Icbc Insurance Coverage Explained

This makes premiums fairer for everyone because only those who want that coverage will purchase it. A new era of car insurance in BC.

Buy Or Renew Car Insurance Policies Online Buy Car Insurance Policy In Easy Steps Get 24x7 Spot Assistance Insurance Money Car Insurance Better Credit Score

ORV in a parking lot or for any other on-highway operation as permitted by an operation permit.

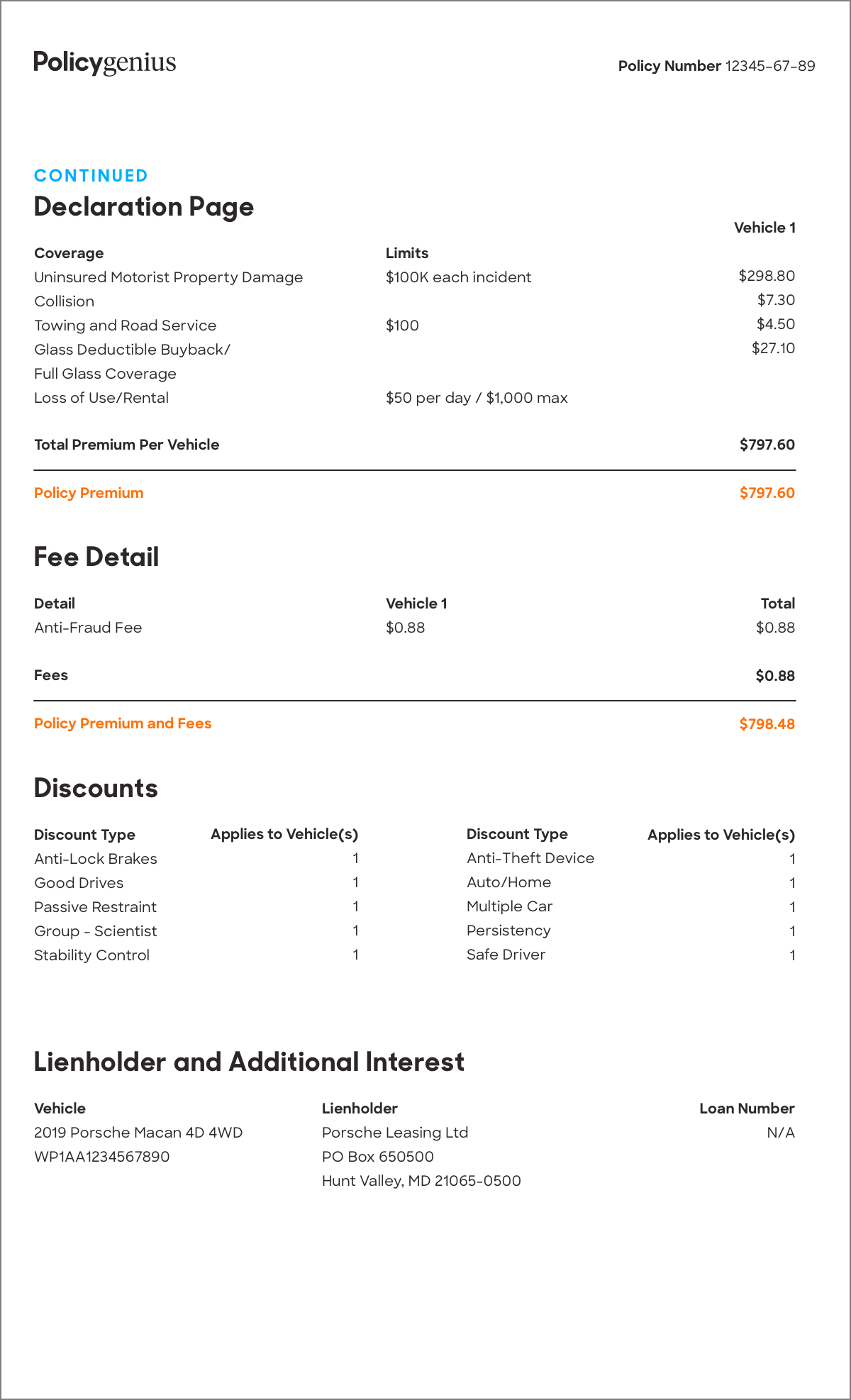

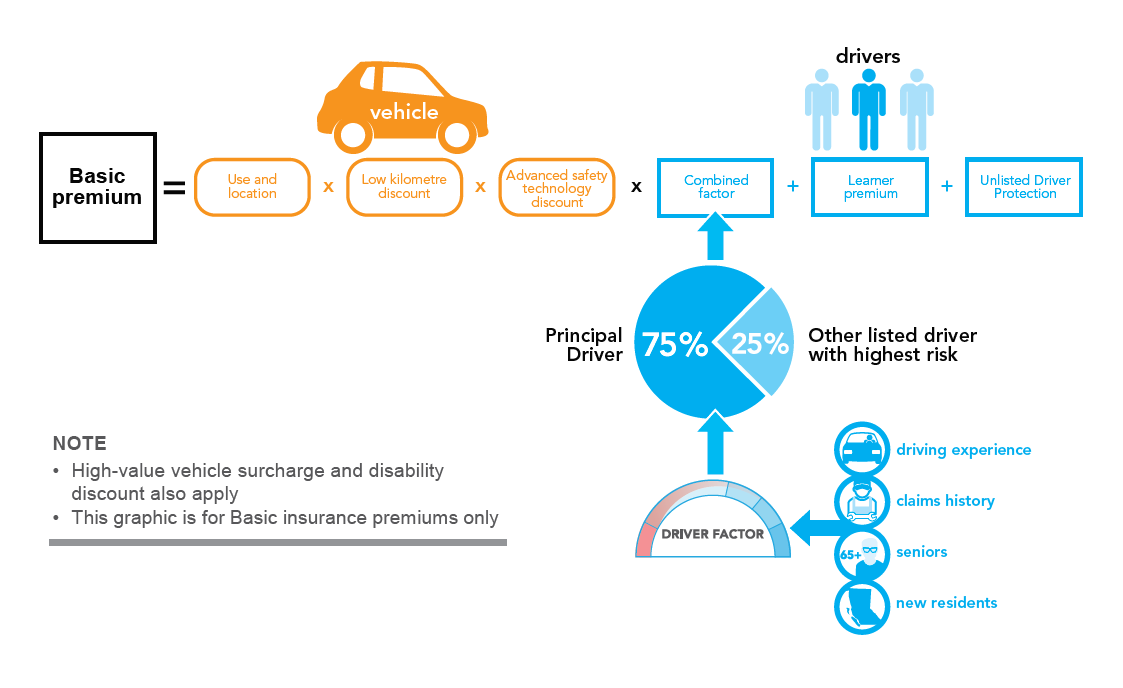

Icbc insurance coverage explained. Motorists are in line to see dramatic changes to their auto insurance and a 20 per cent cut to premiums in May 2021 under the new no-fault. Occasional use is up to 12 days in a year per driver in any vehicle owned or leased by the registered owner lessee or principal driver. ICBC No Fault Insurance ICBC Enhanced Care Coverage will now apply to everyone that is injured in a motor vehicle accident on or after May 1 2021.

Income Top-Up As of May 1 2021 ICBCs new Enhanced Care coverage is in effect which has introduced significant changes to BCs auto insurance system. Bodily injury will be covered under ICBCs new Enhanced Accident Benefits. This new hit-and-run coverage does not cover injuries sustained from hit-and-run incidents.

Insurance Corporation of British Columbia is committed to protection and peace of mind for British Columbia drivers quality products and services and offering customers the best coverage at the lowest possible price. ICBC Basic Insurance. Collision 300 deductible.

Which as of April 1 have doubled to 300000 -- six times as much as those in Alberta. Your coverage under the new model explained As youve probably heard by now ICBCs new car insurance model will come into effect on May 1 st. What is ICBC No Fault Insurance.

When ICBC was created in the early 1970s by the then NDP government the basic ICBC insurance coverage which had to be purchased by every motorist in B. Drivers in line for dramatic insurance changes. All motorists in BC.

ICBC Insurance An Auto Insurance for BC. Close to those in. For highway crossings controlled by a stop sign or traffic light or when loading and unloading an.

Optional collision coverage also protects you from hit and runs outside of BC. Let us help navigate what auto insurance is right for you. Knoepfels basic and optional coverage which she gets through ICBC dropped 226 a year from 1450 to 1224 a difference of over 15 per cent.

Third Party Liability up to 2 million. Are required to buy a basic package of ICBC Autoplan insurance. ICBC changes explained.

How does Comprehensive coverage help you. If you do not carry Collision coverage with ICBC or hit-and-run coverage from a private insurer ICBC will offer a new standalone optional coverage for hit-and-run accidents. Non-collision damage can happen in a variety of ways.

I couldnt believe it. This basic coverage requirement covers the bare minimum level of insurance. The new models goal is to make car insurance more affordable for British Columbians and provide better care and recovery benefits to anyone injured in a crash.

Any British Columbia driver that wishes to register or drive a vehicle must first obtain an ICBC insurance plan. The amount of this coverage. So if you buy ICBCs collision coverage as approximately 80 per cent of personal insurance customers do you are still protected.

The good news is that this coverage from ICBC now costs much less under Enhanced Care than it did in our old system. Public Insurance ICBC offers the mandatory basic auto plan which includes third-party liability insurance underinsured motorist coverage and accident benefits. C included coverage for medical rehabilitation death and wage loss benefits.

There is one obvious reason ICBC insurance coverage is so prevalent. ICBC Basic Autoplan insurance is the mandatory coverageyou need for a vehicle in BC. Finally ICBC outlined differences in insurance coverage including the example of medical benefits in BC.

Private Insurance This includes car insurance policies sold by private insurers. It helps ensure that all British Columbians who own and drive a motor vehicle here are protected with a basic level of coverage. Your vehicle is much more than an investment in your life.

Anyone injured in an auto accident can receive benefits payments for medical care and wage-loss compensation in amounts pre-determined by ICBC based on the type of injuries suffered. The changes would bring the insurance system in BC. Comprehensive coverage helps offset the costs from this kind of damage.

When you buy car insurance in BC you will be purchasing basic mandatory coverage which is provided by the Insurance Corporation of British Columbia ICBC sold through us either by email. ICBC No Fault Insurance puts the rights of injured claimants at risk. Buy renew update or cancel your insurance ICBCs Autoplan insurance is sold exclusively through our province-wide network of 900 Autoplan brokers.

This new coverage protects you from a one-time financial penalty should an occasional driver not listed on your policy causes a crash in your car. Motorists are in line to see dramatic changes to their auto insurance with changes to ICBC announced last week. Find out whats included in your Basic Autoplan insurance.

What Is Covered Under No-Fault Insurance. If you operate an ORV on or across highways youre required to obtain ICBCs Basic Insurance. Thats why you may want to purchase optional third-party liability coverage to extend the coverage you receive in your basic insurance and protect yourself when driving out of province.

According to ICBC enhanced care means better care and coverage after a car accident. This includes pedestrians and cyclists. See your options for buying and renewing your coverage.

Rental Vehicle Coverage protects you when youre renting a vehicle or using a courtesy car. Dave Eby explains ICBC overhaul and move to no-fault system Feb 7 2020. New ICBC Coverages Explained.

Break-ins a chipped windshield falling treesa lot more can happen to a vehicle than just a crash. Third Party Liability up to 1 million. Obtaining a policy is mandatory.

What Is Comprehensive Insurance The Hartford

How To Choose An Insurance Broker Insurance Broker Travel Insurance Quotes Insurance

How Does Auto Insurance Work In Bc Ultimate Guide 2021

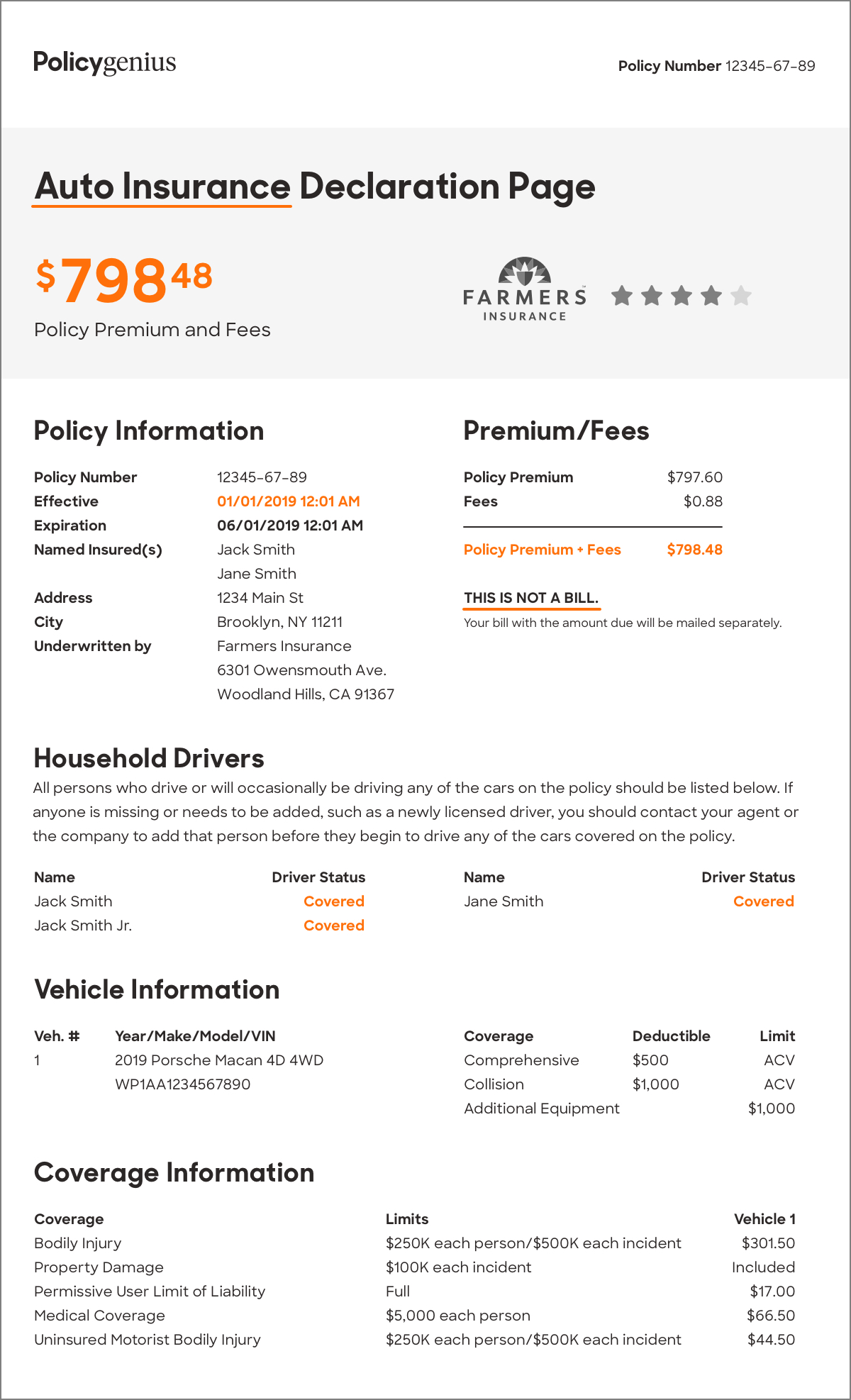

Understanding Your Car Insurance Declarations Page Policygenius

Understanding Your Car Insurance Declarations Page Policygenius

Icbc Car Insurance Explained Vina Insurance Services Ltd

Third Party Vs Comprehensive Car Insurance 09 Oct 2021

Liability Car Insurance Guide For 2021 Key Things To Know

Who Knows Exactly The Secret To Lower Icbc Insurance Rates Ctv News

Protecting All Your Most Valuable Toys Best Insurance

Collision Insurance Typically Pays For Damages To Your Vehicle If You Re Involved In An Accident Here Are Car Insurance Insurance Comprehensive Car Insurance

How To Buy Car Insurance For The First Time Valuepenguin

A Comprehensive Car Insurance Cover Protects Against The Losses Caused By Damage To Your Vehicle Car Insurance Facts Life Insurance Facts Auto Insurance Quotes

4 Things To Look For When Selecting An Insurance Provider In Singapore In 2021 Health Insurance Plans Healthcare Costs Private Health Insurance

What Does Full Coverage Car Insurance Cover

Enhanced Care Icbc S New Changes Good Or Bad

One Of The Most Basic Types Of Auto Insurance Coverage Liability Is Also One Of The Few Coverage Optio Car Insurance Auto Insurance Quotes Insurance Marketing

Car Insurance In Pakistan Car Insurance Insurance Compare Insurance

Posting Komentar untuk "Icbc Insurance Coverage Explained"