Title Insurance Coverage Period

Title insurance premiums are always calculated based on the amount of the policy. The GAP is the time period between the closing of the sale and purchase transaction when a title commitment is issued to the buyer and the actual recording of the sellers deed.

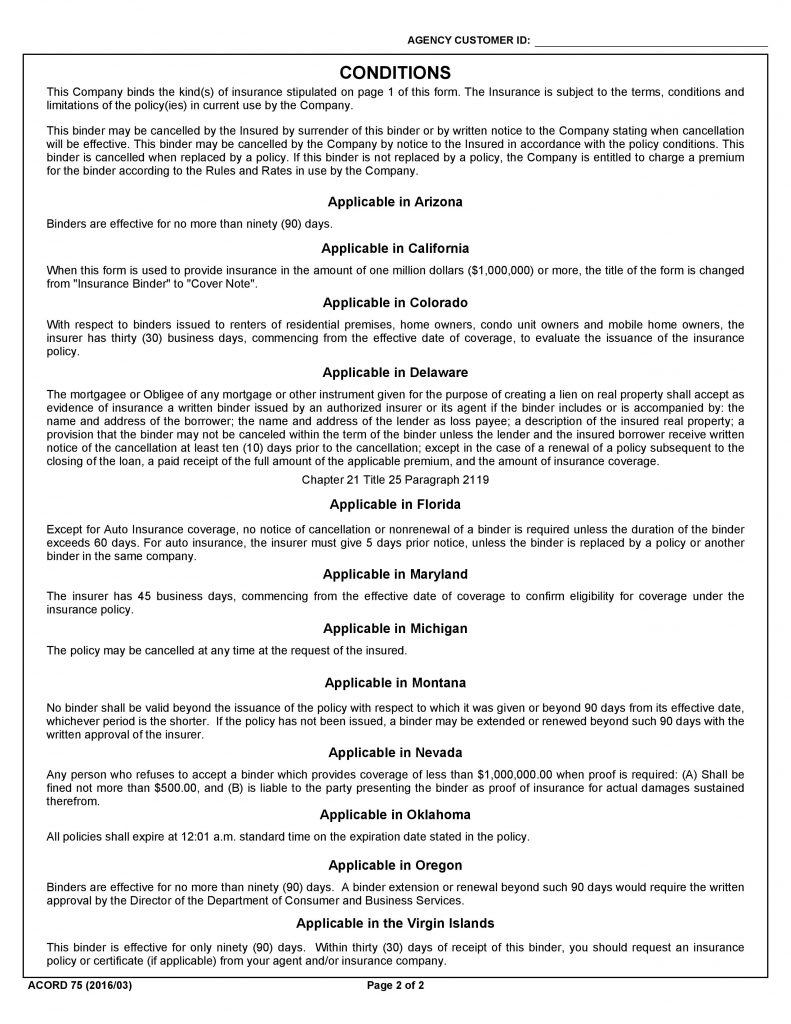

Insurance Binder What It Is How It Works Honest Policy

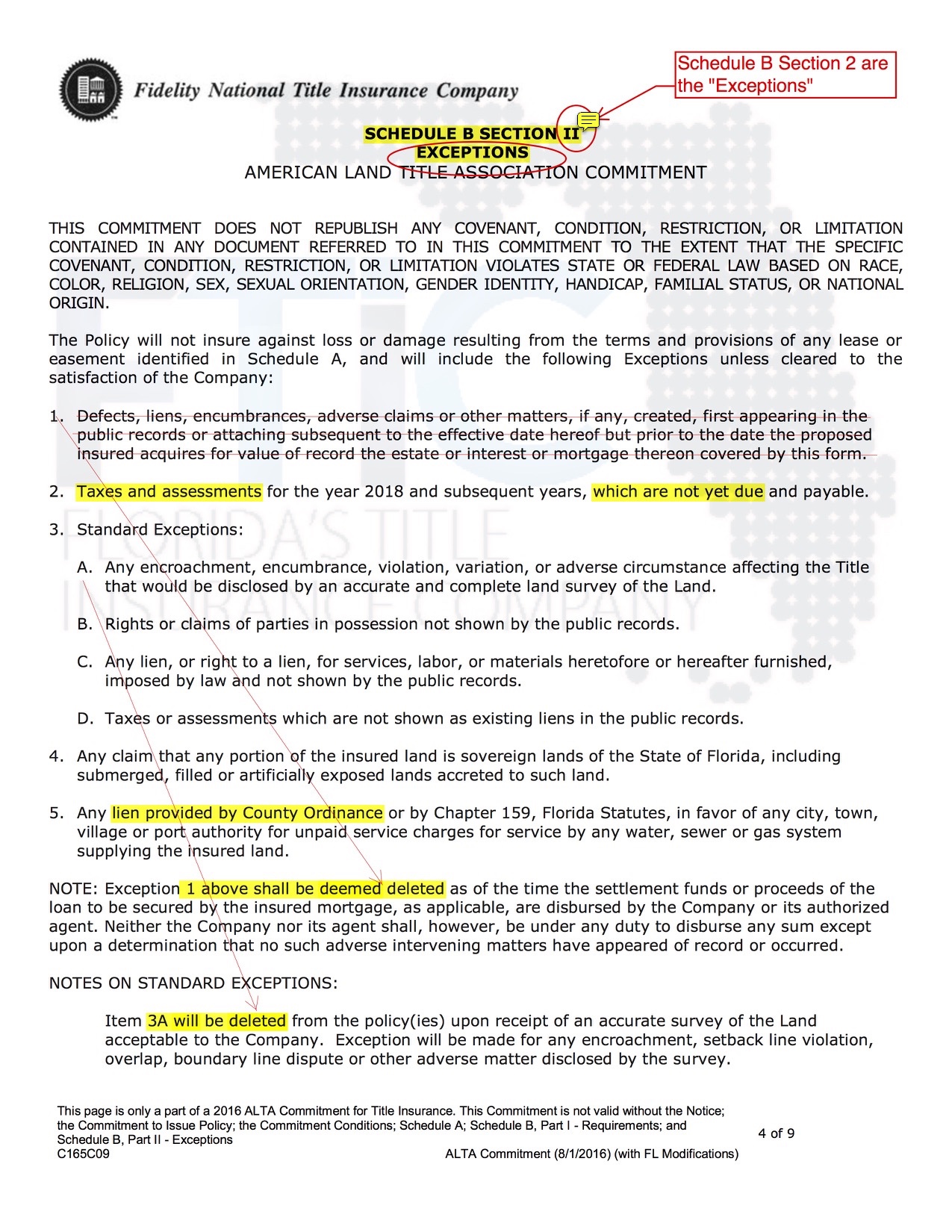

Through a better understanding of the matters excluded from coverage in a title insurance policy a real estate.

Title insurance coverage period. All policies have defined periods. Karlen and incorporates Chicago Title Insurance Company underwriting guidebooks and manuals and the Guide to Residential and Commercial Surveys article by Richard F. The policy provides coverage against losses due to title defects even if the defects existed before you purchased your home.

Covers up to 10000 after a deductible equal to the lesser of 1 of the policy amount or 2500. Title insurance covers any underlying issues with a home or propertys title that the title company may have missed during the home-buying process. Title insurance is generally a two-step procedure and the period of time between those two steps is the gap period.

About Title Insurance. Just follow the instructions on our website. It will also give the parties and the title company time to work out any potential insurance coverage prior to closing.

A title insurance gap policy provides insurance coverage to the policyholder for title defects that may arise during the gap period. You can submit a claim on-line at httpsfctcamake-a-claim. This most often applies to car insurance.

That the title policy shall give coverage for the lack of priority of an Insured Mortgage over street improvement assessment liens for ongoing or completed construction at Date of Policy. The CLTA title insurance coverage remains active until the property is sold while the ALTA lenders policy remains in place until the loan is paid off. After all title insurance can cost between 500 and 3500 depending on your state the cost of your home and what insurance provider you pick.

The one-time title insurance premium is part of the closing costs for the loan and like most insurance premiums the cost is based upon the coverage amount. The owners coverage under the policy lasts for as long as he or she owns the property or. With the exception noted below title insurance only protects against losses arising from events that occurred prior to the date of the policy.

Most Title Insurance Premiums Are Graduated by Policy Amount at Intervals of 500 or 1000 of Coverage. Coverage if extended by the title company comes by issuing the title insurance policy without an exception for unrecorded construction liens or for some lenders endorsing the exception off an existing policy such as policy for a construction loan or a. The start date and end date are the cutoff dates on your documentation payments and coverage unless you renew.

The first is lenders title insurance which covers your mortgage lenders interest in your property. It is imperative that the title searcher and title insurance agent take steps to minimize the risks associated with the indexing-delay-gap and other gap periods. Stasko edited by Douglas M.

A title insurance policy provides coverage to an insured owner for unknown or undisclosed title matters that occurred prior to the effective date of the policy. There are also different types of title insurance and youll want to make sure that youre fully covered and not just the lender. This article was written by Christopher J.

This coverage applies if the policyholder cannot close a sale secure a loan or obtain a building permit because the land was improperly subdivided prior to purchase. The typical premium structure begins with a stated dollar amount for a minimum policy amount which is typically 10000. Now the owners insurance would cover the full 400000 purchase price but the cost is based on the 150000.

Bales dated September 2015. In other words this is construction lien coverage required by a lender or buyer after the house is finished but before the 75 day filing period has expired. This coverage is available to you for your commercial and residential transactions.

Coverage ends on the day the policy is issued and extends backward in time for an indefinite period. Your lender will do an active title search when you apply for a mortgage. FCTs title insurance policy provides protection for any loss that results should a registration occur between the period that a title search is conducted and the closing documents are registered at.

Title insurance is an insurance policy that protects you the home owner against challenges to the ownership of your home or from problems related to the title to your home. Upon recording an actual title policy can be issued by the closing agent this recording period can take from one day to several weeks. A residential owners title insurance policy provides coverage for losses when you are forced by a governmental authority to remove or remedy any part of your building because it was constructed without a required building permit.

When you purchase a home the lender or attorney will request a title examiner to perform a title search for closing. This is in marked contrast to property or life insurance which protect against losses resulting from events that occur after the policy is issued for a specified period into the future. Coverage ends on the day the policy is issued and extends backward in time for an indefinite period.

Lenders title insurance coverage would be 250000 and the owners policy would be 150000 the difference between the price and first mortgage loan amount. A title search gives a history of the property including its previous owners and depending on your state the required search period could range between 40 and 70 years. So comparison shopping can help shave down that price.

This will stay in place as long as your mortgage is active. An insurance policy period is the time frame during which an insurance policy is effective. Recognizing the importance of the effective date of the commitment performing a date-down search understanding the Gap Coverage Endorsement and promptly recording instruments of conveyance can significantly reduce these risks.

For the purposes of this subchapter any policy period or term of less than 6 months shall be considered a policy period or term of 6 months and any policy period or term of more than 1 year or any policy with no fixed expiration date shall be considered a policy period or term of 1 year. In any real estate transaction the title company runs a public records search to ensure that the home being purchased is free. The examiner would head to the local courthouse and perform.

A title defect is a problem with the title which.

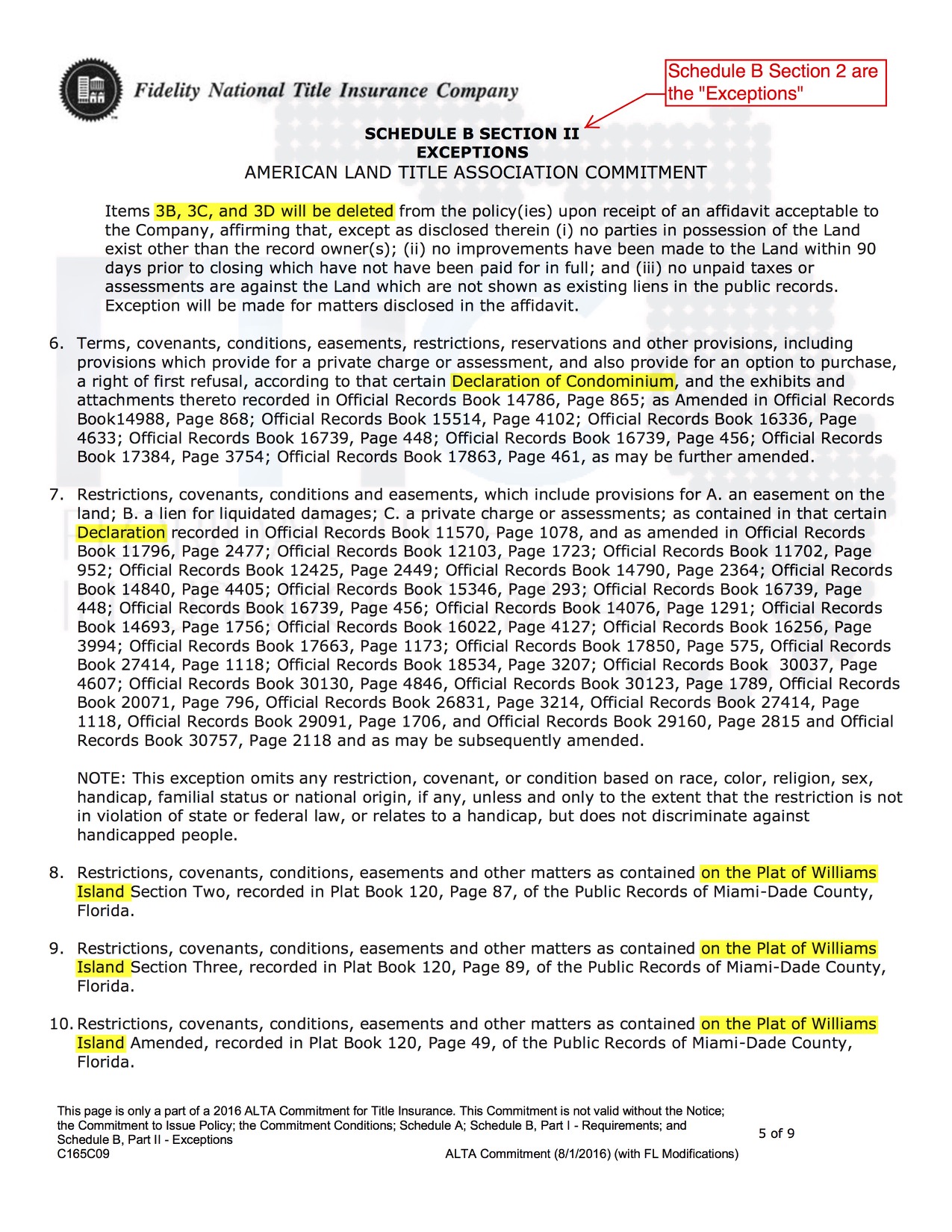

How To Read A Title Commitment Florida S Title Insurance Company

Title Policy Coverage What Is It And What Is It Not Texas National Title

3 Reasons A Title Agent Needs Release Tracking Title Insurance Real Estate Fun Business Development

What Is Waiting Period In Health Insurance A Detailed Guide

Title Commitments Title Insurance Standard Exceptions To Coverage The Closing Agent

How To Read A Title Commitment Florida S Title Insurance Company

How To Read A Title Commitment Florida S Title Insurance Company

Understanding Your Car Insurance Declarations Page Policygenius

Title Commitments Title Insurance Standard Exceptions To Coverage The Closing Agent

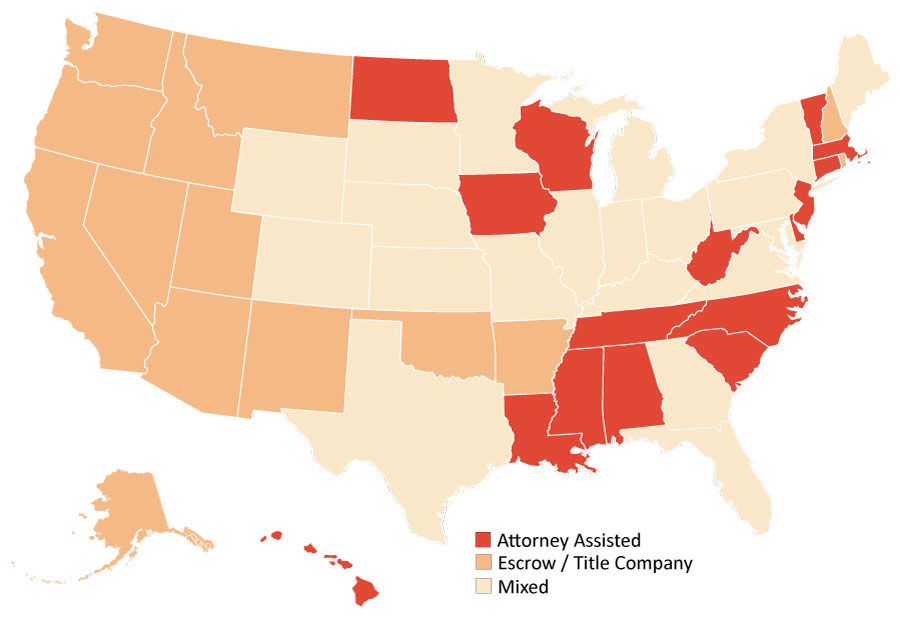

State By State Closing Guide Sandy Gadow

How To Read A Title Commitment Florida S Title Insurance Company

Vehicle Sale Agreement Lettering Letter Templates Free Lettering

Pin On Quote For Short Term Insurance For Location For Film

Title Commitments Title Insurance Standard Exceptions To Coverage The Closing Agent

Posting Komentar untuk "Title Insurance Coverage Period"