What Does Catastrophic Coverage Limit Mean

Prior to the ACA catastrophic coverage was a generic term that referred to any sort of health plan with high out-of-pocket costs and limited coverage for routine health needs. Part D plans have four payment stages with a limit you must reach before moving on to the next phase.

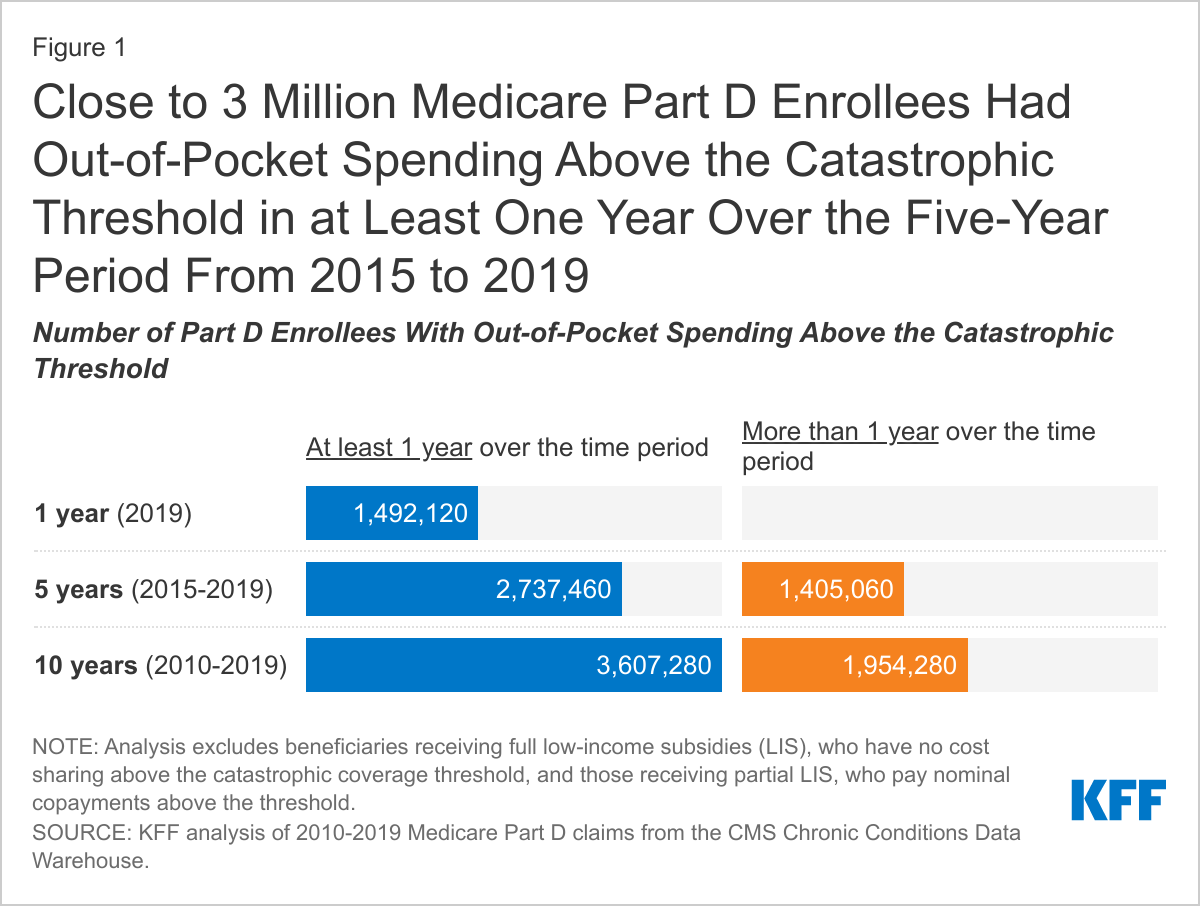

Millions Of Medicare Part D Enrollees Have Had Out Of Pocket Drug Spending Above The Catastrophic Threshold Over Time Kff

Services that are not covered.

What does catastrophic coverage limit mean. The tradeoff is catastrophic plans have lower monthly premiums the amount you pay each month in order to keep your insurance policy active compared to most health insurance plans since you could be on the hook to pay some health costs yourself. Cost of catastrophic health insurance plans. Named storm hurricane flood and earthquake rather than to all perils.

A catastrophic event property deductible CAT deductible differs from a traditional property insurance deductible. It is the amount of money that a person must pay out-of-pocket for health care expenses incurred by a catastrophic illness before. Catastrophic coverage refers to the point when your total prescription drug costs for a calendar year have reached a set maximum level 6550 in 2021 up from 6350 in 2020.

The catastrophic phase of Part D coverage happens when a person reaches their maximum OOP expenses. What is the catastrophic coverage limit. Catastrophic health insurance plans have a deductible that is the same as your out-of-pocket limit.

What Does Catastrophe Insurance Mean. The catastrophic cap is the maximum out-of-pocket amount the beneficiary will pay each calendar year for TRICARE-covered services. Dont worry its not as scary as it sounds.

The 2021 standard Initial Coverage Limit ICL is 4130. But that does not mean that remaining on a parents health plan is always the best choice. We limit your annual out-of-pocket expenses for the covered services you receive to protect you from unexpected healthcare costs.

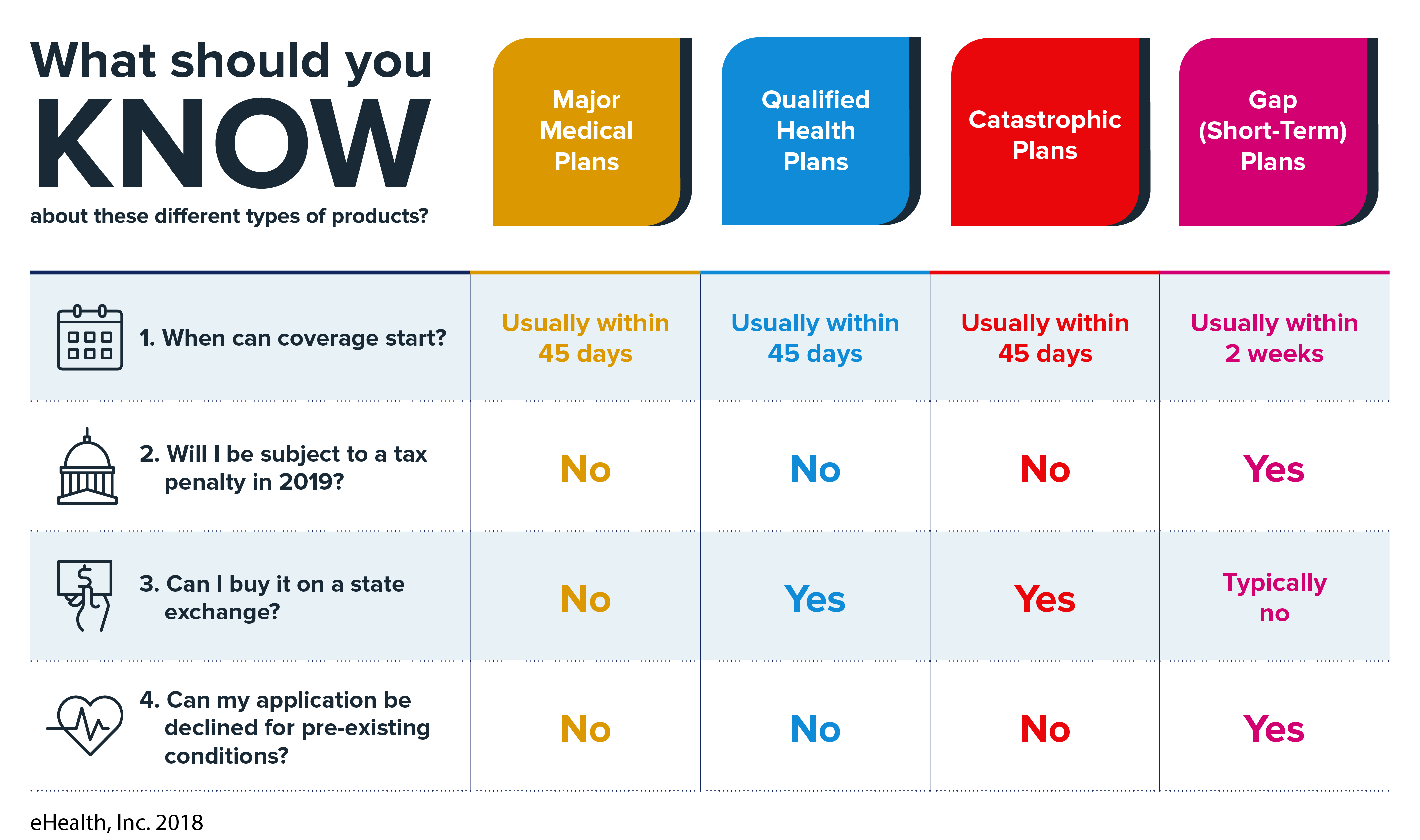

At this point you are out of the prescription drug donut hole and your prescription drug coverage begins paying for most of. What is the catastrophic limit. But the ACA created catastrophic health plans as a new type of plan available in the individual market.

When your out-of-pocket costs reach 6550 on covered drugs. The Medicare Catastrophic Coverage Act was a 1988 law meant to establish catastrophic coverage for those on Medicare. The catastrophic limit also known as the out-of-pocket limit is the highest amount of money you have to pay out-of-pocket during a given period of.

Once youve automatically entered catastrophic coverage for reaching the TrOOP limit your drug costs are almost completely covered except for a small coinsurance or copayment for covered drugs. The additional 15 percent non-participating providers. Catastrophic Limit Health Care Law and Legal Definition.

McGraw-Hill Concise Dictionary of Modern Medicine. 4 The Catastrophic Coverage Phase begins once your total out-of-pocket drug costs exceed a certain point for instance over 6550 in 2021 you will exit the Donut Hole or Coverage Gap. These include natural disasters such as earthquakes floods and hurricanes as well as man-made disasters such as terrorist attacks.

Once youve reached your Medicare TrOOP limit youll enter whats called catastrophic coverage. Youll pay most of your medical costs out of pocket until you reach it. Catastrophic coverage refers to the point when your total prescription drug costs for a calendar year have reached a set maximum level 6550 in 2021 up from 6350 in 2020.

In exchange for a low premium youll have a high deductible. The Initial Coverage Limit is the measured by the retail cost of your drug purchases and is used to determine when you leave your Medicare plans Initial Coverage Phase and enter the Donut Hole or Coverage Gap portion of your Medicare Part D prescription drug plan. Point of Service charges.

For 2021 the OOP limit is 6550 out of. Catastrophic Coverage is the 4th stage of Medicare Part D drug coverage after the Coverage Gap or Donut Hole stage. The beneficiary is not responsible for any amounts over the catastrophic cap in a given year except for.

Catastrophe insurance protects businesses and residences against natural disasters such as earthquakes and floods and against man-made disasters. The Medicare Part D coverage gap also known as the donut hole is the payment stage between the initial coverage limit and the catastrophic coverage. In the catastrophic stage you will pay a low coinsurance or copayment amount which is set by Medicare for all of your covered prescription drugs.

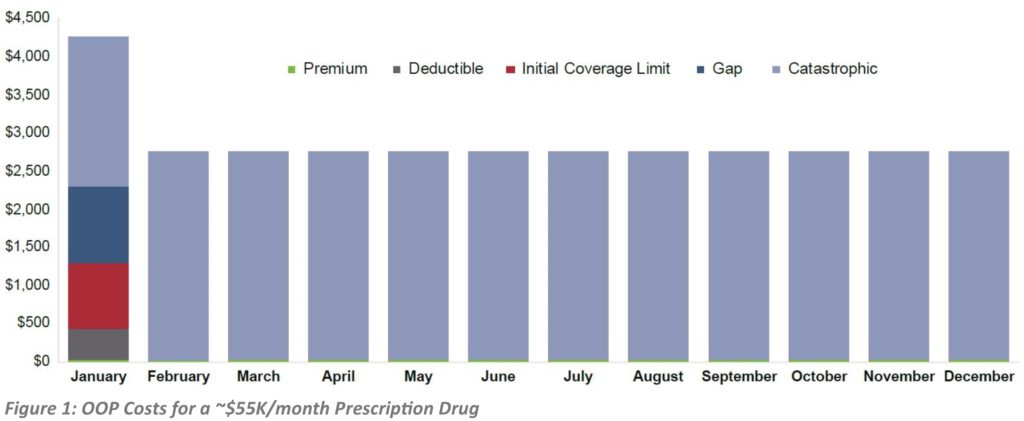

In the Catastrophic Coverage phase you will receive your medications at a low-fixed price paying around 5 of the retail price for brand drugs for the remainder of the year. Once youve spent 6550 out-of-pocket in 2021 youre out of the coverage gap. Annual Deductible Initial Coverage Coverage Gap or donut hole and Catastrophic Coverage.

Managed care A ceilingeg 1000 on the amount of money that a person must pay out-of-pocket for the health care expenses incurred by a catastrophic illnesseg AIDS burns CA MVA etc before the insurer pays bills. After your out-of-pocket cost totals 6550 you exit the gap and get catastrophic coverage. Catastrophe insurance provides coverage in the event of catastrophic events.

Skip to main content. Among other cost-cutting measures it set limits on out-of-pocket costs for seniors on Medicare and most importantly established coverage for outpatient prescription drugs. 2002 by The McGraw-Hill Companies Inc.

CAT deductibles are a significantly higher out-of-pocket expense to the policyholder and apply to specific perils eg. How much does catastrophic coverage cost. Once you get out of the coverage gap Medicare prescription drug coverage you automatically get catastrophic coverage It assures you only pay a small.

Unless you receive Extra Help from Medicare you automatically leave the Coverage Gap and enter the Catastrophic Coverage stage once youve spent a total of 5000 in out-of-pocket drug costs during 2018. This amount is made up of what you pay for covered drugs and some costs that others pay. Find Lowest Drug Prices.

Catastrophic limit refers to the maximum amount of certain covered charges set by the insurance policy to be paid out of pocket of a beneficiary during a year. Catastrophic health insurance is an inexpensive coverage option designed to protect you from major medical expenses. In all Part D plans you enter catastrophic coverage after you reach 6550 in out-of-pocket costs for covered drugs.

Medicare Part D And Catastrophic Coverage Costs Rules And Support

How The Tricare Catastrophic Cap Affects Your Health Care Costs Military Com

Medicare Part D And Catastrophic Coverage Costs Rules And Support

Jsa Examples Use Or Copy These Job Safety Analysis Examples In Safety Analysis Report Template Best Sample Template Hazard Analysis Analysis Stock Analysis

Occupy Austin Poster Graphic Design Posters Graphic Design St Austin

18 Cat House Design Images Modern Cat Houses Of 2019 The Architecture Designs Calicoca Muebles Para Mascotas Areneros Para Gatos Casa De Juegos Para Gatos

Nyc Balconies Rooftops Covetable Outdoor Spaces In The City Architecture Interior Architecture Design House Styles

An Out Of Pocket Cap Will Help Millions Of Medicare Beneficiaries Maprx Info

Donut Hole Medicare Part D Donut Hole Closing In 2020

Green Lanterns 028 2017 Reading Comics Online For Free Jessica Cruz Green Lantern Green Lantern Corps Green Lantern

Inferential Statistics Statistics Math Statistics Quantitative Research

En Las Calles De Barcelona Javier Y Mario Tiene Un Accidente Cuando Acelerar El Mercedes S Inexpensive Car Insurance Car Accident Lawyer Getting Car Insurance

Catastrophic Health Insurance Pros And Cons Insurance Com

Catastrophic Health Insurance Definitions Plan Costs

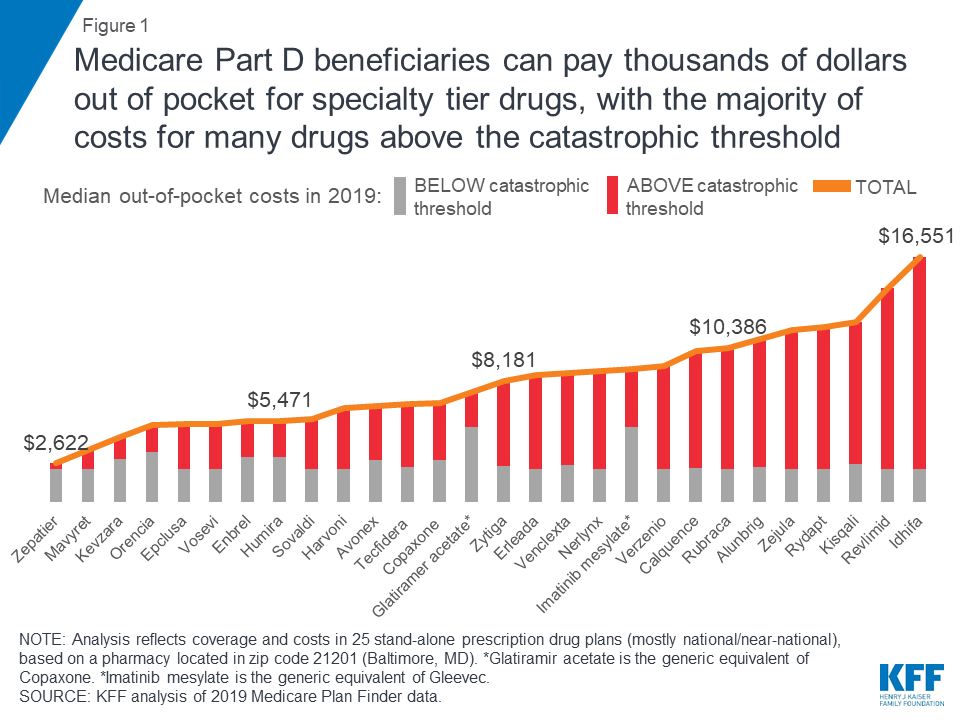

The Out Of Pocket Cost Burden For Specialty Drugs In Medicare Part D In 2019 Kff

Big Crunch Theory Old Uniserse New Universe Stephen Hawking Cosas Que Rebotan Universo

Three Limits To Growth Our World

The Out Of Pocket Cost Burden For Specialty Drugs In Medicare Part D In 2019 Kff

Waymo Cto In A Natural Disaster Self Driving Cars Must Recognize Their Limits Self Driving Driving Fleet

Posting Komentar untuk "What Does Catastrophic Coverage Limit Mean"