Life Insurance Cover Covid Death

COVID-19 Coverage By Law And By Choice. Insurance can give you the peace of mind that comes with knowing your loved ones are financially secure.

These costs include copays coinsurance and deductible payments.

Life insurance cover covid death. Well pay claims when death is due to COVID-19. The good news is that a life insurance company can not deny a claim for a death caused directly or indirectly by receiving a COVID-19 vaccination. The insurance package covers loss of life due to COVID-19 and accidental death on account of COVID-19-related duties.

For the first 12 months of funeral cover youre only insured for accidental death or accidental serious injury so any illness such as COVID-19 wont be covered. Anganwadi workers and helpers involved in COVID-19-related duties will now be given an insurance cover of Rs 50 lakh under the Pradhan Mantri. A COVID-19 term insurance plan is essentially a traditional insurance plan that provides an additional financial cover against death due to COVID-19.

Generally term plans only provide death benefit due to illness if the insured succumbs to critical ailments such as cancer stroke and heart disease amongst others. The life insurance companies have clarified that death due to Covid-19 will be treated as a general death and the claim will be admissible if the coronavirus was diagnosed post policy issuance. More than 15 million Australians who have life insurance with Zurich or OnePath Life may be eligible for additional cover for COVID-19 vaccinations to the tune of a 50000 one-off payment in a bid to speed up vaccination rates among people concerned about the risk of a rare.

The Covid-19 pandemic is considered a once-in-a-lifetime event which has resulted in unprecedented death claims for our industry and yet life. So a death being caused directly by receiving a COVID-19 vaccine has almost no chance of happening. A post including segments of Allianzs policy documents alongside claims vaccine side effects would be considered self-inflicted is false and fraudulent the insurance company said.

If you have Woolworths Funeral Insurance youre covered as long as youve had your policy for more than 12 months. Our Extended Health Care EHC travel benefit includes Out. When it comes to securing the future of your loved ones or doing proper financial planning term insurance turns out to be one of the most popular options for insurance seekers.

But inevitably with enough people receiving shots it will occur. They further added if the doctor certifies that the death has occurred due to Covid-19 disease death benefits shall be payable post investigation and scrutiny of medical. Heres the good news.

Deaths Due To Coronavirus Covered by Life insurance for Existing Policyholders. According to the Kaiser Family Foundations analysis insurance companies covered COVID costs for 88 of insured people. Federal law requires all private insurance plans to cover the entire cost of COVID-19 testing.

Deaths from COVID-19 will be covered by life insurance policies just like those from other causes. If you die of a heart attack cancer an infection kidney failure stroke old age or. In most cases people who have term or whole life insurance already will be covered which means insurance companies will pay out for deaths related to COVID-19.

As long you have an active life insurance policy in good standing your beneficiary or beneficiaries will get a death benefit should you die of coronavirus-related complications. What is COVID-19 term insurance. Receiving a COVID-19 vaccine will not void a persons life insurance policy according to Australias peak body for insurers.

Anganwadi workers helpers in Covid duties to get 50L insurance cover. Life insurance industry recorded its largest year-over-year increase in direct and net death benefits in at least 24 years as excess mortality due to COVID. COVID 19 insurance like many other life insurance products provides financial protection against the most terrifying human life event.

What about funeral insurance. Types of Deaths Covered and Not Covered by Term Insurance. If you need to buy life insurance it is still possible to obtain it from most insurers.

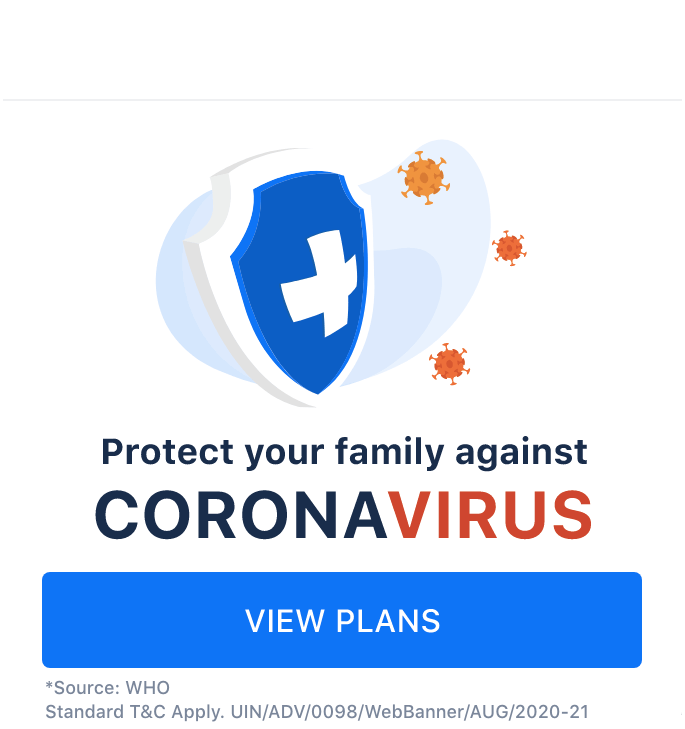

However you need to consider the conditions of the life insurance policy add-ons whose benefits will be paid out only if those conditions are adhered to. Life insurance covers death due to natural causes. Will my life insurance policy cover COVID-19.

If you have an active life insurance policy and you were to die of a pandemic illness such as COVID-19 your family would receive the death benefit even if. For example theres the tweet that said just so you are aware many have died from the covid vaccine and if you have life insurance you cannot collect it because the vaccine. Life insurers Zurich and OnePath announce COVID-19 vaccine cover.

The Life Insurance Council of New York LICONY a trade association representing life insurance companies doing business in New York and the American Council of Life Insurers ACLI a trade association representing the life insurance industry nationally have each confirmed that life insurance. By Press Release. Traditional life insurance policies such as whole and term life likely cover deaths from COVID-19 according to spokespeople from industry research group LIMRA State Farm.

With affordable premium rates term life insurance plans provide financial protection to the family of the insured in case of any. Has the Department of Financial Services seen life insurance companies attempt to deny death benefits covering an insured person who has received a COVID-19 vaccination. Although human life cannot be measured in monetary terms a precise sum assured aids the deceaseds family in dealing with financial matters in case of the insured persons untimely demise.

If a person dies due to coronavirus had a life insurance policy the beneficiary of the policy will receive the sum assured amount as the death benefit.

The Impact Of Covid 19 On The Life Insurance Market Was Minimal

How Is The Coronavirus Covid 19 Affecting Life Insurance An Faq Valuepenguin

.jpg?bJwrqQeYT40MB5oMMv8rehV47UHYrBXl&size=1200:675)

Covid 19 Deaths How Nominees Can Claim Rs 2 Lakh Under Pmjjby Details Of Registration Eligibility And Steps Information News

What To Do If You Can T Pay Your Life Insurance Bill Forbes Advisor

How Does Life Insurance Work Forbes Advisor

Covid 19 And Insurance What You Should Know William Russell

Types Of Deaths Covered And Not Covered By Term Insurance

Corona Kavach Policy Buy Corona Kavach For Covid 19 Online

How Much Life Insurance Do You Need Forbes Advisor

To Grasp Who S Dying Of Covid 19 Look To Social Factors Like Race Stat

Zurich Life Insurance Supporting You Through Covid 19 And Beyond Zurich Australia

Covid 19 How Rbc Insurance Is Helping Clients

International Life Insurance Plans For Expats And International Citizens

Iterm Plan Term Insurance Plan Starting At Rs 388 Per Month Aegon Life

Best Life Insurance For Seniors

Iterm Plan Term Insurance Plan Starting At Rs 388 Per Month Aegon Life

Personal Accident Insurance Accidental Insurance Plan Online

What Happens To Pension Policies And Life Assurance Policies The Deceased Held At Death Low Incomes Tax Reform Group

Super Insurance Insurance Through Super Australiansuper

Posting Komentar untuk "Life Insurance Cover Covid Death"