Insurance Policy Nose Coverage

As long as you have a policy that covers you back to your retroactive date you do not need tail. This alternative to tail coverage is called nose coverage the colloquial term for prior acts coverage.

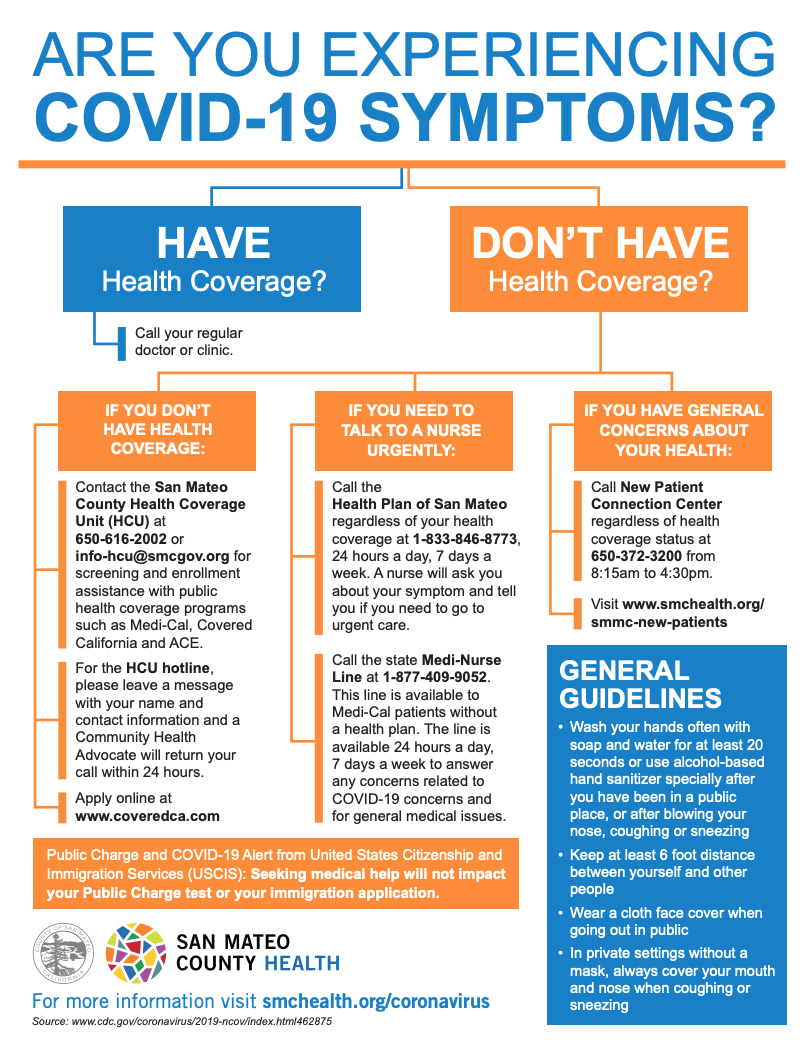

If You Have Symptoms Of Covid 19 But Don T Have Health Insurance San Mateo County Health

Nose coverage is a feature of claims-made insurance that covers a mistake or oversight you made while insured under a previously terminated policy.

Insurance policy nose coverage. This is done by way of a retroactive date on a new or replacement policy. Nose coverage most commonly provides prior acts coverage for insureds who are moving from a claims-made policy to an occurrence policy. Sometimes the coverage for liability from a claims-made policy that has been dropped can be included in your new insurance policy.

What is Tail Coverage. Also known as prior acts coverage it involves your new insurer extending its coverage to something you did in the past while you were insured by another carrier. A new claims-made policy with a retroactive date of June 1 2000 would cover this claim because the retroactive date is prior to the surgery date.

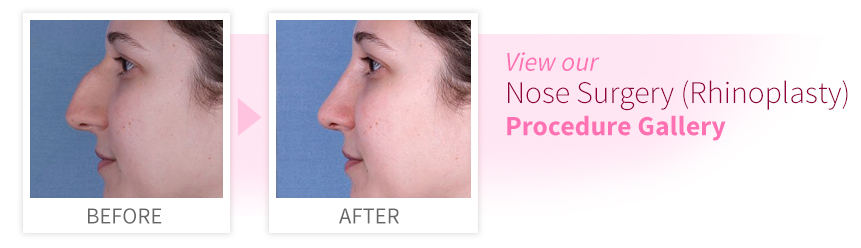

For nose job there are many insurance companies that will analyze the process carefully to ensure that it is not a cosmetic surgery but for breathing problems such as a deviated septum. If your main goal is to change the exterior shape of the nose for cosmetic reasons also known as cosmetic rhinoplasty it is typically not covered by insurance. This simply means that you are asking them to honor the retroactive date shown on your current policy.

Keep asking your agent tough questions and be sure to look up any more unfamiliar terms in our Insurance Terms Glossary. Therefore insurance coverage is applicable only if the insured files a claim with the insurer during the period expressed in the policy. Getting a new insurer in the same state to pick up prior acts is fairly easy changing insurers across state lines.

A nose and a tail are essentially the same thing. Nose Endorsement An endorsement that will provide coverage for incidents that occurred before the inception of the policy. Nose Coverage the period between the inception date and retroactive date in a claims-made liability policy if the specified retroactive date is earlier than the inception date of the policy.

Instead of buying a tail a physician may purchase nose prior acts coverage. Nose coverage involves getting your new insurance carrier to essentially pick up your prior acts. Nose coverage covers incidents that occurred before the beginning of the new insurance relationship but for which no claim has.

Rhinoplasty is a cosmetic procedure and the insurance coverage of this surgery depends very much on the individuals health and his health insurance policy. The trigger of coverage is a claim being made and reported during the policy period. Nose coverage is almost always the cheaper of the two options if available.

What is Nose Coverage. It is generally provided by the replacement policy. Nose coverage involves getting your new insurance or employer to pick up your prior acts.

Meaning that you are responsible for 20 of the total bill and your insurance is responsible for the remaining 80. For example a common percentage set forth by insurance companies is 8020. If a physician switches from one job to another or one group to another they can often ask the new malpractice carrier to provide continuous coverage with so-called nose coverage Instead of purchasing tail insurance through the prior employer coverage for prior acts is purchased through the new employers policy.

Sometimes the coverage for liability from a claims-made policy that has been dropped can be included in your new insurance policy. Nose coverage is usually less expensive than purchasing tail coverage from the old carrier. Like Tail coverage Nose coverage provides protection for claims reported after the cancellation of a policyholders prior claims made policy.

Once you stop the policy covering the nose you need to secure tail so that you continue to be covered for anything that occurred on or after your retroactive date. This happens when coverage is provided for a claim that arises from a medical procedure performed while under a previously terminated policy but first reported under your current policy. Claims-made liability policies typically include a retroactive date and the policy will not cover claims arising from covered occurrences acts or omissions committed prior to that date.

It is a nose if you purchase the coverage through the carrier or policy you are joining and a tail if you purchase it from the carrier or policy you are. A popular term for a supplement to a claims-made malpractice insurance policy that may be purchased from a new carrier when a physician changes carriers and had claims-made coverage with a previous carrier. Best Seller Several purchased in the last 48 hours.

However if the interior passages of the nose need altering to improve breathing or correct a deviated septum also known as functional rhinoplasty then insurance may cover the cost of the procedure. Co-insurance is a form of payment in your policy whereby you must contribute a certain percentage of each medical bill submitted and received by your health insurance provider. For insurance purposes a nose provides coverage for claims that arise from medical procedures performed while covered under a previous terminated policy but first reported under your current policy.

Prior acts or nose coverage transfers the retro-active date for an old policy to a new insurance carriereliminating the need to purchase tail coverage from the last carrier. Examples are provided to help illustrate this concept. This alternative to tail coverage is called nose coverage the colloquial term for prior acts coverage.

Tail coverage costs 2-3 times the expiring premium. Well you cant set a nose. The period prior to the purchase that is covered known as the retroactive period is stipulated in the new insurance contract.

Nose coverage is a feature in a liability policy that covers the professional acts of the insured prior to the purchase of the policy. Prior Acts Coverage aka Nose Coverage When switching to a new insurance company under a claims-made policy you can often request prior acts coverage. However unlike Tail coverage which can be very expensive to purchase Nose coverage requires no initial expenditure and may be obtained through the insurer to which a doctor is going.

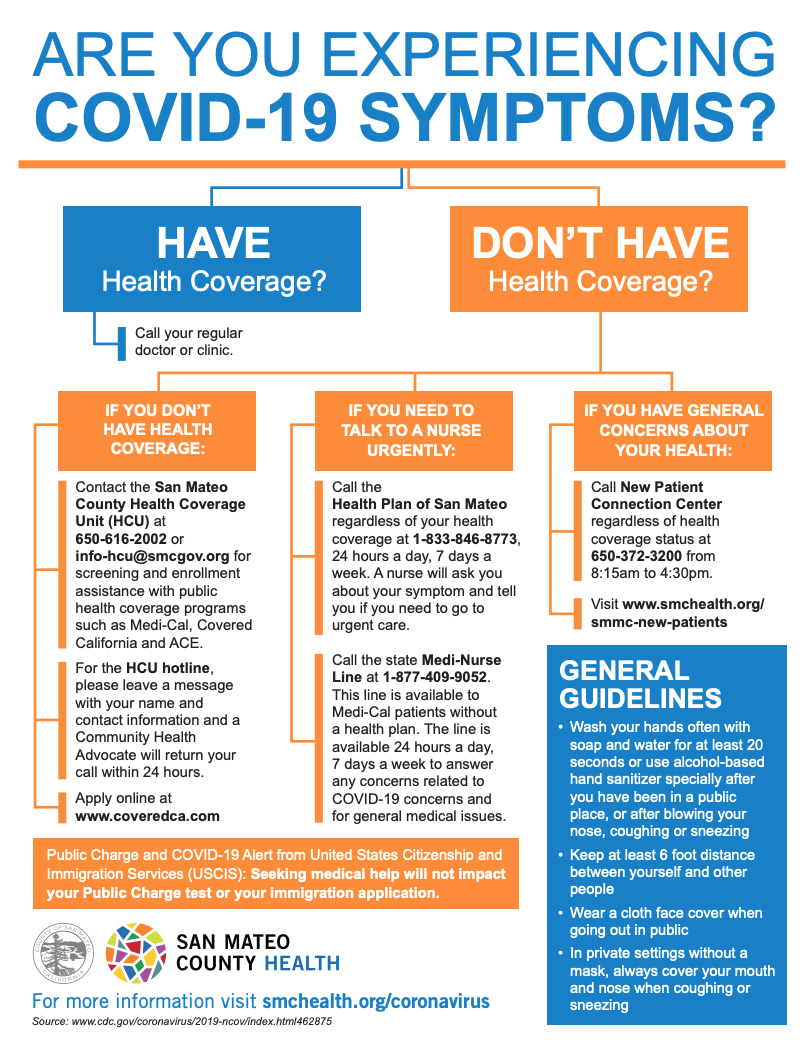

Coronavirus Health Insurance Buy Covid 19 Insurance Plan Online

Is Plastic Surgery Covered By Insurance Surgery Costs

Cosmetic Vs Medical Reasons For A Nose Job Rhinoplasty In Houston

Nose Vs Tail What S The Diff Presidio Insurance

Will Health Insurance Cover Nose Surgery

Will Insurance Cover My Rhinoplasty Procedure

Will Insurance Cover Rhinoplasty

Does Health Insurance Cover Cosmetic Surgery Quotewizard

Does Insurance Cover Cosmetic Surgery Cosmetic Surgery Prices

Rhinoplasty Chicago Il North Shore Aesthetics

10 Crazy Insurance Policies That Actually Exist Harry Levine Insurance

Does Insurance Cover A Medically Necessary Nose Job Boston

Nose Vs Tail What S The Diff Presidio Insurance

Gbg Global Benefits Group Expat Major Medical Insurance West Coast Mexico Insurance

Pin On Cover 360 Com Best Insurance Provider In India

Nose Surgery Rhinoplasty Ocala Plastic Surgery

Things You Should Know About Ent Coverage Under Health Insurance

&srotate=0)

Will Insurance Cover My Rhinoplasty Procedure

Posting Komentar untuk "Insurance Policy Nose Coverage"