Insurance That Covers Covid-19 Philippines

5 rows Pru Life UK is the first life insurance provider in the Philippines to provide coverage for. What COVID-19 risks can travel insurance cover.

Coherent Health Financing For The Covid 19 Response A Perspective From The Philippines Thinkwell

When booking your flight or trip be sure to read the terms and conditions of the insurance offered to you by your travel provider if applicable.

Insurance that covers covid-19 philippines. For those purchasing travel insurance for future travel benefits included in comprehensive coverage may apply in the following unforeseen scenarios. Etiqa Philippines launches MyLife a comprehensive health insurance plan with COVID-19 coverage. BI Declaration of acknowledging the risks involved in travelling including risk of delay in their return trip For those travelling on tourist or short-termvisitor visas.

Travel and health insurance to cover travel disruptions and hospitalisation in case of COVID-19 infections during their allowable period of stay abroad. Medical costs if you or anyone covered. Our certificates of insurance provided on our website include the statement.

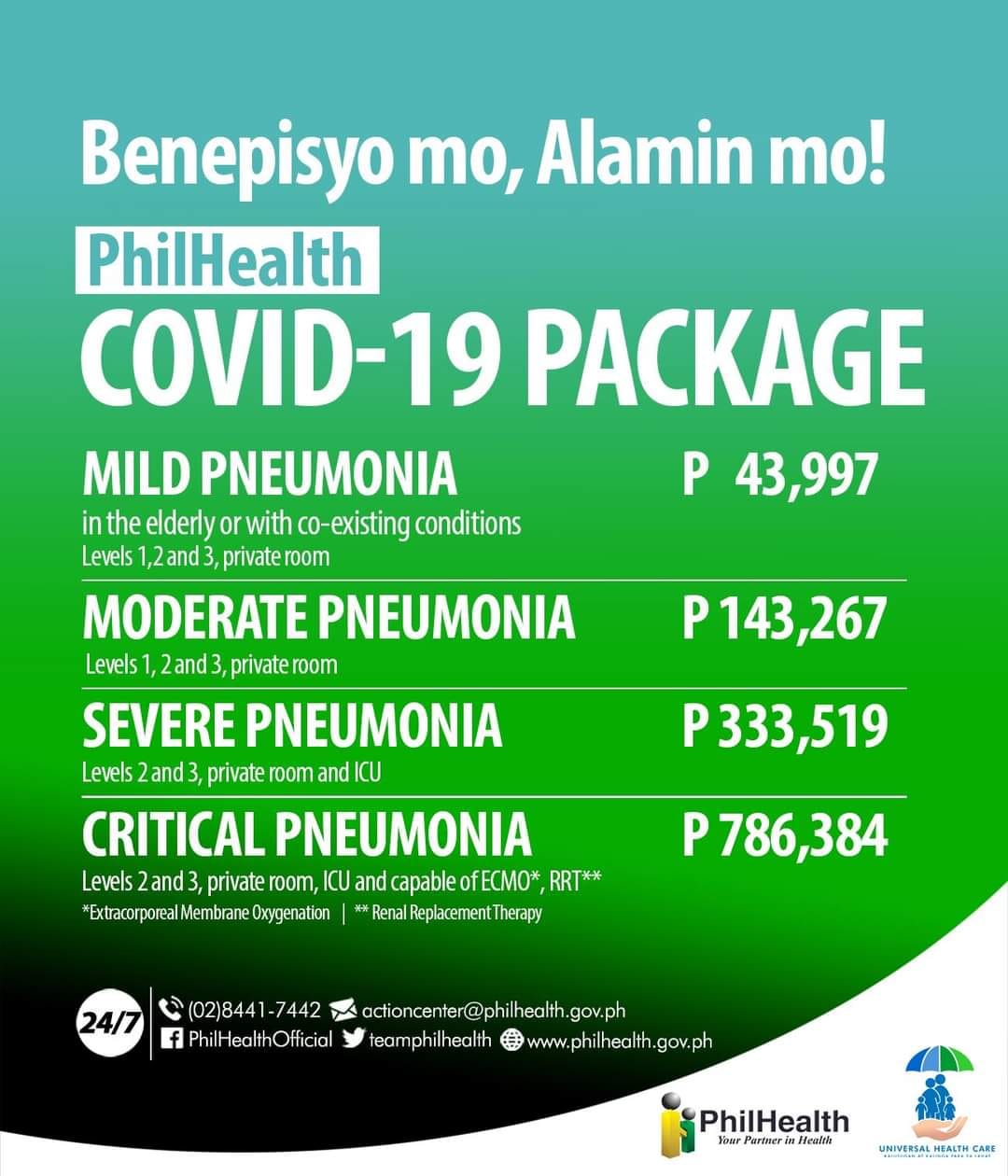

We hope this gives you extra confidence to book an upcoming trip knowing some COVID-19 cancellation cover is included in your travel insurance policy. These Covid19-focused insurance products are Travel Master and a standalone annual personal accident PA package. COVID-19 treatment costs and hospital bills in the Philippines comes with a big price tag.

The following travel insurance benefits can offer coverage for the costs of quarantining assuming the plan covers Covid-19 expenses. MANILA Philippines With the Philippines logging in almost a million COVID-19 cases as of yesterday even as vaccinations take place COVID-19 insurance has been essential now more than ever. June 1 2020 Due to travel restrictions plans are only available with travel dates on or after.

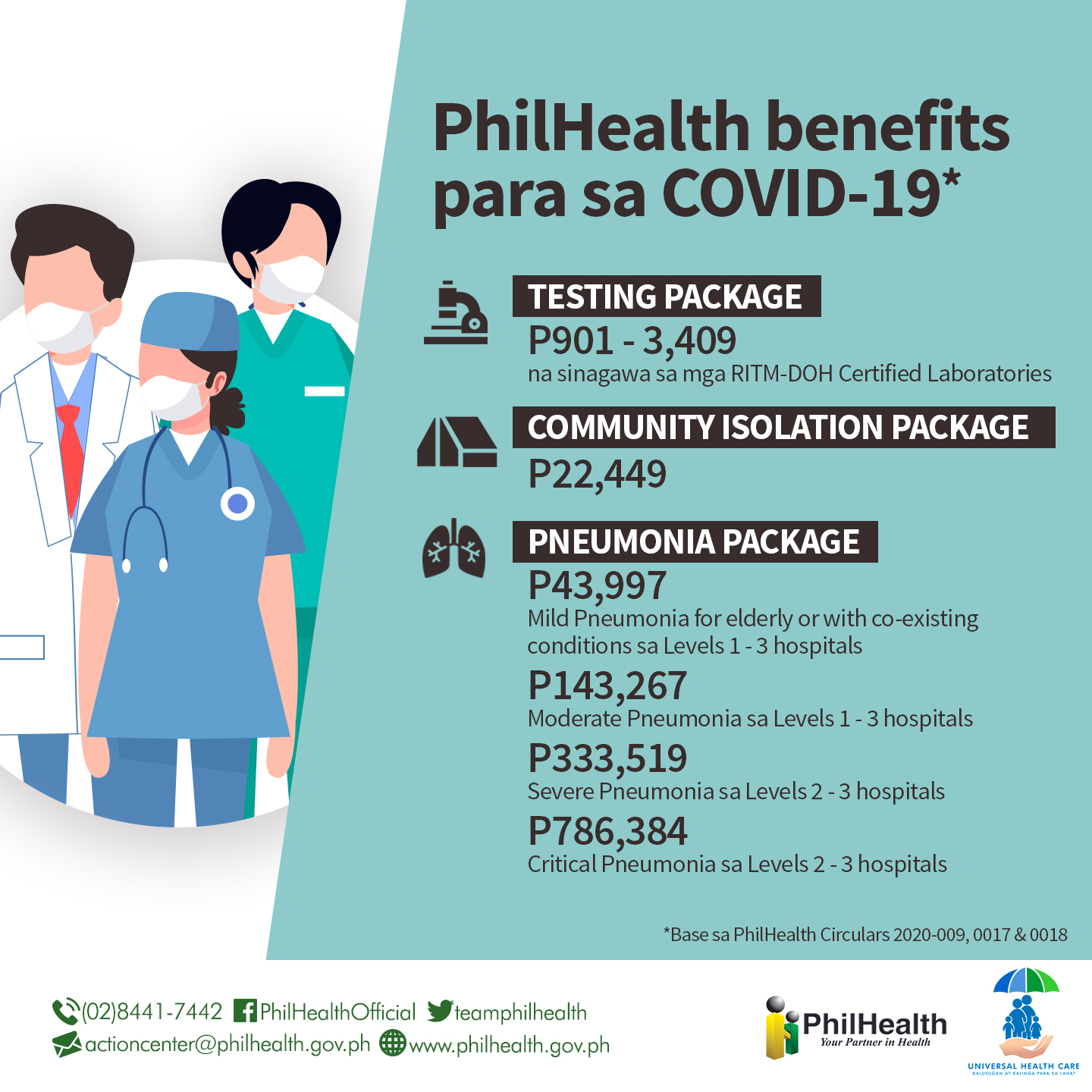

Etiqa Philippines one of the leading life and non-life insurance providers in the Philippines recently launched MyLife a yearly renewable health insurance plan that gives consumers access to Etiqas extensive medical network nationwide. If news reports are any indication the cost of treating COVID-19 can range from 43000 up to over 1 million. With the prospect of international travel resuming around the corner Canstar took a look at travel insurance providers currently offering COVID-19 cover to travellers in certain situations as well as some of the important exclusions to watch out for.

Cancel For Any Reason optional time-sensitive benefit. Of UK said yesterday it has provided over 100000 Filipinos with free insurance coverage against the coronavirus disease. Before any of those benefits will cover a COVID-19 quarantine you must test positive for the virus and have a travel insurance plan that covers expenses related to COVID-19.

Cancellation if you or anyone covered by the policy gets coronavirus before you travel. Coronavirus travel insurance will cover emergency hospitalization and medical treatment expenses incurred on the treatment of COVID-19 during his trip. If you are infected with COVID-19 how much would you have to pay.

With Starr Insurance youll be able to claim up to 1000000 for medical expenses including in and outpatient treatments. TraveLead travel insurance with Covid-19 coverage. Typically policies with cover for COVID-19 disruption will offer cover for.

Whether its domestic travel insurance policy or international travel insurance plan emergency medical expenses will be covered as long as the policy was purchased before the government had imposed travel. Our policies will cover your medical costs if you are the victim of an accident or fall ill including suffering from COVID-19 and related illnesses. Do medical insurances provide COVID-19 coverage.

No waiting period no co-payment exclusion quarantine by law. What Does Travel Insurance Cover for COVID-19. Pru Life Insurance Corp.

For full details on our travel insurance that covers coronavirus cancellation and amendment costs see the PDS or visit our COVID-19 travel insurance FAQs page. If so you will not be covered for any other types of medical emergencies. Medical expenses related to COVID-19 are covered within the limits conditions and exclusions defined in the insurance policy.

Under these medical insurance you may receive COVID-19 coverage upon diagnosis such as cash relief hospital income benefit and various policy waivers eg. As Pacific Cross is here to find ways to best serve clients during times of need they are superseding their standard exclusion on pandemics for. Like other Covid-19 Insurances it also covers medical expenses for unintentional and unexpected injuries or illnesses including Covid-19 for a minimum of 100000 or 35 million and life insurance coverage loss of life due to.

Guidelines on the Issuance of Extension of Coverage or Hold Cover in Insurance Policies Pre-Need Plans and Agreements due to COVID-19 Pandemic in the Philippines Circular Letter 2020-24 A Call for Responsive Action on the Coverage of Covid-19 Coronavirus-Related Conditions in Health Insurance Policies and HMO Agreements. Emergency Medical Evacuation Coverage. Also some insurance only reimburse expenses incurred because of a COVID-19 infection.

Squaremouth recommends a minimum of 100000 in emergency medical and medical evacuation coverage in order to account for COVID-19 related medical care and evacuation expenses. Yes most medical insurance provide coverage for COVID-19. Quarantine-Related Travel Insurance Coverage.

Allianz Global Assistance recently added benefits related to epidemics such as COVID-19 to some of our most popular travel insurance plans not available in all jurisdictions. So now the question stands. The Insurance Commission IC has approved two insurance products for risks related to the Coronavirus disease 2019 Covid19 offered by Malayan Insurance Co Inc.

Pacific Cross is a leading medical and travel insurance provider in the Philippines. Your travel insurance generally wont cover a mandatory quarantine issued by your destination state or country in the absence of a positive test.

Covid Insurance For Foreigners In Thailand

Ph Covid 19 Quarantine And Travel Ban Updates Kpmg Global

Axa Philippines Launches Family Plan That Covers Covid 19 Expenses Businessworld

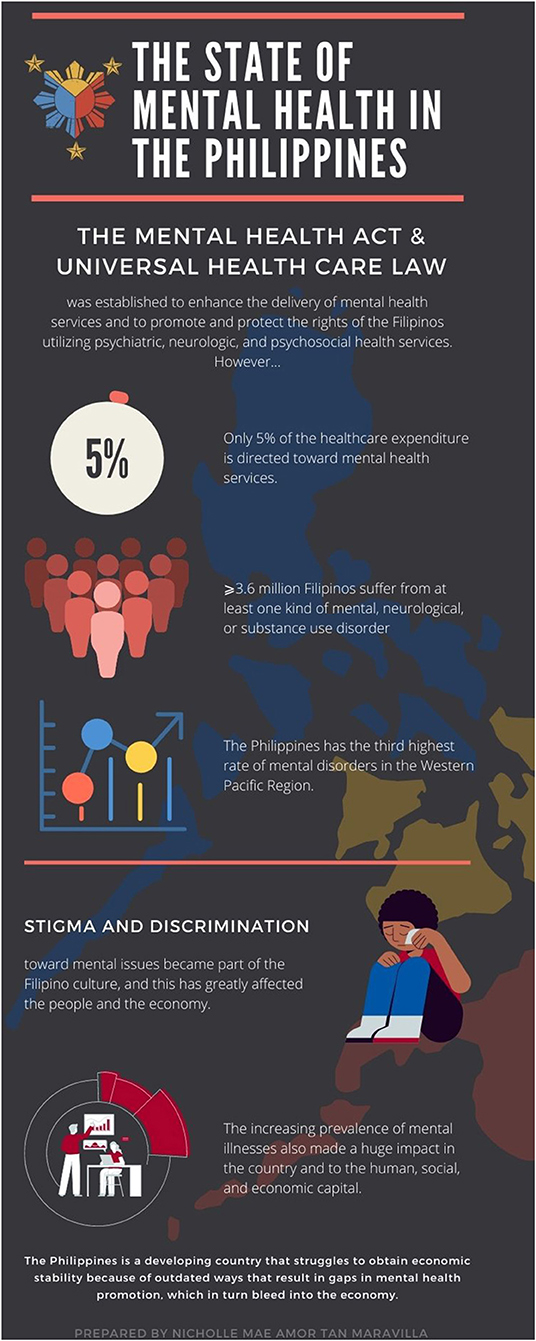

Frontiers Philippine Mental Health Act Just An Act A Call To Look Into The Bi Directionality Of Mental Health And Economy Psychology

Cnn Philippines Philhealth Will Be Covering The Hospital Expenses Of Covid 19 Patients Starting April 15 2020 Bookmark Our Live Blog For More Updates On The Coronavirus Pandemic Bit Ly 2xbzvxw Facebook

Pacific Cross Philippines Home Facebook

Coronavirus Covid 19 Legal Liability And Insurance Issues Arising From Vaccination Of Seafarers International Chamber Of Shipping

Covid 19 Worries In The Philippines Prompt Healthier Lifestyle Habits Among Filipinos

In Philippines Coronavirus Crisis Led To Massive Philhealth Corruption Whistle Blowers Claim South China Morning Post

Axa Sawasdee Thailand Covid 19 Insurance For Foreigners

Covid Insurance For Foreigners In Thailand

Inlife Inlife Health Care Offer 3 In 1 Covid 19 Cover Inlife

The Impact Of The Covid 19 Pandemic On Social Health Insurance Claims For High Burden Diseases In The Philippines Center For Global Development

Covid 19 Worries In The Philippines Prompt Healthier Lifestyle Habits Among Filipinos

Philhealth Information On Covid 19 Philhealth

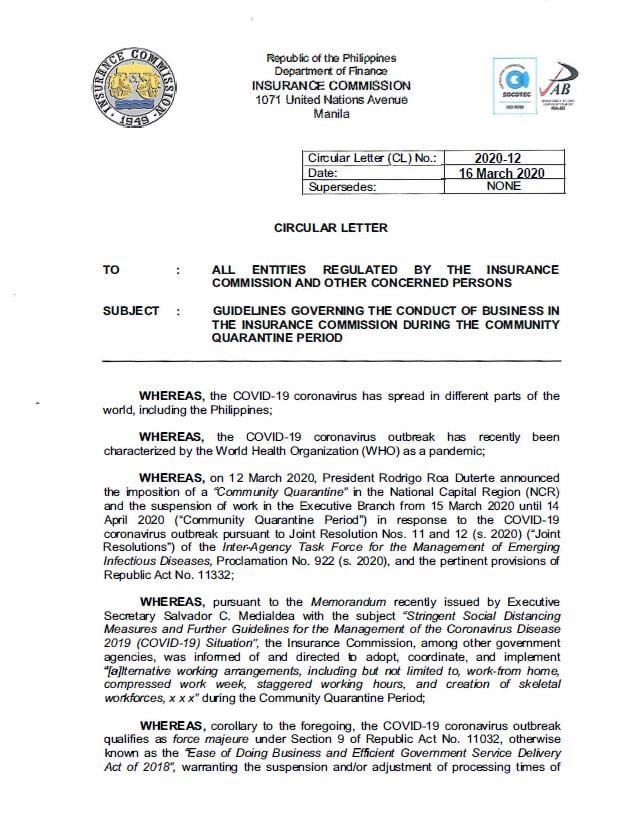

Guidelines Covering The Conduct Of Business In The Insurance Commission During The Community Quarantine Period Grant Thornton

Philhealth Information On Covid 19 Philhealth

Posting Komentar untuk "Insurance That Covers Covid-19 Philippines"