Insurance Tail Coverage Definition

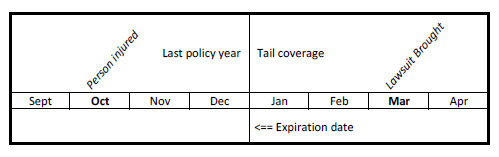

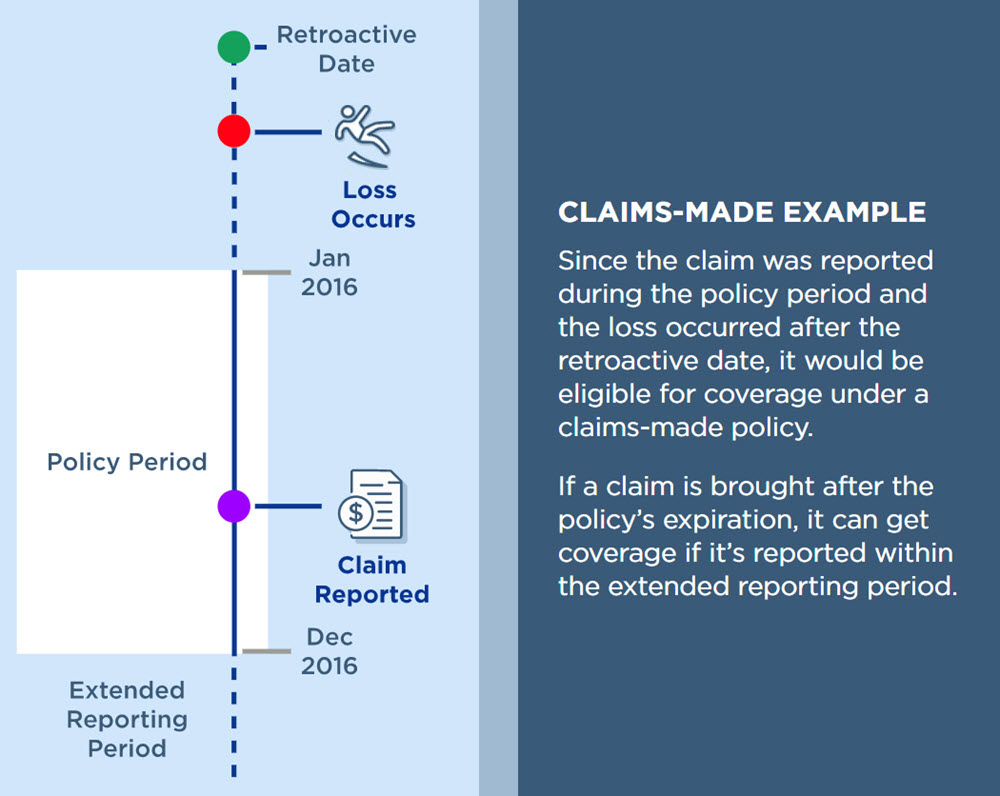

Many liability policies are written on a claims-made basis which means the insurer pays only. Tail coverage is an endorsement or an addition to your insurance that allows you to file a claim against your policy after it expired or was canceled.

Oamic Legal Malpractice Insurance What Exactly Is Tail Coverage And How To Know If You Need It

A tail policy covers what would otherwise be a gap in coverage for directors and officers after the sale of a.

Insurance tail coverage definition. Malpractice A malpractice insurance rider or supplement to a claims-made policy that provides coverage for an incident that occurred while the insurance was in effect but was not filed by the time the insurer-policyholder relationship terminated. Doctor As insurance policy is in effect from January 1 2010 through December 31 2020. An extended reporting endorsement often called an ERE or tail coverage is an endorsement to your policy that provides a period of time to make or report a.

Here is an example of how tail coverage works. Definition of Tail coverage. This coverage is also known as an extended reporting period.

It differs from typical medical malpractice insurance policies which are known as claims-made policies. Tail coverage is another name for an extended reporting period. It gives your business protection for claims that are reported after your insurance policy ends.

Liability insurance that extends beyond the end of the policy period of a liability insurance policy written on a claims-made basis. Tail coverage insurance policy definition. Tail coverage is usually offered by the insurance company your current policy is with.

Tail coverage applies to acts that occurred while your prior policy was in force but for which claims didnt arise until after you canceled it. Bobtail liability insurance is a type of vehicle liability coverage that covers a vehicle when not in use for business purposes. Tail Insurance allows the purchaser to continue to cover EO claims after the policy has expired.

Professional liability insurance coverage usually does not include defamation libel and slander breach of contract breach of warranty. This tail coverage quote will cover you if there are any claims filed after your claims-made malpractice policy expires but occurred while the policy was active. Extended Reporting Period ERP or Tail Coverage Announcement.

Tail Coverage A Definition. Tail coverage is a provision found within a claims-made policy that permits an insured to report claims that are made against the insured after a policy has expired or been canceled if the wrongful act that gave rise to the claim took place during the expiredcanceled policy. Liability claims are often made long after the accident or event that caused the injury.

Tail coverage is a part of how your business insurance coverage works if its written on a claims-made form. Tail coverage is an endorsement also called a rider typically found within a claims-made policy such as errors and omissions insurance EO or directors and officers insurance DO. What Is Tail Coverage.

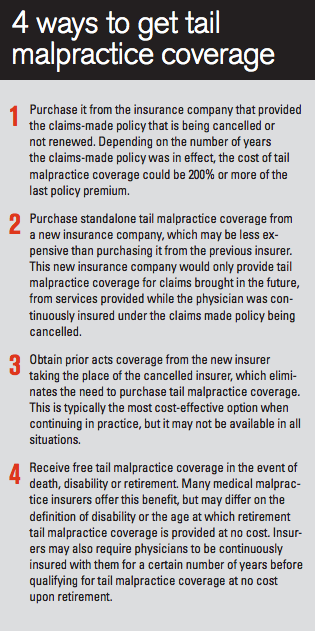

Tail coverage costs 2-3 times the expiring premium. Tail coverage extends the reporting period of malpractice insurance so that medical practitioners can report a wrongful act even after their malpractice insurance lapsed or was cancelled. In contrast to a standard policy tail coverage provides protection for medical malpractice claims that are reported after the providers policy expired or was cancelled.

You may also know tail coverage as extended reporting period coverage. For example a doctor takes out a malpractice claims-made policy that covers the period from January 1 to December 31 20X1 and which contains tail coverage for an additional. However the extension only applies to wrongful acts that happened while the malpractice insurance policy was still in force and it does not apply to wrongful acts that occured after the malpractice.

This is an insurance product that extends your liability coverage beyond the end of your policy period. Tail Coverage a provision found within a claims-made policy that permits an insured to report claims that are made against the insured after a policy has expired or been canceled if the wrongful act that gave rise to the claim took during the expiredcanceled policy. Some policies go further than the standard coverage.

Bobtail insurance is a liability coverage for truckers that pays for property damage or injuries to others that. If you practice medicine under a claims-made insurance policy your insurance only pays out for claims received during the policy period. Below is a copy of an announcement about Extended Reporting Period ERP or tail coverage from one of the Errors and Omissions providers in the country.

What is Bobtail Insurance Coverage. Nose coverage addresses acts that occurred prior to your current policys start date. What is the difference between nose coverage and tail coverage.

Tail coverage is a type of insurance that is designed to cover claims arising before the termination of a claims-made insurance policy but which are reported afterwards. This type of coverage is only applicable to acts that occur during your real estate license period. This policy endorsement is also known as an extended reporting period.

Tail Coverage also known as Extended Reporting Coverage ERP is an important type of insurance add-on for an agencys Errors and Omissions EO policy. DO Tail Policy means a directors and officers liability and fiduciary liability insurance coverage for all directors officers and employees of Company that covers on a primary basis acts or omissions occurring on or prior to the Closing including with respect to acts or omissions occurring in connection with this Agreement and the consummation of the transactions contemplated hereby with a. Tail coverage is meant to address this problem by providing coverage for medical malpractice claims made after an insurance policy has ended.

It applies to claims-made insurance policies and typically involves paying your insurer an additional fee. Its especially useful when buying from a firm selling or closing down an agency. Tail coverage or tail insurance is a general concept that is utilized to extend the claims made reporting time on claims made policy forms of medical professional liability policies.

Installment Tail Coverage the purchase of an extended reporting period ERP also referred to as tail coverage for a claims-made liability policy in 1-year increments.

What Is Malpractice Tail Coverage

Un Dragon Convertido En Coche De Lujo Bmw Z4 Fancy Cars Cool Cars

Claims Made Prior Acts And Tail Coverage

Do You Need Malpractice Tail Coverage

Geico Hawaii Office Homeowners Insurance Home Insurance Quotes Renters Insurance

Picture Desk Live The Best News Pictures Of The Day Animals Animals Beautiful Animals Wild

Pin By Bethany Deluca On Reptiles Forgs Cute Animals Cute Lizard Cute Reptiles

2020 Physician S Guide To Tail Insurance Medpli Professional Liability Insurance

What Is E O Insurance Tail Coverage And How Does It Work In Real Estate Vaned

Tail Coverage What Is It How Does It Work And When Am I Eligible

Claims Made Vs Occurrence Insurance Claims Made Policy The Hartford

What You Need To Know About Health Insurance Tax Benefits Health Insurance Quote Health Insurance Plans Affordable Health Insurance

Tiliqua Rugosa Shingleback Bobtail Stump Tail 15 Australian Blue Tongued Skink Cute And Docile P Reptiles And Amphibians Blue Tongue Skink Amphibians

What Is Tail Insurance Medpli Professional Liability Insurance

What Is Medical Malpractice Tail Coverage Equotemd

Tail Insurance Faqs Aegis Malpractice Solutions

Mexican Mole Lizard Bipes Biporus Mexican Mole Lizard Reptiles

Una Madera Muy Costosa Suscribete A Nuestro Canal De Youtube Para Ver Las Excentricidades Millonarias Mas E Best Luxury Cars Bmw Sports Car Luxury Cars Bmw

Posting Komentar untuk "Insurance Tail Coverage Definition"