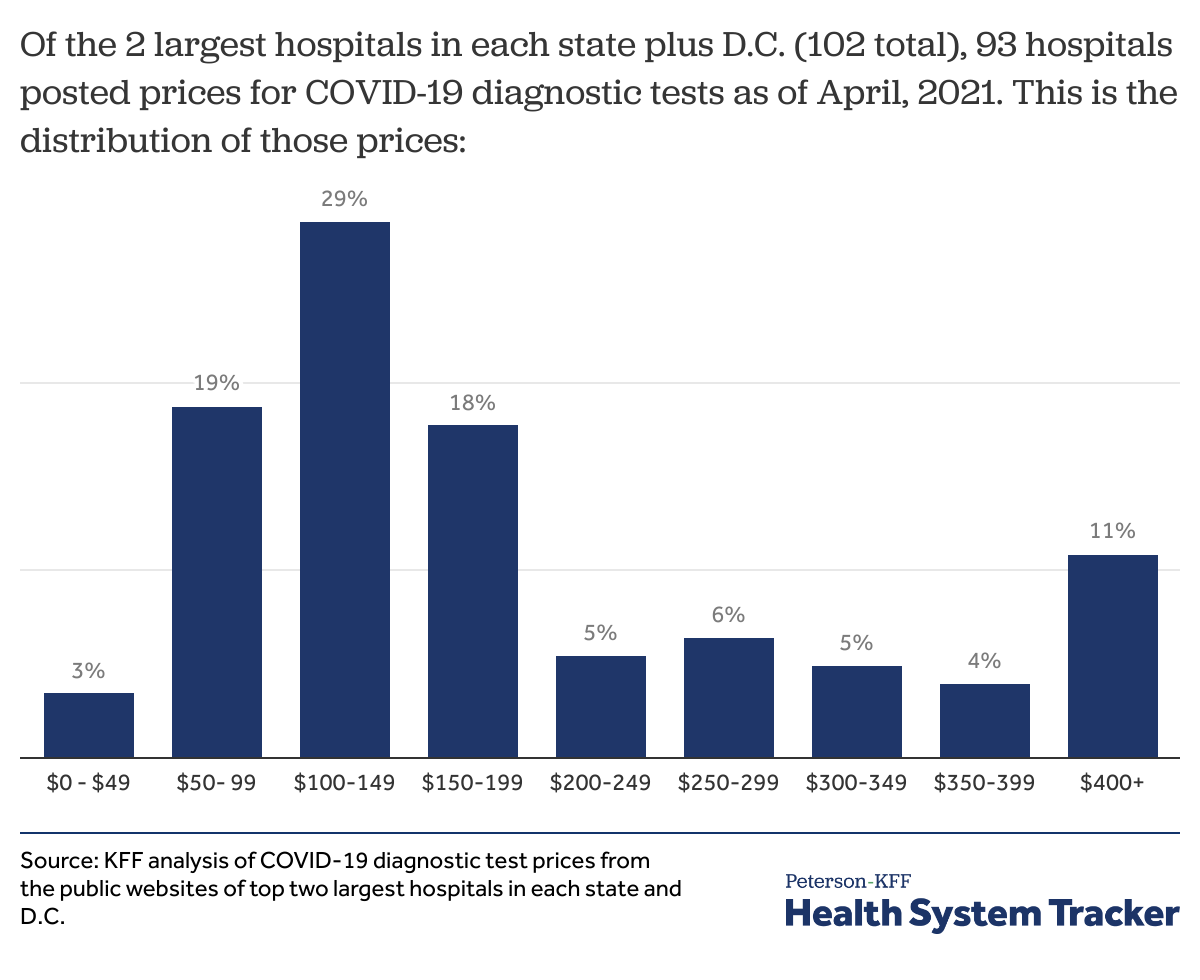

Covid 19 Test Prices And Payment Policy Peterson Kff Health System Tracker

Health Insurance and Its Role During COVID-19 Outbreak.

Does normal insurance cover covid 19. Our experts reviews will. If you get COVID-19 and need help you can be covered as long as youve declared your pre-existing medical conditions. To help you work through this new normal weve created this useful guide to answer your questions about coronavirus and travel insurance.

This includes any in-hospital treatment that may be required as a result of rare adverse reactions to COVID-19 vaccinations. However this health insurance has a standard waiting period. However we are pleased to announce the introduction of our Epidemic Coverage Endorsement to certain plans purchased on or after March 6 2021.

Some insurers have also announced cover for travelling to New Zealand now that that option has been available since 18 April for eligible travellers. What Travel Insurance Does Not Cover Related to COVID-19. If you contract COVID-19 and would like to be treated as a private patient you can use your private health insurance.

Private health insurance companies will likely cover COVID-19 vaccines the same as other preventive services. Coverage will be available in all products that offer hospitalisation cover. If you negotiate a rental decrease with a tenant for a certain period of time then this decrease will need to be.

Your claim will also be limited by the maximum sum insured by your health insurance policy. If you are not hospitalised for at least 24 hours. Also if you have a health insurance policy for a specific illness like cancer heart ailments critical illness cover etc they do not offer a cover for COVID-19 treatment.

Does my existing health insurance cover Coronavirus-related ailments. Some travel insurers now offer limited cover for COVID-19. Check with your health insurer if itll cover Covid-19 when its declared a pandemicInsurers are mandated to cover hospitalization as well as quarantine expenses related to coronavirus.

This means youll have cover for cancellation or curtailment as well as emergency medical expenses if youre diagnosed with COVID-19 both at home and on your holiday. Cancelled holidays and insurance The major question that has been asked of insurers is about whether insurance policies will cover the cancelled holidays and flights that were shut down as a result of COVID-19 restrictions. Does my private health insurance cover treatment for COVID-19.

It will likely only cover medical quarantine and cancellation costs if you or someone youre travelling with tests positive to COVID-19. While most health insurance policies in India are providing cover for the coronavirus infection you may not be able to get a claim for its treatment in the following scenarios. We at HDFC ERGO cover hospitalization expenses for Coronavirus under all our health insurance plans subject to all terms and conditions of the policy.

Is testing for Coronavirus covered by the insurance policy. Health insurance plans that cover treatment costs of Coronavirus infection cover you and your family members if you get infected with COVID-19. If you are quarantined due to the Covid-19 outbreak then the general exclusions likely apply and therefore means that you will not be covered.

Standard travel insurance does not cover trip cancellation due to fears or concerns about traveling during the coronavirus pandemic or any other epidemic. The same principles apply. We cover pre-hospitalization expenses.

If you are insured by an ACA marketplace plan or in many cases an employers group health plan your insurer will probably pay 100 of the cost of the COVID-19 vaccine under the essential health benefits rules. The COVID-19 vaccine has been added to the list of recommended vaccines and the CARES Act required private health plans to begin fully covering it within 15 business days much faster than the normal timeframe which can be nearly two years depending on the circumstances between when a preventive care recommendation is made and when insurers have to cover it with no cost-sharing. Of the 40 insurance brands that participated in both surveys and are currently selling policies 16 40 improved their Covid-19 cover while the remaining 24 60 kept their cover the same.

The coverage starts from the day you get diagnosed with COVID-19 infection. Dread disease riders may not apply however. As such our travel insurance plans do not generally cover trip cancellations or interruptions directly or indirectly related to COVID-19.

If you are hospitalized for a minimum of 24 hours for treatment of Covid-19 medical expenses will be covered in standard health insurance policies. But travel insurance is unlikely to cover cancellation if youre not able to travel due to government travel bans. Standard travel insurance will not offer trip cancellation for government mandated travel restrictions either.

Travel insurance providers should still include cover for COVID-19 even if you have pre-existing medical conditions as long as you declare the condition when you take out the policy. With Covid-19 continuing to spread people are concerned whether their life insurance will pay out if. We analysed insurers levels of covid protection twice in October last year and AprilMay 2021.

Provided the destination is at a Level 3 travel advisory or below and youve received at least one Health Canada approved COVID-19 vaccination 14 days or more prior to your departure you will be covered up to 25 million CAD per insured for emergency medical treatment related to COVID-19 and related complications. Landlord insurance policies generally arent covering rent reductions offered to tenants during COVID-19 because of one simple reason. Life insurance policies will cover deaths from COVID-19 just as they cover deaths from other causes.

Our enhanced COVID-19 cancellation cover above applies to all new policies bought from 29 April 2021 as long as youve had your recommended COVID-19 vaccinations. An investigation of travel insurance policies on Canstars database in April 2021 revealed there are some companies that specifically provide cover related to COVID-19 for domestic travel.

Is Covid 19 A Pre Existing Condition What Could Happen If The Aca Is Overturned Kff

Equinet S Response To Covid 19 Equinet

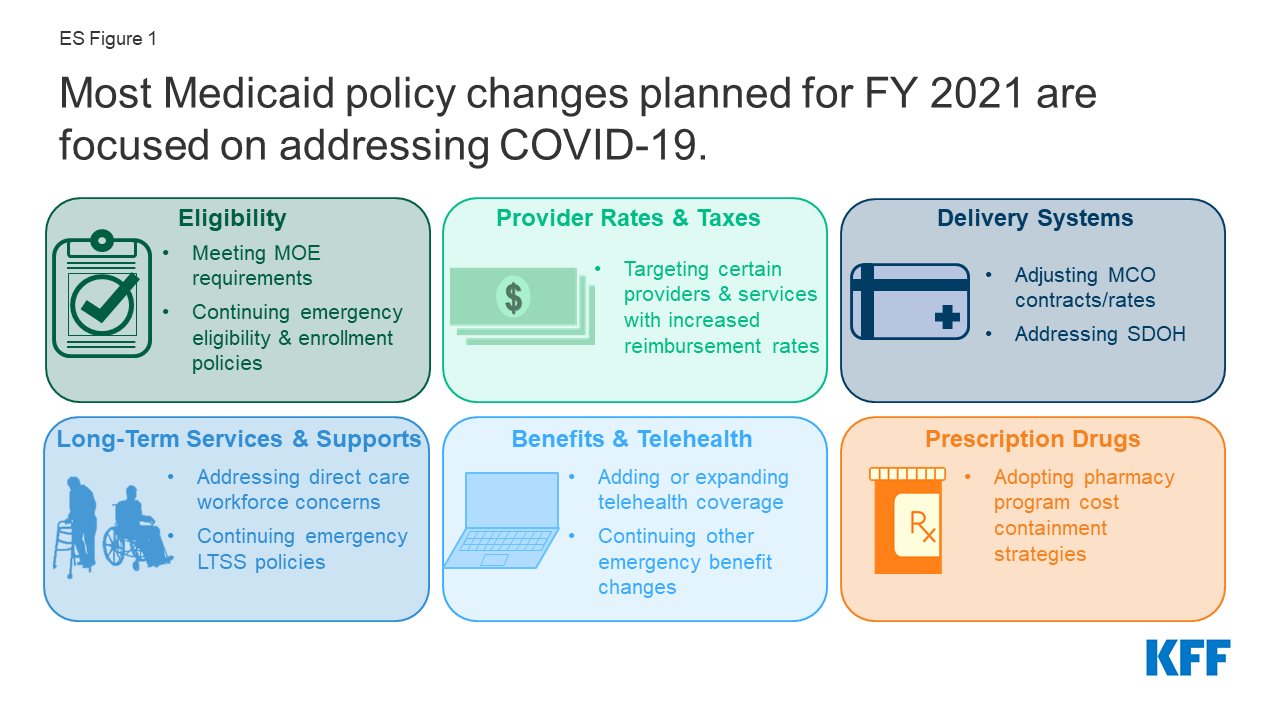

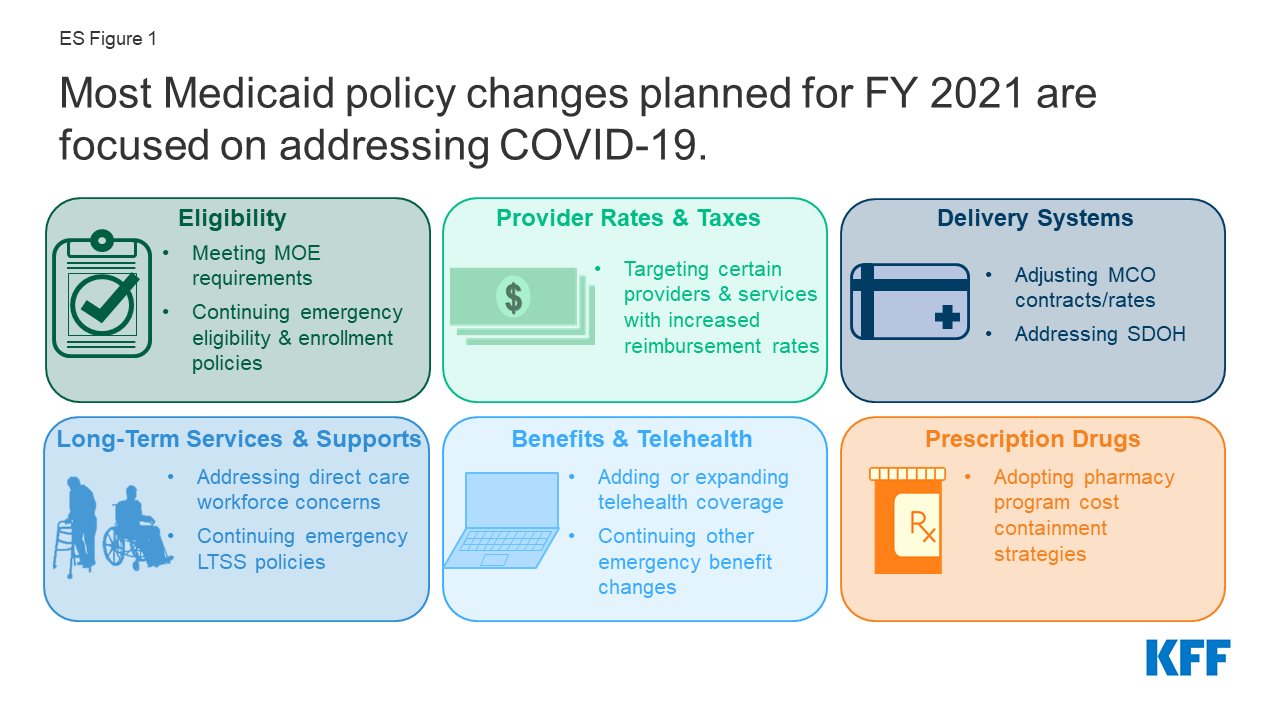

State Medicaid Programs Respond To Meet Covid 19 Challenges Results From A 50 State Medicaid Budget Survey For State Fiscal Years 2020 And 2021 Kff

![]()

National Health Insurance Administration Ministry Of Health And Welfare Taiwan Can Help National Health Insurance S Contribution In Combating Covid 19

Vacunas Contra Covid 19 En El Va Veterans Affairs

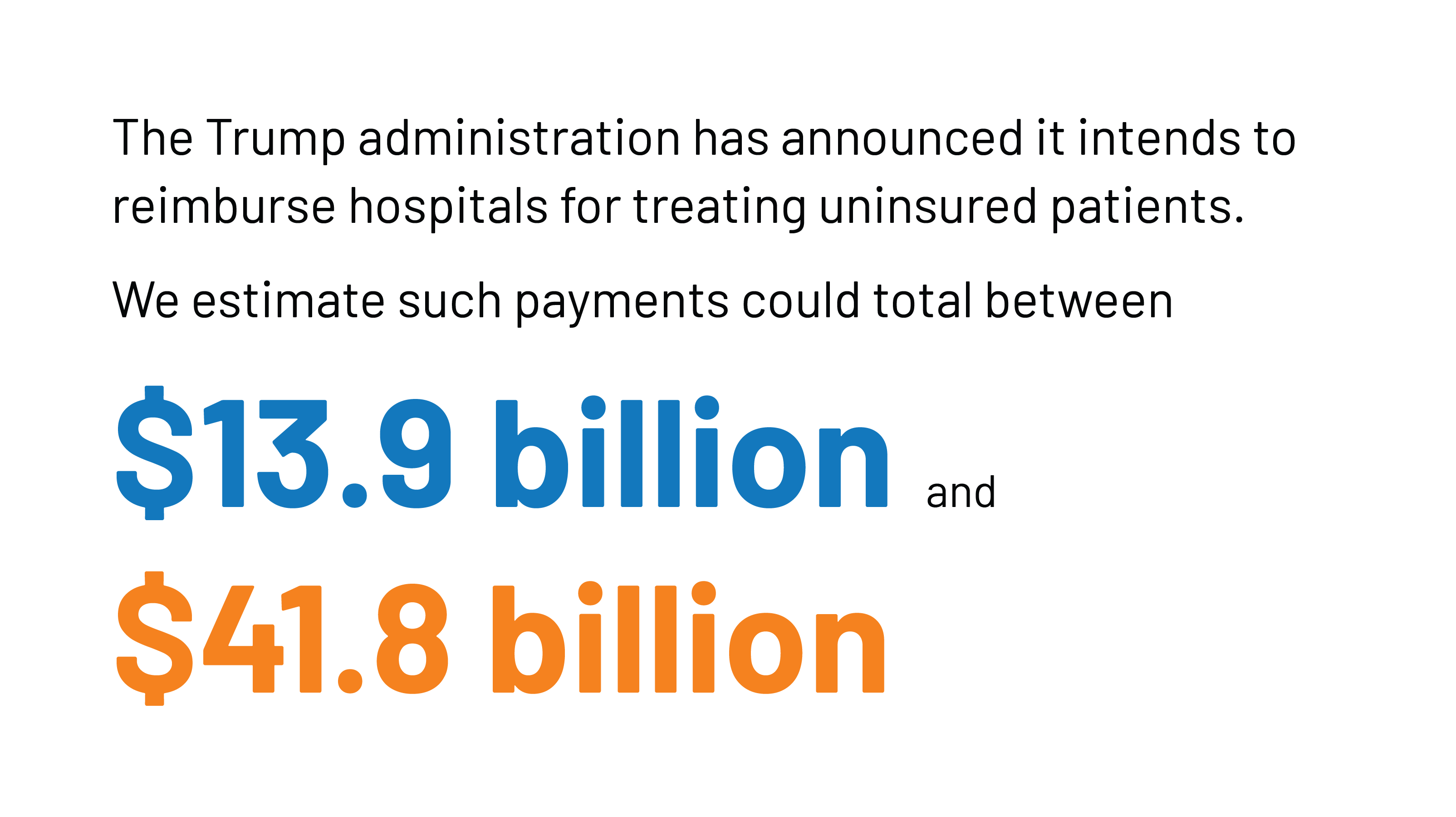

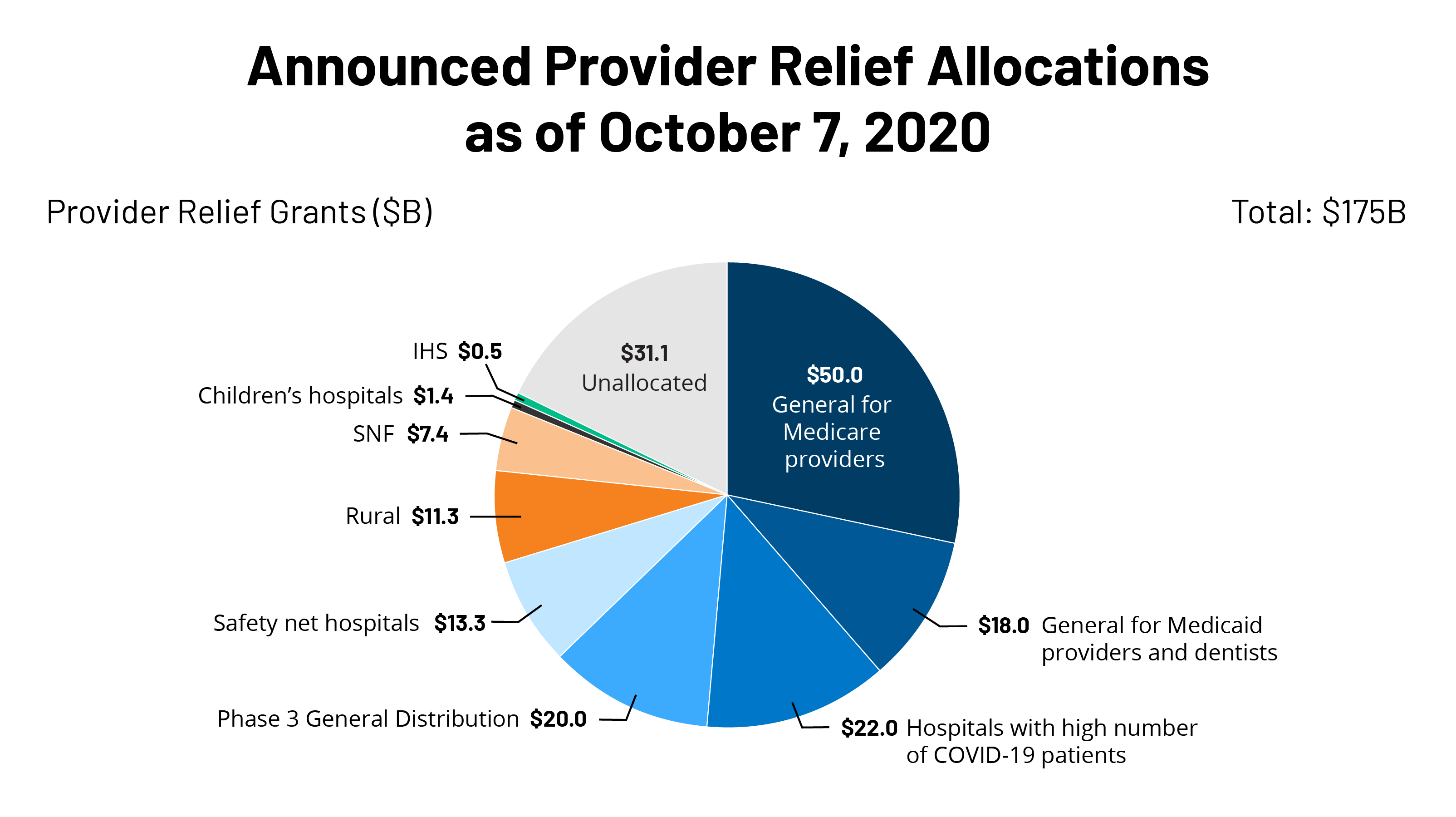

Estimated Cost Of Treating The Uninsured Hospitalized With Covid 19 Kff

Limitations Of The Program For Uninsured Covid 19 Patients Raise Concerns Kff

![]()

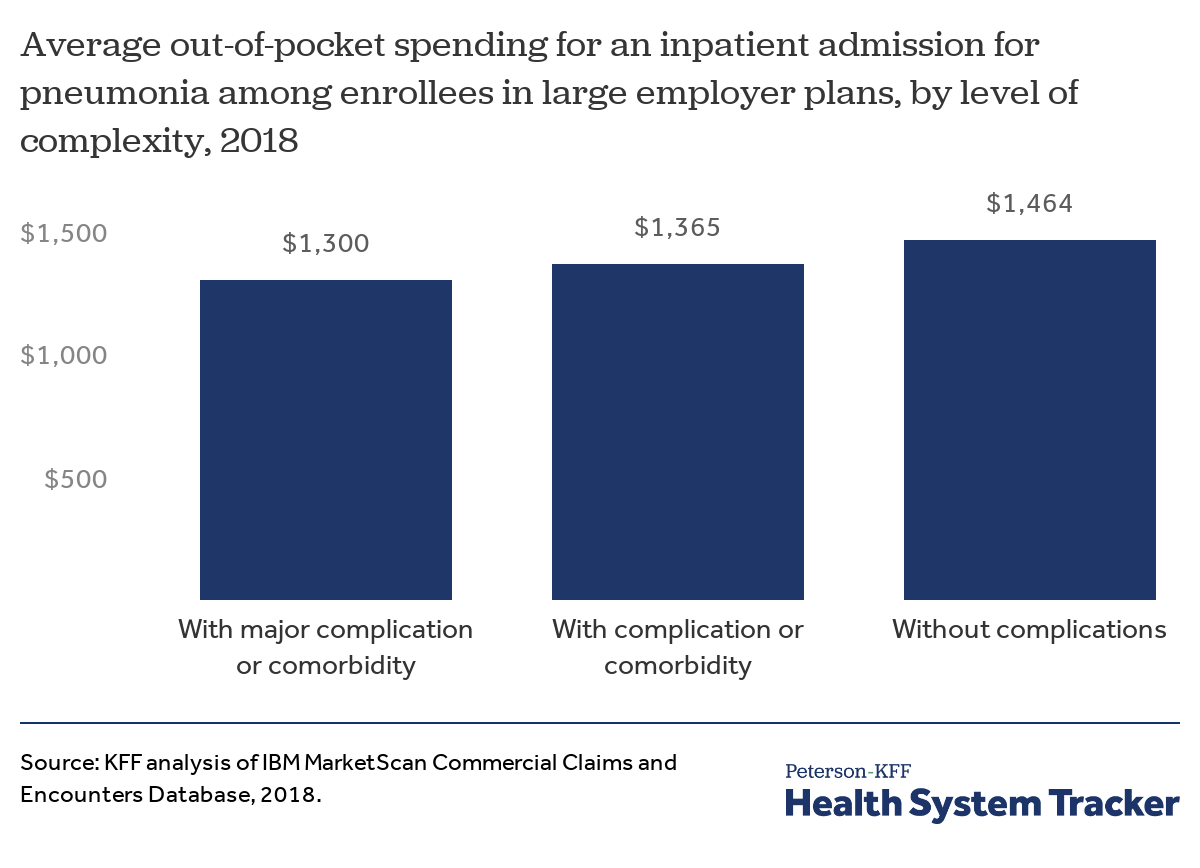

Potential Costs Of Covid 19 Treatment For People With Employer Coverage Peterson Kff Health System Tracker

Key Economic Findings About Covid 19 Bfi

Life After Covid 19 Pandemic Prepare For A Life After Covid 19 Pandemicaegon Life Blog Read All About Insurance Investing

Equinet S Response To Covid 19 Equinet

Potential Costs Of Covid 19 Treatment For People With Employer Coverage Peterson Kff Health System Tracker

Key Economic Findings About Covid 19 Bfi

Equinet S Response To Covid 19 Equinet

![]()

National Health Insurance Administration Ministry Of Health And Welfare Taiwan Can Help National Health Insurance S Contribution In Combating Covid 19

Covid 19 In Latin America And The Caribbean An Overview Of Government Responses To The Crisis

Posting Komentar untuk "Does Normal Insurance Cover Covid 19"