Solvency Coverage Ratio Formula Insurance

The average solvency coverage ratio for firms in our sample was 184 with no insurer reporting a ratio below 100. W r i t t e n displaystyle netassetsdiv netpremiumwritten.

Chapter 3 Financial Statement Analysis Business Ratios Financial Statement Analysis Financial Analysis Accounting And Finance

The highest ratio in our sample of 1338 was for a non-life insurer whose own.

Solvency coverage ratio formula insurance. Requirements under the Standard Formula. The solvency ratio of an insurance company is the size of its capital relative to all risks it has taken. This Section seeks to highlight the more commonly used ratios and comment on.

Where EBIT Earnings before interest and taxes or Net Profit before interest and tax. The solvency ratio is calculated by dividing the eligible own funds by the Solvency Capital Requirement. As a result and with other words the assets are twice the liabilities.

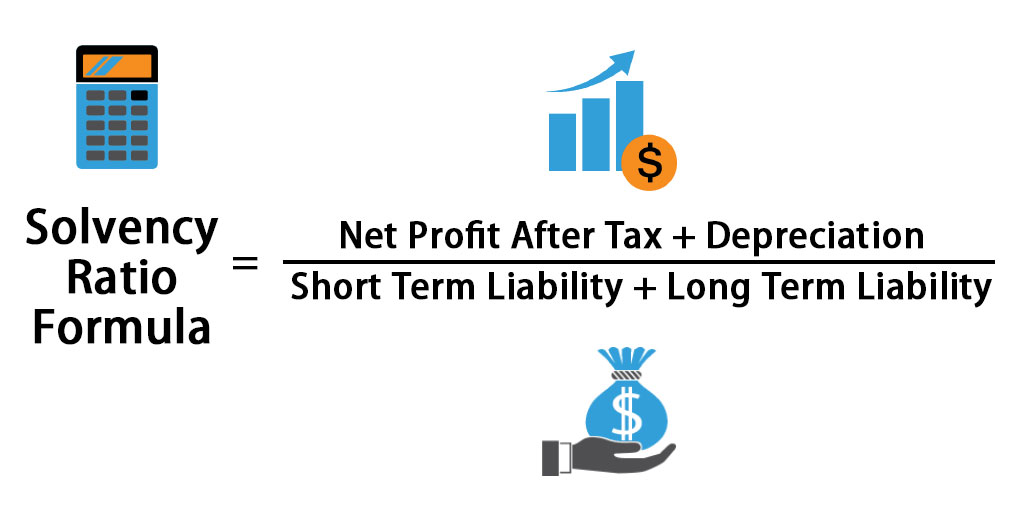

A s s e t s n e t. Solvency Ratio Net Income Depreciation All Liabilities Short-term Long-term Liabilities. Interest coverage ratio EBIT interest on long term debt.

The SCR coverage ratio is the ratio of capital that insurers have available to support their SCR the eligible own funds to the SCR. An insurance company generally has to maintain its Solvency ratio at 100 throughout time. The solvency ratio is most often defined as.

It provides a measure of the buffers a firm has in place to withstand balance sheet volatility while still holding enough capital to comply with the regulatory requirement. Asset Coverage Ratio is calculated using the formula given below Asset Coverage Ratio ACR Total Tangible Assets Short Term Liabilities Total Outstanding Debt Asset Coverage Ratio 3600000 600000 2000000. If the EOF is 10 million and the SCR is 5 million the ratio would be 2 or in percentages 200.

How to Calculate the Solvency Ratio. Such as the solvency ratio appear in many guises. N e t.

A ratio above 100 means full compliance with regulatory requirements. This ratio measures the ability of a business to meet its short-term liabilities with the current. The overall Solvency II ratio is provided alongside a breakdown of the capital charges across all risk categories including catastrophe premium and market risk.

The higher the ratio is the stronger the balance sheet of the company appears. Solvency In this paper solvency should be read as referring to the ongoing ability of an insurance company to meet its obligations as and when they fall due and not being limited to consideration on a going concern basis. Formula for Cash Flow Liquidity Ratios.

Any insurance company experiencing a Solvency ratio below 100 should devise a contingency plan against potential losses. SCR is a formula-based figure calibrated to ensure that all quantifiable risks are considered including non-life underwriting. A Available Solvency Margin means the excess of value of assets furnished in IRDA- Form- AA over the value of life insurance liabilities furnished in Form H as specified in Regulation 4 of Insurance Regulatory and Development Authority Actuarial Report and Abstract Regulations 2000 and other liabilities of policyholders fund and shareholders funds.

The formulas can be described as per below SCR Ratio EOF SCR. Sensitivities are provided that quantify the overall capital requirement. Solvency Assessment The practice of assessing the solvency of an insurance company.

In assessing solvency of insurance companies single ratios cannot be relied on to detect problems but rather a combination of key ratios are needed which when viewed together lead to the conclusion that problems exist. A higher coverage ratio is better for the solvency of the business while a lower coverage ratio indicates debt burden on the business. The SCR and MCR both represent capital requirements that must be held in addition to the technical.

And market credit. MCR Ratio EOF MCR. The SCR can be calculated using a prescribed standard formula approach or by using a company-specific internal model which has to be approved by the regulator.

As explained later there are a couple of other ways to determine a companys solvency but the main formula for calculating the solvency ratio is as follows. The lower a companys solvency ratio the greater the probability that it will default on its debt obligationsThe formula for solvency ratio can be derived by dividing the summation of net income and non-cash charges like depreciation amortization by the summation of total short term and total long term liabilities. Solvency ratios are highly necessary for assessing the risk of meeting all the financial obligations of a company.

The Solvency Capital Requirement SCR and the Minimum Capital Requirement MCR. It is a variant for a formula for cash flow that indicates whether the business generates sufficient. P r e m i u m.

On average general insurers on the Standard Formula had the highest ratios at 285 with London Market Standard Formula insurers the lowest at 156. Measuring uncertainty of solvency coverage ratio in ORSA for Non-Life Insurance Version1 34 20120427 Frédéric Planchet12 Quentin Guibert2 Marc Juillard2 1Institut de Science Financière et dAssurances ISFA Laboratoire SAF Uni- versité de Lyon Université Claude Bernard Lyon 1 50 avenue Tony Garnier 69366 Lyon Cedex 07 France. One can consider a company to be healthy with a solvency ratio of 05.

Reinsurance in this case. All things considered a Solvency ratio of 150 secures the ability of the insurance provider to maintain itself afloat in the case of an adverse event. Companies with a lower score of solvency ratios are often seen to pose a higher risk to creditors and banks.

The Investfourmore Blueprint For Real Estate Investing Real Estate Investing Investing Blueprints

Solvency Ratios Cfa L1 Financial Statements Youtube

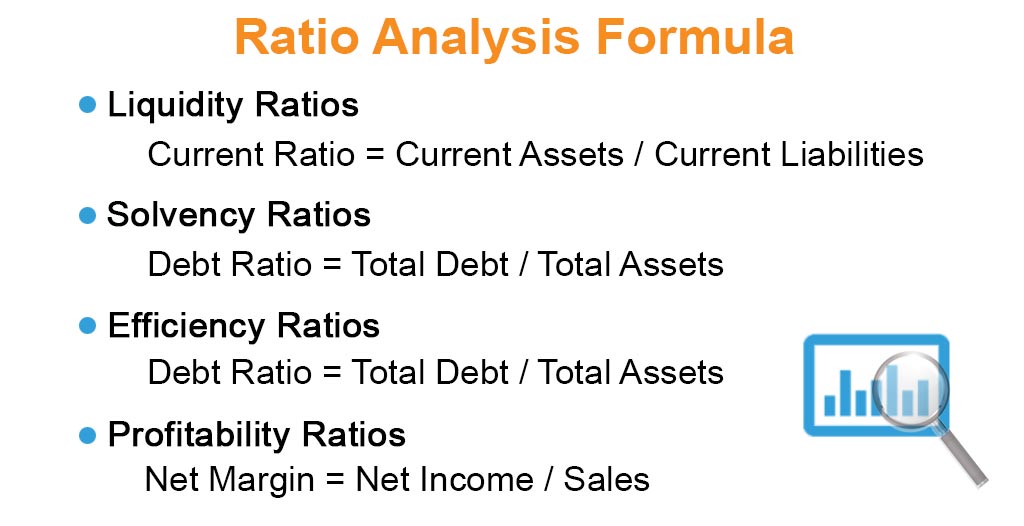

Ratio Analysis Formula Calculator Example With Excel Template

Pdf Measuring Underwriting Profitability Of The Non Life Insurance Industry

Learn French Easy Online Learn French Learn A New Language Learning

Solvency Ratio Formula Calculator Excel Template

Money Therapy Should I Follow The Money Personal Finance Articles How To Attract Customers Success Business

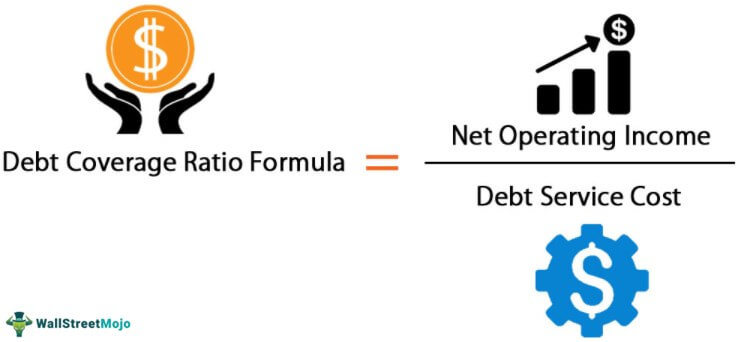

Debt Coverage Ratio Meaning Formula How To Calculate

/dotdash_Final_EBITDA_To_Interest_Coverage_Ratio_Dec_2020-012-3a127232967d435d93bda56dd6b7211f.jpg)

Ebitda To Interest Coverage Ratio Definition

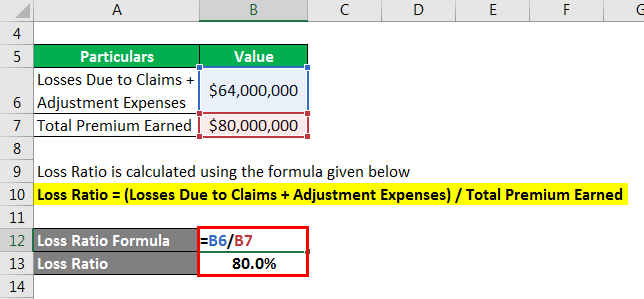

Loss Ratio Formula Calculator Example With Excel Template

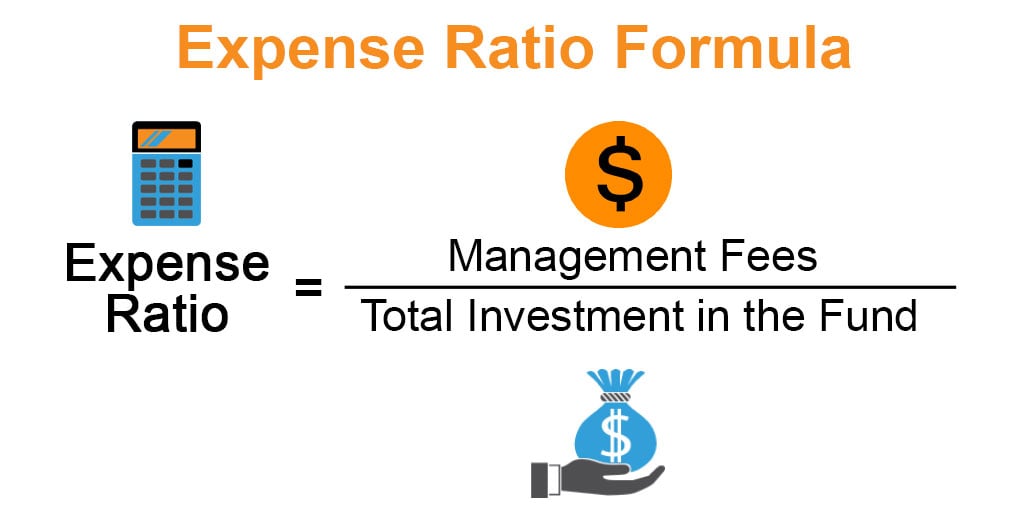

Expense Ratio Formula Calculator Example With Excel Template

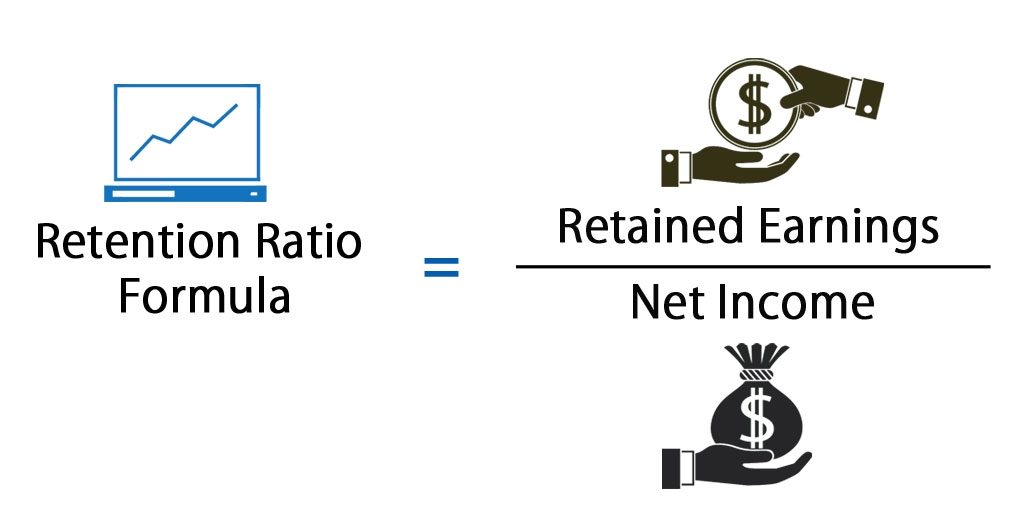

Retention Ratio Formula Calculator Excel Template

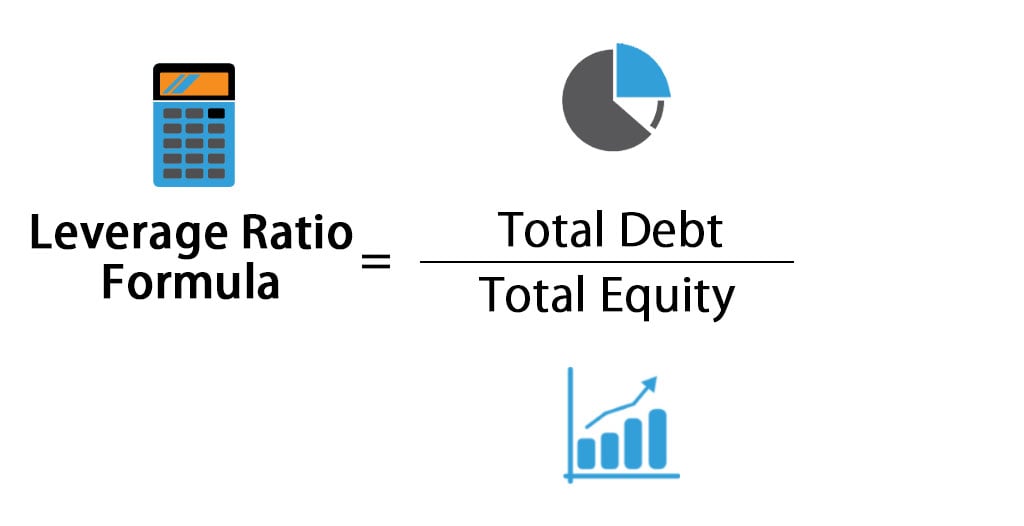

Leverage Ratio Formula Calculator Excel Template

Times Interest Earned Ratio Daily Business

Loss Ratio Formula Calculator Example With Excel Template

Free Cash Flow Statement Templates Smartsheet Accounting Job Ideas Of Accounting Job Accounti Cash Flow Statement Bookkeeping Business Accounting Basics

Self Employment Ledger 40 Free Templates Examples Self Employment Employment Self

Interest Coverage Ratio Meaning Uses Formula Limitation

Posting Komentar untuk "Solvency Coverage Ratio Formula Insurance"