Renters Insurance Coverage Meaning

Youll select a personal property coverage limit meaning the maximum amount your renters insurance company will pay if your personal belongings are damaged or destroyed due to a problem covered. Personal property coverage Covers your personal possessions if theyre stolen damaged or destroyed by a covered peril Liability and medical expenses coverage Covers the financial risk if you accidentally injure someone either at home or away.

What Does Renters Insurance Cover 7 Surprising Things Real Estate 101 Trulia Blog

The good news is that renters homeowners and condo insurance policies typically include coverage for the contents of your home.

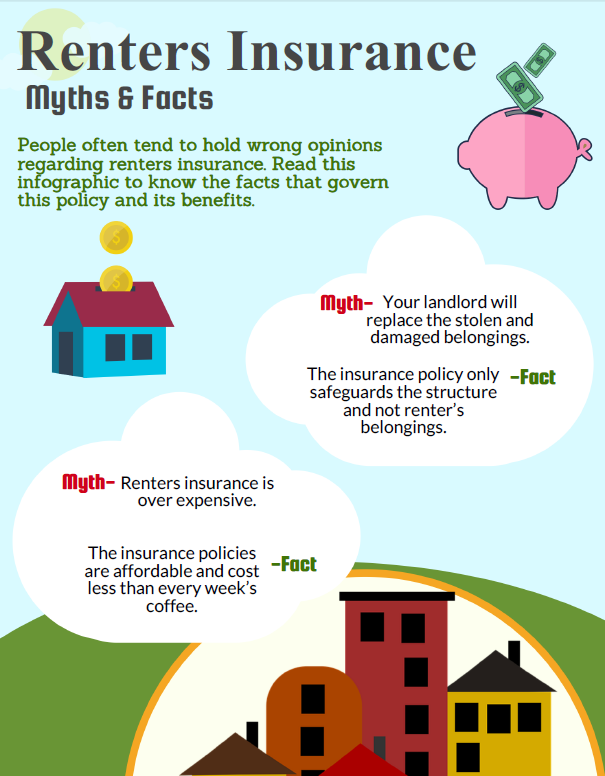

Renters insurance coverage meaning. Most landlords insurance covers only the building and damages due to negligence. What does renters insurance cover. It covers losses caused by theft fire smoke storm damage water overflow and electrical surges.

Renters insurance liability coverage typically starts at a 100000 limit for claims or lawsuits says the Insurance Information Institute. Falling trees or debris. Coverage for some of the most common causes of property damage and loss such as theft vandalism and fire is entirely up to you.

Renters liability coverage may also help cover your legal expenses if youre sued over an incident that occurs in the place youre renting. Renters insurance covers personal belongings up to a predetermined coverage limit. This coverage is sometimes known as contents insurance but is usually described in most insurance policies as personal property coverage.

It provides living expenses if your property is not fit to live in due to a covered loss. In particular if you are dealing. But not all damage to your property is covered by renters insurance.

A Stillwater Renters policy reimburses you for damaged or stolen possessions and more. Who shouldnt you list as an additional insured on your renters insurance policy. Provides compensation for damaged or lost personal property anywhere in the world if it belongs to your home.

The purpose of renters insurance is to protect your personal property and finances. The central feature of renters insurance is coverage of your personal belongings from common sources of unexpected damage and theft. Renters insurance is property insurance that provides coverage for a policyholders belongings liabilities and possibly living expenses in case of a loss event.

Its designed to pay for bodily injury or property damage that you cause to someone who is not an insured. What does renters insurance cover. Most renters insurance policies have these standard coverages.

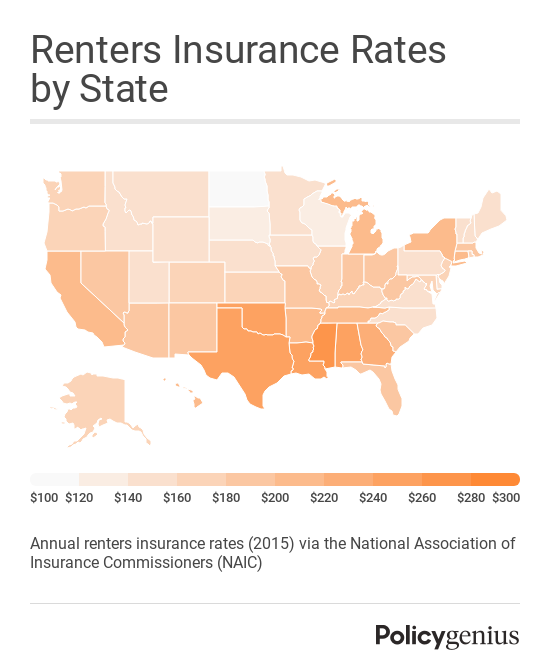

Renters insurance is insurance coverage that is designed to prevent losses for people who are renting property. The amount of renters coverage is defined by the insurance policy and may total 10 of the policys personal liability coverage. Renters insurance cost varies based upon your coverage limits and location as well as a.

Hurricanes except for flooding Hail. What Does Renters Insurance Mean. Renters insurance covers a renters liabilities in addition to his or her property within the condo house or other building that is being rented.

Depending on the specific plan you purchase you can expect your plan to include policies that help with both property damage and liability expenses in the case of an accident. What renters insurance covers. In addition to home contents coverage a renters policy also contains personal liability coverage and medical expenses so if you are found liable for damage to someone elses property or cause them injury your liability coverage will help you pay for some of the.

Personal property includes almost everything you own in and outside your rental unit or home. If you rent an apartment home or even a dorm renters insurance is recommended for protecting your space and. Renters insurance covers the costs associated with all of these disasters and more.

Both GEICO and State Farm advertise plans beginning at under 10-15 per month while Lemonade offers policies as low as 5 per month. Coverage E is also known as renters insurance personal liability coverage. More on that later.

Renters insurance is an insurance policy that can cover theft water backup damage certain natural disasters bodily injuries and more in a rented property. Renters and landlord insurance coverage plans are usually a combination of property insurance and liability insurance. This means that the following people dont need to be listed as an additional insured.

A renters insurance policy is made up of three different categories of coverage and each category offers a different type of protection. Are Renters Insurance And Homeowners Insurance The Same. Renters insurance coverage is made up of several types of protection.

Renters insurance covers theft of your personal items from your car parked on your rental property but it doesnt cover theft of the car itself or parts of. In short renters insurance covers what you own. What does loss of use coverage mean in renters insurance.

In other words the sorts of things that people could sue you for and win. Loss of use coverage also called additional living expenses ALE refers to a situation where the home you rent is not usable for a period of time. A renters insurance policy is a group of coverages designed to help protect renters living in a house or apartment.

High-value belongings arent covered and should be scheduled separately as part of a rider on your policy. Renters insurance covers damage or losses resulting from the following insurance perils. A typical renters insurance policy includes three types of coverage that help protect you your belongings and your living arrangements after a covered loss.

Metlife Offers Renters Insurance That Also Covers Damage To The Property You Are Responsible For Learn Mo Life Insurance Quotes Insurance Quotes Car Insurance

3 Things To Know About Renters Insurance Farmers Insurance Life Insurance Policy Renters Insurance

What Is A Personal Umbrella Policy And When Do You Need It Allstate Umbrella Insurance Insurance Marketing Umbrella

What Is A Renters Insurance Premium

About Wfl Insurance Sarasota Insurance Services

Will Renters Insurance Cover Moving Damage National Van Lines Has The Answer

Pin By Fusco Insurance Agency Inc On Insurance Articles Resources Casualty Insurance Insurance Meant To Be

Do You Know What Does Renters Insurance Cover Infographic Rentersinsurance Renters Insurance Renter Funny Motivation

Renters Insurance In A Nutshell Renters Insurance Tenant Insurance Insurance Marketing

What Is Insurable Interest Definitions Permanent Life Insurance Universal Life Insurance

Renters Insurance 101 What It Is And What It Covers

96 Reference Of Auto Vehicle Insurance Definition Car Insurance Insurance Definitions

See How Much You Could Save On Homeowners Or Renters Insurance With Geico Tenant Insurance Renters Insurance Renters Insurance Quotes

Renters Insurance Vs Homeowners Insurance Moneysupermarket

Trustpilot Rebrands To Appear Confident And Understated Culture Meaning Logo Inspiration Understated

Top 5 Most Reliable Vehicles By Claim Rate Endurance Learning Center Reliable Cars Infographic Infographic List

Renters Ho4 Insurance Lemonade Com

What Is A Renters Insurance Premium

/shutterstock_709343611.zimmytws.renters.insurance.cropped-5bfc335346e0fb0083c1e3dc.jpg)

A Comprehensive Guide To Renters Insurance

.svg)

Posting Komentar untuk "Renters Insurance Coverage Meaning"