What Is Deposit Insurance Coverage In India

Deposit Insurance and Credit Guarantee Corporation DICGC is a subsidiary of the Reserve Bank of India RBI that provides insurance on deposits held by customers in a bank. Each depositor in a bank is insured upto a maximum of Rs100000 Rupees One Lakh for both principal and interest amount held by him in the same capacity and same right as on the date of liquidationcancellation of banks licence or the date on which the scheme of amalgamationmergerreconstruction comes into force.

Dicgc Deposit Insurance Coverage Increased To Rs 5 Lakh I Paisabazaar

5 lakh insured amount will not go in vain.

What is deposit insurance coverage in india. Click here for Paper I GS. Deposit Insurance in India Explained. Deposits of CentralState Governments.

The DICGC insures all deposits such as savings fixed current recurring etc. At present the coverage is up to Rs. Deposits of foreign governments.

Deposits of the State Land Development Banks with the State co-operative bank. Deposit insurance is insurance for deposits held by customers in a bank. It offers protection against loss in case of bank failures.

This means that if a bank fails your hard-earned money Rs. Every year banks pay a premium amounting to 0001 of their deposits to DICGC to enjoy the insurance cover. Currently the Federal Deposit Insurance Corp FDICguarantees deposits of up to 250000 per person per bank.

In this context here is an overview at the nature of deposit insurance in India and the working of Deposit Insurance and Credit Guarantee Corporation DICGC. Deposits except the following types of deposits Deposits of foreign Governments. The DICGC is a wholly-owned subsidiary of the Reserve Bank of India and in case of a bank failure the DICGC provides protection to bank deposits that are payable in India.

In India the ratio of deposit coverage is 61 times which is one of the highest in the world See Annexure II2. It offers relief to depositors of troubled banks and failed financial institutions. In India the deposit insurance activity is done by an RBI subsidiary called Deposit Insurance Corporation.

Deposit Insurance and Credit Guarantee Corporation DICGC which was established in 1978 is a fullyowned subsidiary of the Reserve Bank of India. That limit was enshrined in law by the 2010 Dodd-Frank reform law passed following the 2008 financial crisis. What is deposit insurance.

What is Bank Deposit Insurance. Click here for Paper II CSAT. DICGC insures fixed deposit savings current and recurring accounts up to Rs.

The deposits in a bank including savings account current account fixed deposit and even recurring deposits are insured by the Deposit Insurance and Credit Guarantee Corporation DICGC. What is the crisis at PMC. Deposit insurance is a protection cover available for bank depositors if the bank fails financially and go for liquidation.

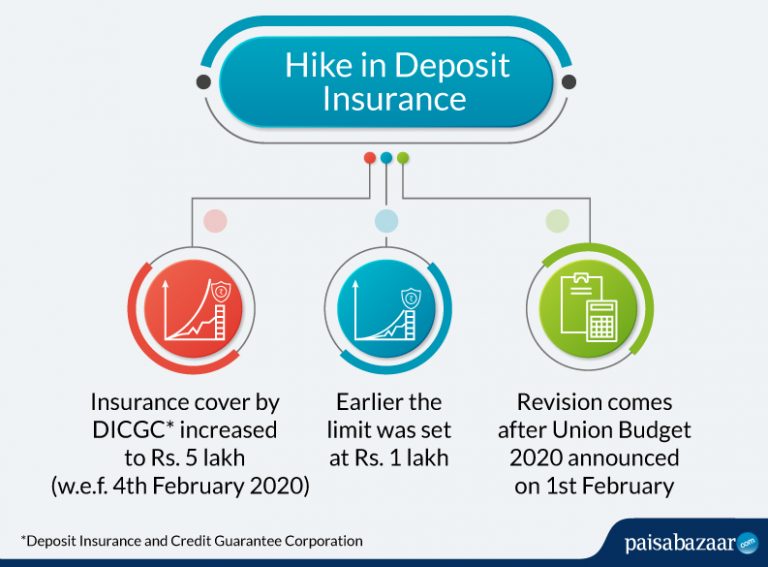

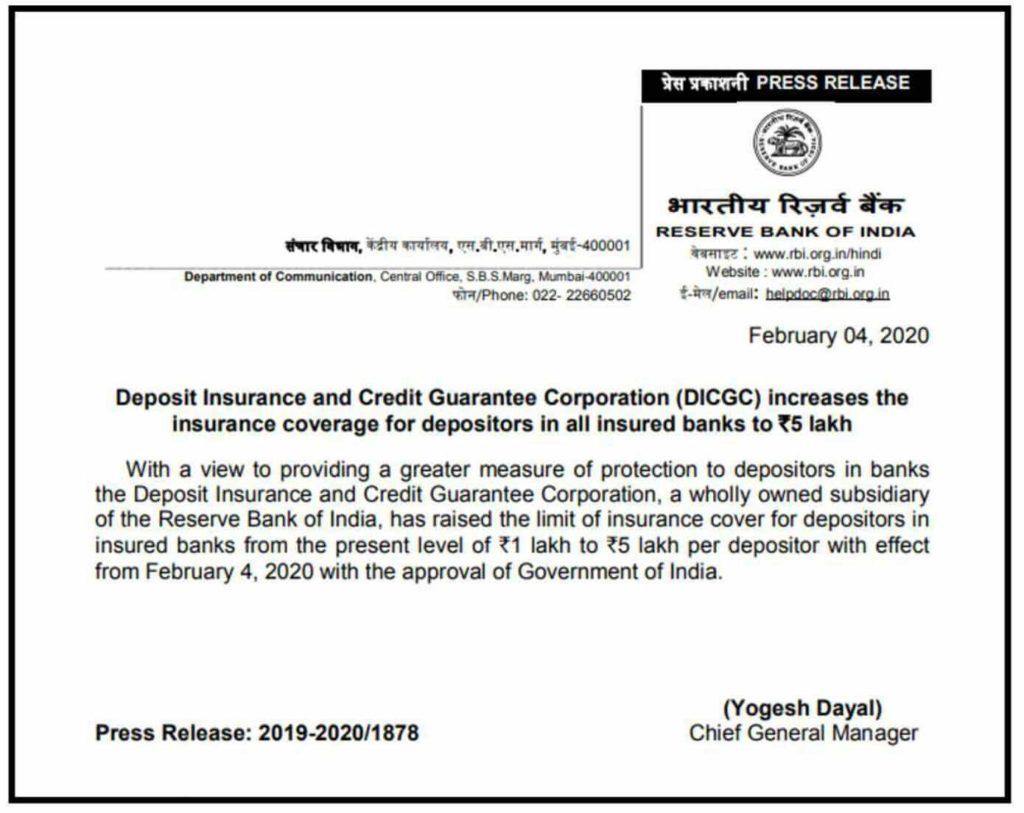

But given the fact that a substantial portion of GDP is coming from the unorganized sector we recommend no change in the deposit insurance coverage for deposits. Deposit Insurance and Credit Guarantee Corporation DICGC increases the insurance coverage for depositors in all insured banks to Rs5 lakhs Updated account details of DICGC for Premium Payment by banks Repayments by Liquidators etc. Any amount due on account of and deposit received outside India.

The coverage of Bank Deposit Insurance is extended to the deposits held in commercial public banks and small finance banks such as State Bank of India SBI ICICI Bank Suryodaya small finance bank etc. This insurance pays back depositors in case the bank goes bankrupt and is restricted by RBI for further operations. All India Online Mock Test 4 is available now.

In simple terms deposit insurance is the protection given to the deposits in the bank in full or. Deposit insurance is a financial safety net provided by the government to each depositor in case a lender goes bankrupt. Deposit Insurance and Credit Guarantee Corporation DICGC is a specialised division of Reserve Bank of India which is under the jurisdiction of Ministry of Finance Government of IndiaIt was established on 15 July 1978 under the Deposit Insurance and Credit Guarantee Corporation Act 1961 for the purpose of providing insurance of deposits and guaranteeing of credit facilities.

Deposits of CentralState Governments. RELOOK AT DEPOSIT INSURANCE IN INDIA. Online test and the performance analytics will remain available for 24 hrs.

It includes commercial public banks and small finance banks. The basic idea of deposit insurance in India is quite familiar Verma 2019. For queries reach us on prestormingshankariasin.

What is insurance cover offered by the DICGC. Deposit insurance is a protection cover for deposit holders in a bank when the bank fails and does not have money to pay its depositors. Deposit insurance is one of the safety nets employed by nations to ensure banking stability and depositor protection.

DICGC covers all deposits such as savings fixed current recurring and so on except for the following deposits. This insurance is provided by Deposit Insurance and Credit Guarantee Corporation DICGC which is a wholly owned subsidiary of the RBI. In India only Rs 1 lakh per depositor is provided in case a bank fails.

All types of deposits like savings deposits term deposits and RDs are covered by DICGC. It is provided by the Deposit Insurance and Credit Guarantee Corporation DICGC. Relook at Deposit Insurance in India What is the issue.

That means for example that a married couple sharing a savings account would be guaranteed for up to 500000 in deposits. Determining the appropriate coverage limit for depositors under a system of. 100000 for bank deposits.

In India Bank Deposit Insurance is covered by Deposit Insurance and Credit Guarantee Corporation which is subsidiary of RBI. This amount was fixed in 1993 and in the meanwhile there has been considerable inflation and economic growth. Bank deposit insurance in India What is it all about.

The RBI recently capped withdrawals from the Punjab and Maharashtra Cooperative PMC Bank at Rs.

Tips To Save Money On Car Insurance Policy Infographic Car Insurance Insurance Money Car Insurance Online

Types Of Car Insurance Coverage Car Insurance Insurance Insurance Coverage

Explainer What Is The Insurance Cover On Your Bank Deposits

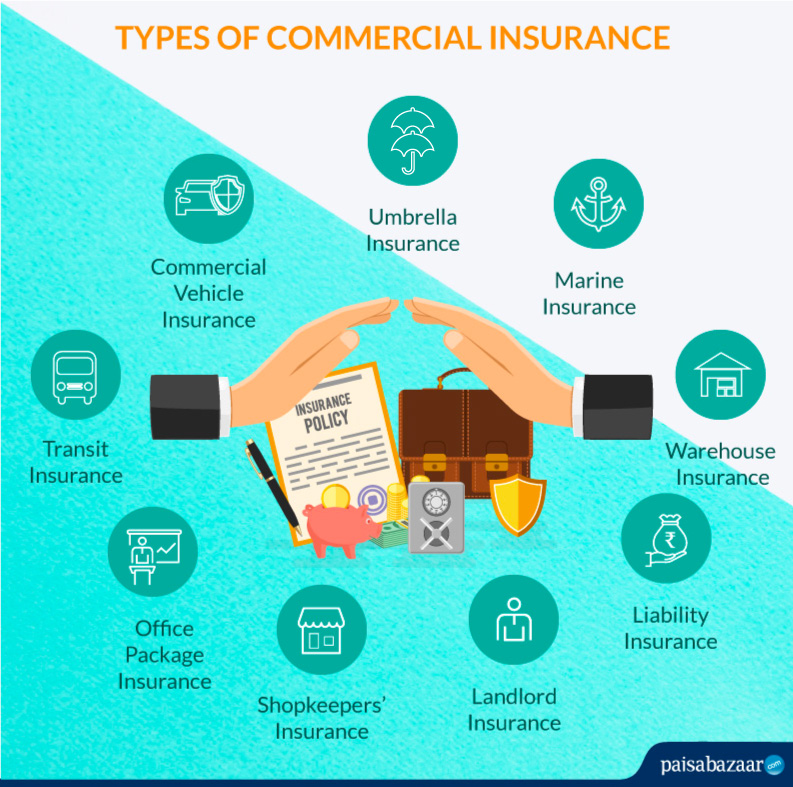

Commercial Insurance In India Coverage Claim And Exclusions

Health Card Vs Health Insurance With Opd Coverage Health Insurance Health Plan Health Check

What Is The Role Of Irda In Insurance Business Insurance Compare Insurance Insurance Industry

Neo Banks Vs Neo Insurers Insurance Business Insurance Underwriting

Auto Insurance Facts And Figures Infographic Car Insurance Car Insurance Facts Car Insurance Rates

Explainer What Is The Insurance Cover On Your Bank Deposits

Types Of Car Insurance Coverages Types Of Insurance Coverage For Cars Types Of Insurance Coverage For Auto Types Of Auto Insurance Coverages What Type Of Vehicl

Functions Of Irda Compare Insurance Commercial Vehicle Insurance Business Insurance

Budget 2020 Govt Increases Deposit Insurance To Rs 500 000 From Rs 100 000 Business Standard News

Car Insurance Quotes Online Young Drivers Https Goo Gl 9jyxyp Car Insurance Auto Insurance Quotes Cheap Car Insurance Quotes

Insurance Health Us Health Insurance Plans Affordable Health Insurance Life Insurance Policy

Today In This Blog We Will Talk About Fixed Deposit Interest Rates In India Fixed Deposits Are Long Term Invest Life Insurance Corporation How To Plan Planner

Common Diseases Impacting Your Health Insurance Coverage Health Insurance Coverage Buy Health Insurance Health Insurance

Five Things You Should Know About Bank Deposit Insurance Scheme

What Is Tds Tax Deducted At Source How To Pay Tds Online Tax Deducted At Source Life Insurance Companies Savings Account Interest

Reasons Why You Should Not Invest In Cryptocurrencies Investing Bitcoin Bitcoin Chart

Posting Komentar untuk "What Is Deposit Insurance Coverage In India"