Coverage Period Insurance Definition

Maximum coverage details are laid out in insurance policies so policyholders can fully understand how much coverage they have. The policy period encompasses the time between the exact hour and date of policy inception and the hour and date of expiration.

Claims Made Vs Occurrence Insurance Claims Made Policy The Hartford

If a person does not have a good coverage period they may think that they are entitled to benefits that they really are not.

Coverage period insurance definition. Insurance coverage is the amount of risk or liability covered for an individual or entity by way of insurance services. Please further note that definitions and. An insurance policy period is the time frame during which an insurance policy is effective.

A probationary period is the period of time after you apply for a policy but before you can make a claim. That assessment would be made based on the facts and circumstances of the product with. This option can sometimes be purchased from your insurance provider typically ranging from one to five years.

The Maximum Indemnity Period is a limit under a business interruption policy relating to the maximum period over which the insurer will pay for loss of profit. And b for Employees who terminate participation it shall mean the portion of the Plan Year prior to the date on which participation terminates as. This most often applies to car insurance.

Product coverage discounts insurance terms definitions and other descriptions are intended for informational purposes only and do not in any way replace or modify the definitions and information contained in your individual insurance contracts policies andor declaration pages from Nationwide-affiliated underwriting companies which are controlling. All policies have defined periods. It is the responsibility of the Insured to decide upon the Maximum Indemnity Period and if the period chosen is inadequate it can have a very serious effect on the Insureds business.

These provide coverage for a specified period ranging from 10 to 30 years. Outside of the coverage period a loss is not covered by such a contract. Insurance company that actually underwrites and issues the insurance policy.

Insurers often provide a free extended reporting period of 30 or 60 days after a policy is canceled or not renewed. Health maintenance organization HMO - A health care system that assumes both. The insurer knows there is coverage during the whole policy period even if claims are only discovered or made later on.

Coverage for care received from a non-network provider except in an emergency situation. Maximum coverage is the most coverage an insurance company will provide during a specific period. The Insureds Coverage Period is shown in the Schedule of Benefits.

If there is an agreement to renew then a grace period would be allowed. The waiting period in health insurance is a specific span of time before which the insured individual is not eligible to avail coverage benefits for some listed ailments even during the policy term of a particular health insurance policy. Policy Period the term of duration of the policy.

Period of Coverage means the Plan Year with the following exceptions. On date of expiration. Basic extended reporting period.

From a loss prevention perspective it can make sense for an insured party to have a procedure in place to always verify when coverage periods expire so that. A coverage period is the period of time during which an insured event is protected by an insurance contract. Supplemental extended reporting period.

A for Employees who first become eligible to participate it shall mean the portion of the Plan Year following the date on which participation commences as described in Section 31. If a policyholder needs coverage beyond this amount then they would have to pay out-of-pocket or use an alternative form of insurance. Unless there is a contractual provision for renewal the policy expiration date is determined to be at 1201 am.

Liability or loss resulting from an accident. The start date and end date are the cutoff dates on your documentation payments and coverage unless you renew. The one exception is when a retroactive date is applicable to a claims-made policy.

This is sometimes referred to as a basic ERP. Expiration dateExact day when insurance coverage ends. A policy providing coverage that is triggered when a claim is made against the insured during the policy period regardless of when the wrongful act that gave rise to the claim took place.

The defined terms and coverage provisions in your policy or certificate of insurance such as Reasonable and Customary may be different from the general information provided below and the policy or certificate language will prevail. Some auto and homeowners insurance policies feature these but they are most often seen with disability insurance. Probationary periods can also.

The coverage period for a travel insurance policy is vital to determining when a person can qualify for its benefits. All claims from cedant underlying policies inception during the period of the reinsurance contract are covered even if they occur after the expiration date of the reinsurance contract. If a claim is reported after this period it will usually not be reimbursed unless the policy specifically states that claims will be reimbursed after the reporting period expires.

Both the death benefit and premium are fixed. Coverage Period means the length of time which the Insured selected in the Insureds application and approved by us not to exceed a month period commencing on the Effective Date. The term refers to the fact that the company carries or assumes certain risks for the policyholder.

Links for IRMI Online Subscribers Only. Period is the first step in developing the coverage units for a group of contracts. It it important to always read and understand when a coverage period starts and stops.

Request by an insured for the insurance. A reporting period is the period of time during which an insurance policyholder can report claims.

Whole Life Insurance Definition And Meaning Market Business News

What Is Life Insurance Exact Definition Meaning Of Life Insurance

What Is Life Insurance Exact Definition Meaning Of Life Insurance

Claims Made Vs Occurrence Insurance Claims Made Policy The Hartford

What Is Term Insurance Term Insurance Definition Meaningaegon Life Blog Read All About Insurance Investing

What Is Life Insurance Exact Definition Meaning Of Life Insurance

Insurance Cover Meaning Importance And Types Scripbox

Glossary Of Life Insurance Terms Smartasset Com

Whole Life Insurance Definition And Meaning Market Business News

Non Life Insurance Policy Types Features And Benefits

When Does Business Interruption Insurance Coverage Stop Expert Commentary Irmi Com

Travel Medical Insurance The Complete Guide Tir

What Is Insurance Grace Period

Insurance Definitions Features

What Is Waiting Period In Health Insurance A Detailed Guide

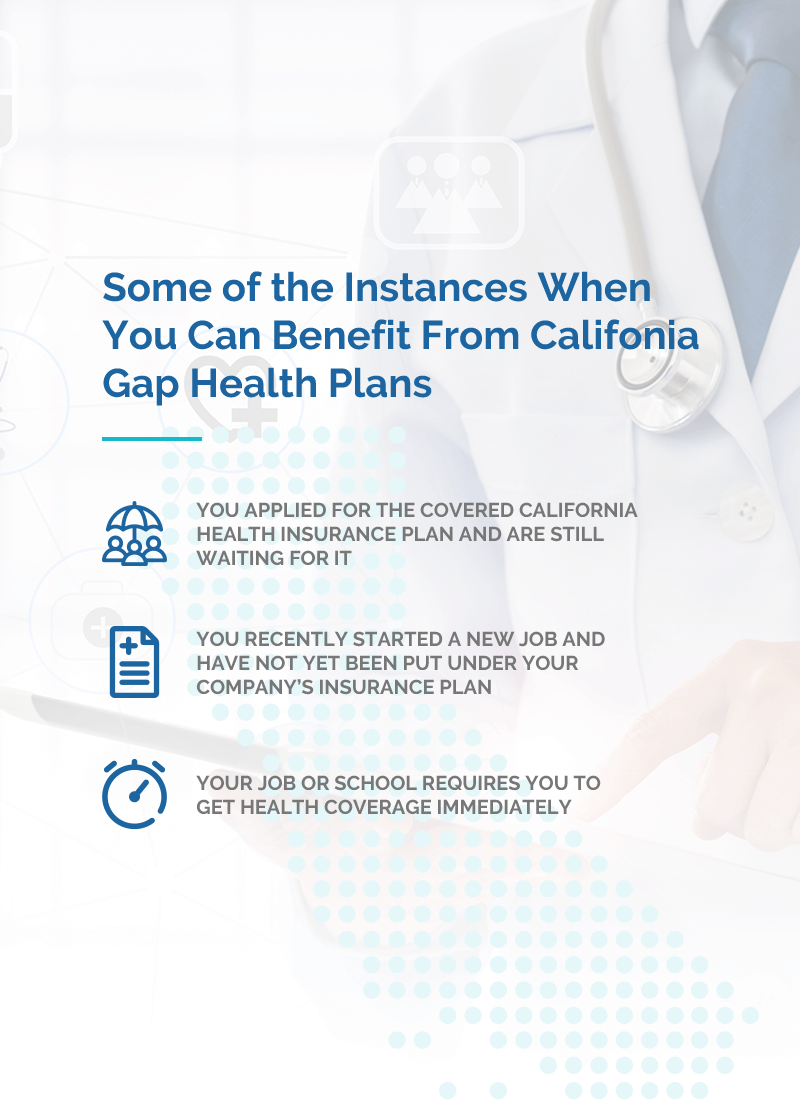

Short Term Health Plans In California Health For California

2021 Guide To Term Life Vs Whole Life Insurance Definition Pros Cons

Understanding Short Term Limited Duration Health Insurance Kff

Different Types Of Health Insurance Plans

Posting Komentar untuk "Coverage Period Insurance Definition"