Blanket Coverage Insurance Meaning

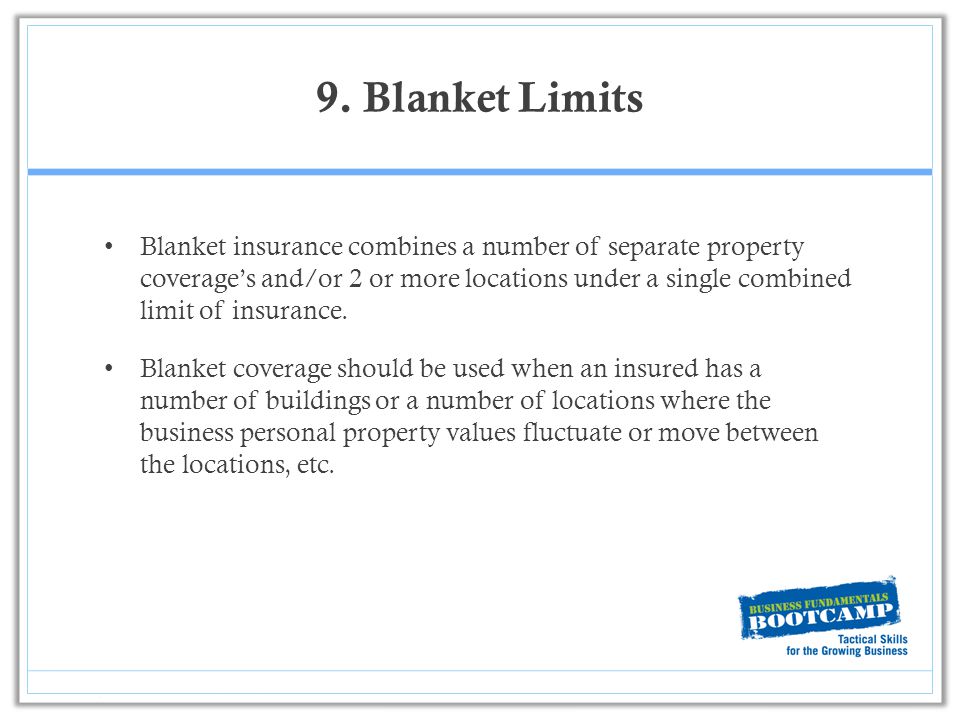

Blanket Building Limit Allie now refers Flynn to a third example 3 in the policy regarding coinsurance how coinsurance is determined if the policy is written with a blanket limit. As opposed to specific coverage it is not limited to one location.

Chapter 6 Property Insurance Ppt Download

Blanket Policy.

Blanket coverage insurance meaning. The persons eligible for coverage under the above referenced blanket accident insurance policy herein called. Flynns commercial insurance policy provides a blanket limit for all his buildings with one limitation that Allie promises to explain later. Blanket coverage in terms of commercial insurance does offer broader protection in the event of a loss but requires a little more in-depth understanding to determine if it right for your needs.

Definition Blanket Limit a single limit of insurance that applies over more than one location or more than one category of property coverage or both. It might seem upon first hearing that one is taking out a policy on their grandmas quilt or that they are only insuring themselves for certain hours. Blanket disability insurance is that form of disability insurance covering special groups of persons as enumerated in one of the following paragraphs.

What Does Blanket Coverage Mean. Under a policy or contract issued to any common carrier or to any operator owner or lessee of a means of transportation which shall be deemed the. In fact it is most often an accident-only policy issued to cover a group of individuals engaged in a specific activity.

1 a policy of temporary secrecy by police or those in charge of security in order to protect a person place etc threatened with danger from further risk. 2 a babys blanket soft toy etc to which a baby or young child becomes very attached using it as a comforter. Blanket coverage and scheduled coverage are two such examples of these terms.

What is Blanket coverage. A Blanket Additional Insured is a type of additional insured endorsement. This is different from standard insurance where each building or specialized personal property is listed separately with specific limits that only apply to that one category.

The coverage of something in the news is the reporting of it. And although it typically costs more than specific coverage blanket coverage often provides broader protection than specific coverage by protecting against all of these liabilities simultaneously. The most common way to insure multiple properties or multiple locations is to list them separately along with the amount of applicable insurance next to each on the policy declarations page.

In lieu of scheduling each limit and location independently a blanket property policy utilizes one limit for all coverages and locations. Blanket limit coverage provides a total limit amount of losses that can be paid of insurance which can be applied to multiple locations or buildings. On a commercial property insurance policy each location a business owns or occupies is listed on the Declarations Dec page.

For example if your blanket coverage offers a limit of 5000 for valuables then there might be a sub-limit of 1000 covering specifically jewelry and watches. The word blanket is a. Besides real estate blanket coverage can also cover other assets such as personal property and mortgage investments.

By contrast a specific also known as scheduled limit of insurance defines separate limits which are applied to each individual property. Blanket coverage provides a certain amount of coverage a limit for a class of property as well as an additional sub-limit per item. Property insurance policies consist of many limits and each of them is applied to each location.

Insurance coverage for more than one item of property at a single location or two or more items of. Meaning pronunciation translations and examples Log In Dictionary. This Description of Coverage describes blanket accident insurance coverage provided to eligible persons of the policyholder named aboveherein called the Policyholder while those persons are participating in Covered Activities.

Who Is Eligible. Single policy coverage like this can be found with different options for health insurance homeowners insurance and even with some types of business insurance. Blanket coverage definition.

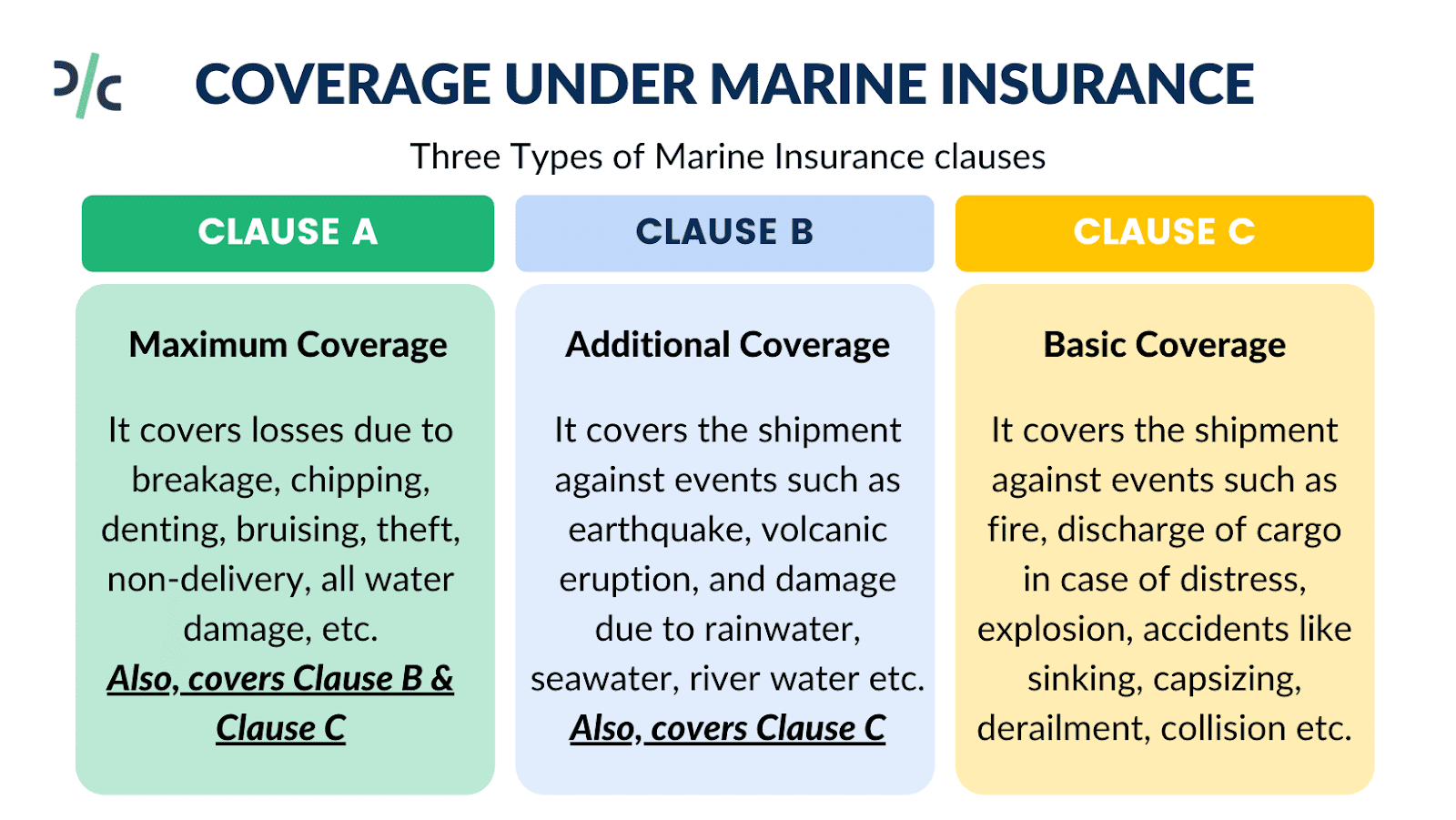

Floating in Marine Insurance policy large exporters may opt for an open policy also known as a blanket policy instead of taking insurance separately for each shipment. What Is Blanket Coverage Insurance. The term blanket coverage refers to a category of business insurance policies covering multiple properties that are similar in nature but not at the same location.

For example school districts colleges and universities and sports teams can purchase Blanket Health coverage to provide health benefits to athletes and cheerleaders. Coverage under a blanket policy is generally triggered in the event of any loss associated with a named property. An open policy is a one-time insurance that provides insurance cover against all shipments made during the agreed period often a year.

Despite its name a Blanket Health insurance policy is less comprehensive than a Group Health policy. Lets say you want to work with a specific subcontractor but they will only enter a contract if you provide them with insurance coverage. Blanket coverage is insurance coverage for multiple similar properties at different locations.

This is in contrast to specific or scheduled limits of insurance which are separate limits that apply to each type of property at each location. Blanket insurance is a single property insurance policy that covers more than one type of property at the same location the same kind of property at multiple locations or multiple kinds or property at two or more locations. Blanket insurance is a type of insurance coverage that allows you to cover multiple buildings andor specialized personal property under one big limit.

Insurance is similar to other specialized industries in that it makes use of terminology that might not convey its actual meaning upon first hearing it. For example a franchise. This type of endorsement covers third parties that require coverage under a contract.

Blanket insurance policies allow an insured to cover thus blanket multiple pieces of property or multiple property locations with a single policy. This can include fires floods thefts personal injury liabilities and more. Blanket insurance is any type of insurance coverage in which a wider range of items or situations is covered under the terms of the policy.

10 Common Gaps In Business Insurance Ppt Download

What Is Blanket Insurance Lemonade Homeowners Insurance

:max_bytes(150000):strip_icc()/an-insurance-agent-holds-a-red-umbrella-over-dollar-bills--savings-protection--keeping-money-safe--investment-and-capital-insurance--the-risk-of-doing-business--corruption-losses--arrest-of-investors-1132238255-427ff6d75b0544689700ae3a80868cb6.jpg)

Blanket Contractual Liability Insurance Definition

Is This Coi Compliant Decoding The Key Terms That Make Up An Insurance Policy The Bunker Vault

Jewelry Insurance Scheduled Vs Blanket Coverage Team Insurance

Blanket Vs Scheduled Coverage For Personal Property Pike Mutual Insurance Company

Additional Insured Endorsements In Construction

Blanket Insurance Near You Match With An Agent Trusted Choice

Marine Insurance Meaning Types Benefits Coverage Drip Capital

What Is Blanket Insurance Lemonade Homeowners Insurance

Blanket Insurance Near You Match With An Agent Trusted Choice

Certificate Holders Additional Insureds What S The Difference

Blanket Vs Scheduled Coverage For Personal Property Pike Mutual Insurance Company

Chapter 6 Property Insurance Ppt Download

/GettyImages-593338912-fafa1cc18ba64c0b8efb16d35f46f8f5.jpg)

/insurance-78da00de55f74526a609fa593bb11efa.jpg)

Posting Komentar untuk "Blanket Coverage Insurance Meaning"