Tail Coverage In Terms Of Insurance

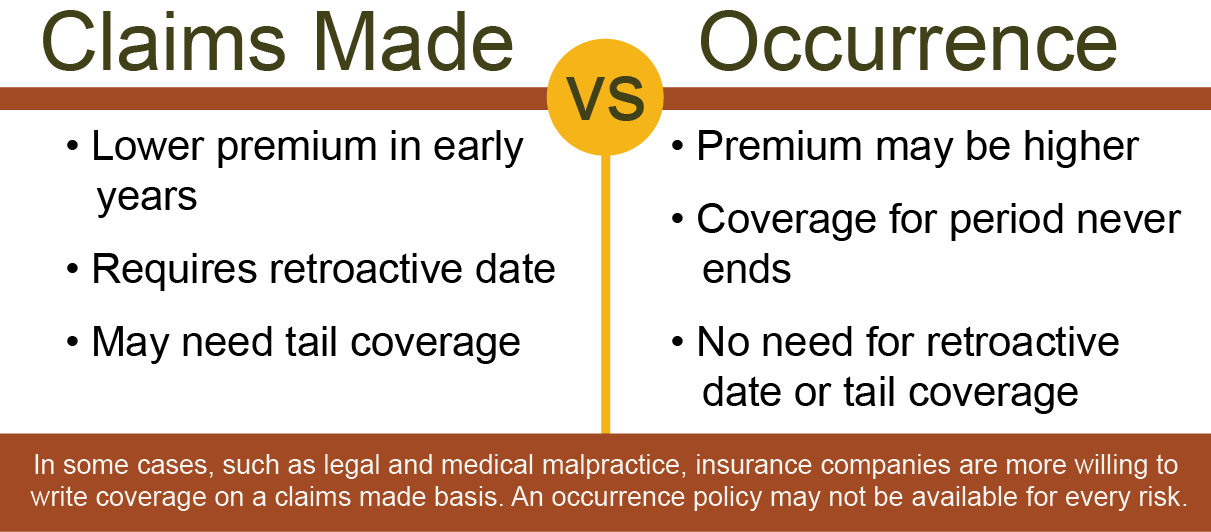

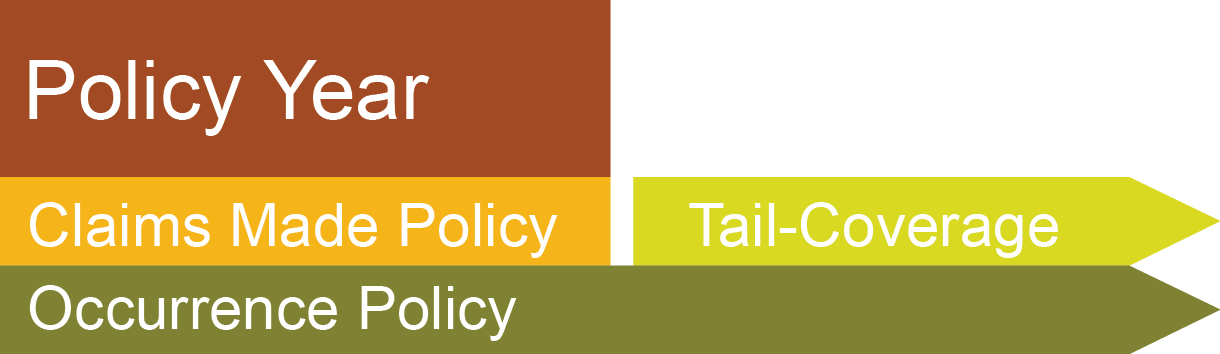

It differs from typical medical malpractice insurance policies which are known as claims-made policies. Tail coverage extends the reporting period of malpractice insurance so that medical practitioners can report a wrongful act even after their malpractice insurance lapsed or was cancelled.

Business Stocks Topstories Tailrisk Tailriskfunds What Are Tail Risk Funds New Investor Study Out Fund Investors Value Investing

In contrast to a standard policy tail coverage provides protection for medical malpractice claims that are reported after the providers policy expired or was cancelled.

Tail coverage in terms of insurance. Tail coverage is a type of insurance that is designed to cover claims arising before the termination of a claims-made insurance policy but which are reported afterwards. With that being said theres those that get tail coverage de facto because theyve had the same insurance carrier for so long. The formal term for this type of coverage is Extended Reporting Period ERP.

Tail coverage requires that the insured pay additional premium. Tail coverage is a provision found within a claims-made policy that permits an insured to report claims that are made against the insured after a policy has expired or been canceled if the wrongful act that gave rise to the claim took place during the expiredcanceled policy. Lawyer Smith may be able to find insurance coverage that will cover claims arising from acts or.

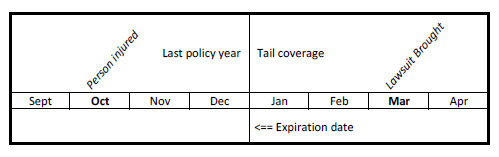

Assume that a claims-made policy with a January 1 2015-2016 term contains tail coverage with a term of January 1 2016-2017. It applies to claims-made insurance policies and typically involves paying your insurer an additional fee. Tail coverage is an endorsement or an addition to your insurance that allows you to file a claim against your policy after it expired or was canceled.

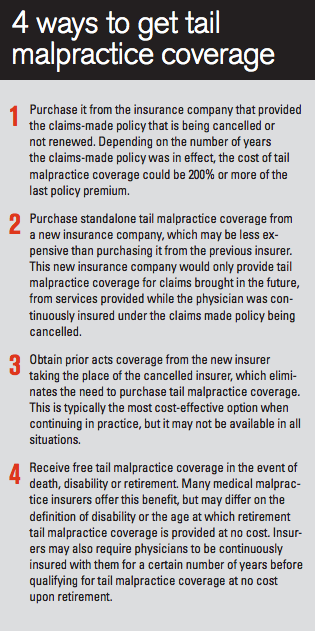

Cost of Tail Coverage. Think of tail coverage as a liability insurance extension plan. Optional Extended Reporting Period Coverage more commonly known as Malpractice Insurance Tail Coverage is an insurance product purchased so that liability coverage extends beyond the end of the policy period of your claims-made medical malpractice insurance coverage.

Tail coverage is meant to address this problem by providing coverage for medical malpractice claims made after an insurance policy has ended. Tail Coverage Insurance. This policy endorsement is also known as an extended reporting period.

However the extension only applies to wrongful acts that happened while the malpractice insurance policy was still in force and it does not apply to wrongful acts that occured after the malpractice. Here is an example of how tail coverage works. Tail claims from workers compensation and liability exposures in a given period can arise for many years thereafter.

What is Tail Coverage. Buyer shall have received evidence that effective as of the Closing Date with the premiums to be paid in full no later than five 5 days after the Closing Date by Seller t. Tail insurance allows you the insured physician to report claims in the future claims which have not been made at the time the tail is purchased after a claims-made policy is terminated.

With tail coverage youre still insured if a claim is filed against you after the policy ends. The Fine Print IMRI provides the following example of how tail coverage insurance works. For example a doctor takes out a malpractice claims-made policy that covers the period from January 1 to December 31 20X1 and which contains tail coverage for an additional.

Namely it can be added to claims-made policies in order to extend coverage for incidents that may have occurred while your policy was still active but were not reported until after your policy expired or was. Tail coverage or tail insurance is a general concept that is utilized to extend the claims made reporting time on claims made policy forms of medical professional liability policies. Liability insurance that extends beyond the end of the policy period of a liability insurance policy written on a claims-made basis.

Tail Coverage A Definition. The aggregate of such incurred but. Tail Coverage a provision found within a claims-made policy that permits an insured to report claims that are made against the insured after a policy has expired or been canceled if the wrongful act that gave rise to the claim took during the expiredcanceled policy.

Malpractice A malpractice insurance rider or supplement to a claims-made policy that provides coverage for an incident that occurred while the insurance was in effect but was not filed by the time the insurer-policyholder relationship terminated. In most cases the new firms insurance policy will by its terms cover only the lawyers acts on behalf of the new firm. Liability claims are often made long after the accident or event that caused the injury.

Doctor As insurance policy is in effect from. Also assume that the insured did not renew the policy when it expired on January 1 2016 2. Tail Insurance or Extended Reporting Period ERP coverage is the mechanism that allows future reporting of claims that have not yet been brought to your attention.

Youll find tail coverage in claims-made policies such as professional liability errors. Definition of Tail coverage. Remember when a claims-made policy ends it must be renewed with prior acts coverage or a tail must be purchased.

Tail coverage can be costly. Tail coverage is an endorsement also called a rider typically found within a claims-made policy such as errors and omissions insurance EO or directors and officers insurance DO. Shopping around for tail coverage later in life especially with a medical or law practice can be problematic.

Tail coverage is a type of policy endorsement that can be purchased to extend certain types of insurance coverage. Many liability policies are written on a claims-made basis which means the insurer pays only. A lawyers exposure.

Also referred to as an extended reporting period tail coverage is an additional feature you might buy after canceling an existing policy or letting one lapse.

What Is Tail Coverage Embroker

Know All About Tail Coverage Before You Take That Job Today S Hospitalist

Editable Physician Assistant Employment Agreement Terms Of Agreement Physician Assistant Emp Contract Template Physician Assistant Continuing Medical Education

Pin By Luz Marina Macias Sierra On Golf Golf Humor Golf Quotes Golf Inspiration

Malpractice Insurance Tail Coverage Do You Need It Leveragerx

What Is Tail Coverage Embroker

The Need For Tail Coverage With Indiana Claims Made Medical Malpractice Insurance

Tail Insurance Faqs Aegis Malpractice Solutions

What Is Tail Coverage Embroker

Dave Ramsey S Homeowner Insurance Homeowners Insurance Refinancing Mortgage Mortgage Loans

Tail Insurance For Medical Malpractice Policies Tail Coverage For Doctors

Do You Need Malpractice Tail Coverage

Tail Insurance Faqs Aegis Malpractice Solutions

Claims Made Prior Acts And Tail Coverage

For Sale New Valenti Led Jdm Taillights Toyota Prius Hybrid Toyota Hybrid Toyota Prius

Tail Coverage What Is It How Does It Work And When Am I Eligible

Established In The Year 1938 United India Insurance Company Offers A Wide Range Of General Insurance Products All Genera Insurance The Unit Insurance Company

Posting Komentar untuk "Tail Coverage In Terms Of Insurance"