Mrta Insurance Coverage Malaysia

Which is better for my needs. For example if your loan tenure is 5 years the MRTA MLTA coverage period must follow the similar period of 5 years.

The Complete Guide To Mrta Mlta Mrtt And Mltt In Malaysia Propertyguru Malaysia

What are the differences between Mortgage Reducing Term Assurance MRTA Overdraft Term Level Assurance ODLTA and Mortgage Level Term Assurance MLTA insurance.

Mrta insurance coverage malaysia. However MRTA and MLTA are often misunderstood. No limit subjects to underwriting should Sum Assured exceeds RM550000. Five years later your coverage reduces to RM400000 your MRTA coverage reduces over time hence the term reducing term.

Guaranteed premium refund at maturity if the optional refund of premium rider is attached if no claims are made during the term of the policy. The sum assured reduces with time Gradually decreases to nothing by the end of the tenure. Buying a house is not easy especially with the increasing price of houses.

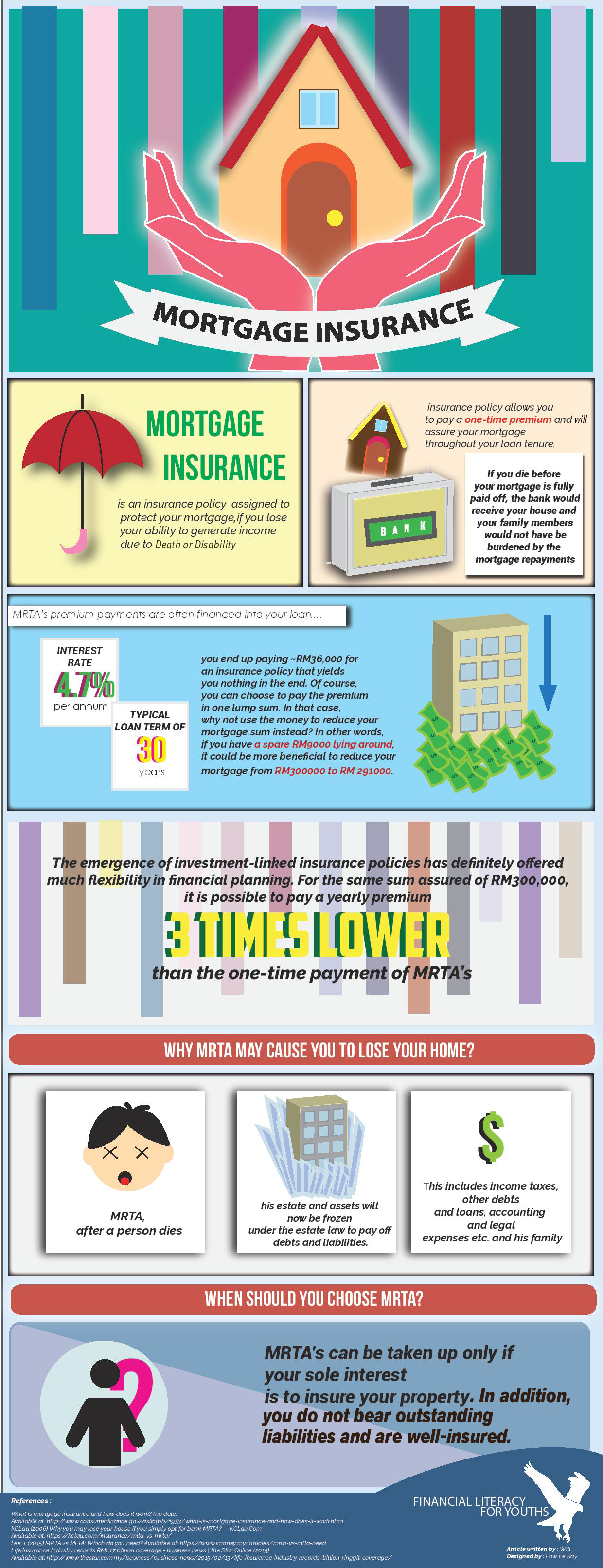

The MRTA will always cover whatever amount is outstanding on the mortgage balance at the point you become unable to pay the mortgage. Mortgage Reducing Term Assurance MRTA life insurance plan with decreasing sum assured over time and it used just to cover your home loan owed to bank. Specifically MRTA helps settle outstanding home loan amounts in the event of death or total disablement of the borrowers.

While Bank Negara Malaysia does not make it compulsory to buy mortgage insurance customers who borrow money from financial institutions will find that their loan approvals are tied to a mortgage insurance. We made a super simple chart to show you. Which do you need as a homeowner.

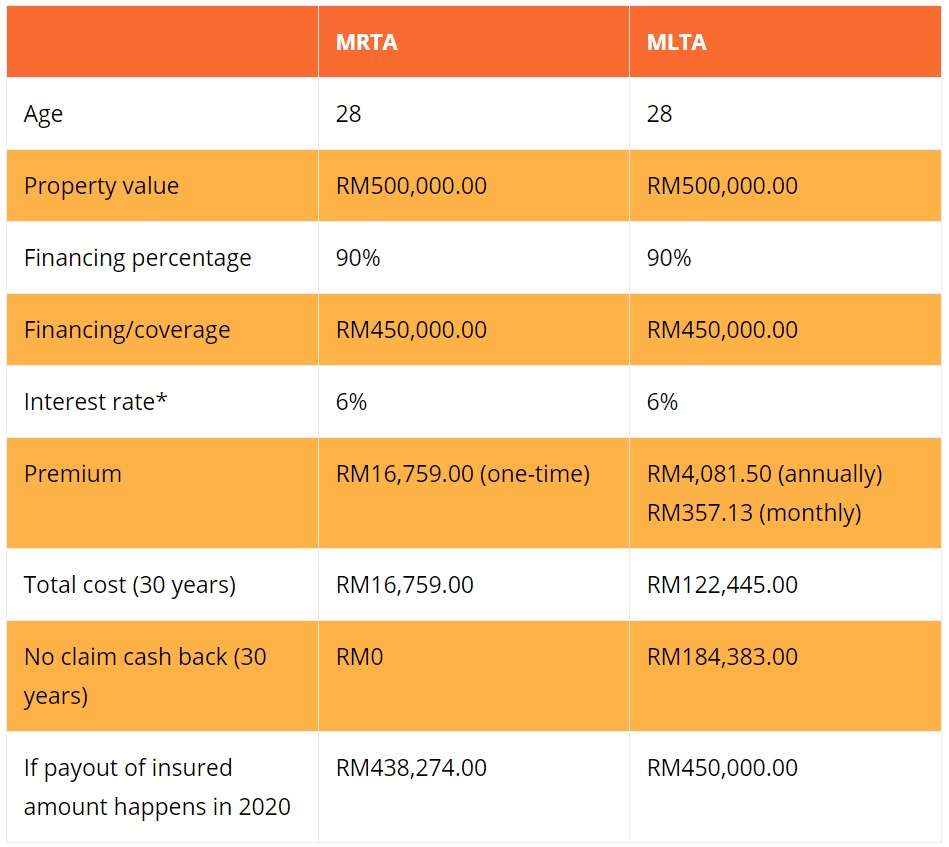

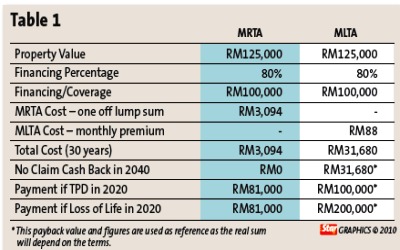

Does it make a difference if the property is for my own stay or for investment purposesUpdated. The housing loan protection plan for public servants. Here is a comparison of the estimated payout between MRTA and MLTA based on insurance cover for the sum of RM450000 using 6 interest over 30 years starting in 2018 for a 28-year-old homeowner.

This plan is usually offered by the bank you are getting the mortgage from as it is used as protection for the bank in case of misfortunes that stop you from servicing the loan. Total and permanent disability TPD benefit. The MRTA MLTA coverage period must be the same as your loan tenure or remaining loan tenure.

MRTA is an insurance policy that provides financial protection for home loan borrowers and their families. To start you off. Choose a coverage term of 10 15 or 20 years to suit your financial needs during the mortgage-paying years.

For example a home buyer purchases an MRTA coverage of RM 350000 with a tenure of 25 years. The Mortgage Reducing Term Assurance MRTA and the other one is the Mortgage Level Term Assurance MLTA. It protects the borrower against death or TPD.

Furthermore getting financial support for it is even harder. You pay a one-time premium of RM11500 for the MRTA. 40 years inclusive of deferment period or expiry at age 70 years old whichever is lower Deferment Period.

Mortgage Reducing Term Assurance MRTA helps you settle your outstanding home financing amount in the event of Death or Total and Permanent Disability TPD. Mortgage Reducing Term Assurance MRTA A comprehensive term life assurance that provides financial protection in the event of premature death or total permanent disability. Covers TPD from accidental and.

In Malaysia there are two types of mortgage life insurance available Mortgage Reducing Term Assurance MRTA or Mortgage Decreasing Term Assurance MDTA and Mortgage Level Term Assurance MLTA. MRTA or MDTA is a reducing term life insurance. Covers accidental death and natural death.

At present there are two. This is used as a protection for the bank in case unfortunate circumstances hinder you from paying the loan. The bank who approves your mortgage loan is usually the one providing MRTA.

The coverage term may. Heres the lowdown on the two. Some MRTA policies such as Prudentials PRUmortgage that is distributed through SCBSL also offer the option of adding cover against total and permanent disability until the policyholder turns 70.

MRTA insurance covers the policyholder during the term of the policy by paying off any outstanding mortgage payments that the policyholders spouse may be left with. Which mortgage life insurance do I need. The premium for this insurance is dependent on the sum assured and the tenure of coverage as well as other factors pertinent to life insurances Eg.

After five years for example you would have paid RM 60000 RM12000 x 5 years in mortgage repayments leaving RM. As the name suggests Mortgage Reducing Term Assurance MRTA is a life assurance plan that has a decreasing sum assured over time. Later on you decide to move into a smaller property unit lets call it Property B and it is valued at RM350000.

Bcz Property Mrta Or Mlta For New Homebuyer Hope This Facebook

Mrta Vs Mlta Difference Comparison Table Easy To Understand

Mortgage Insurance Fly Malaysia

Why Mlta Is Better Than Mrta A Comparison Insurance In Malaysia One Stop Center For Info

The Complete Guide To Mrta Mlta Mrtt And Mltt In Malaysia Propertyguru Malaysia

Mrta Vs Mlta In Malaysia Which Is The Best For You Propertyguru Malaysia

Mrta Vs Mlta Which Is Better Wealthcare Blog

Difference Between Mrta Vs Mlta Mcis Insurance Agent Facebook

Mrta Vs Mlta Which Do You Need Investment Property Do You Need Survival Tips

Mortgage Reducing Term Assurance Mrta Vs Mortgage Level Term Assurance Mlta 2021 Which One Is Better Malaysia Housing Loan

Understanding Differences Between Mrta And Mlta Choon Hong

Mrta Vs Mlta And How Much Coverage Is Needed Mypf My

Mortgage Reducing Term Assurance Mrta Vs Mortgage Level Term Assurance Mlta 2021 Which One Is Better Malaysia Housing Loan

Mortgage Reducing Term Assurance Mrta Vs Mortgage Level Term Assurance Mlta 2021 Which One Is Better Malaysia Housing Loan

Mortgage Or Loan Term Insurance The Star

Property Educational Articles Mpig

The Differences Between Mrta Vs Mlta Which Should I Get

5 Features That Differentiate An Mrta From An Mlta Free Malaysia Today Fmt

Mortgage Reducing Term Assurance Mrta Vs Mortgage Level Term Assurance Mlta 2021 Which One Is Better Malaysia Housing Loan

Posting Komentar untuk "Mrta Insurance Coverage Malaysia"