Underlying Coverage Meaning Insurance

We hope the you have a better understanding of the meaning of Underlying Coverage. Schedule of underlying insurance.

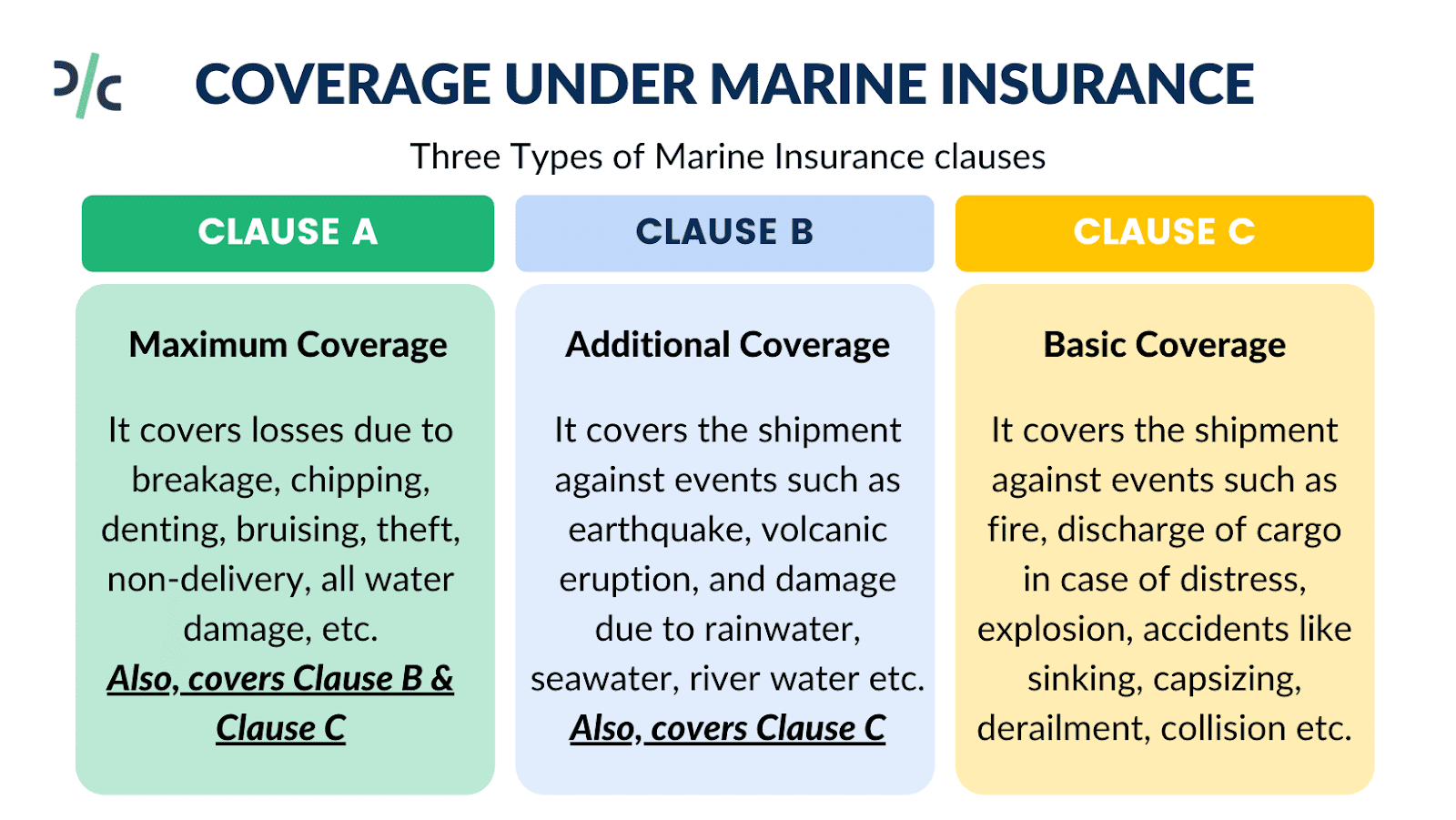

Marine Insurance Meaning Types Benefits Coverage Drip Capital

It provides excess limits when the limits of underlying liability policies are exhausted by the payment of claims.

Underlying coverage meaning insurance. That means if you want a higher policy limit on your commercial auto insurance you will need to already own that type of policy. And it provides protection against some claims not covered by the underlying policies subject. It drops down and picks up where the underlying policy leaves off when the aggregate limit of the underlying policy in question is exhausted by the payment of claims.

Coverage A read in pertinent part. Underlying Insurance clause requiring the insured to maintain the insurance cov - erage listed on the Schedule of Underlying Insurance an excess policy will separately require an insured to exhaust the underly-ing insurance before the excess insurers policy obligations are triggered. The provision typically refers to the policys schedule or declarations where all of the applicable underlying coverage is listed.

The coverage provisions of the Scheduled Underlying Policies are incorporated as part of this policy. Underlying Limit means the amount equal to the aggregate of all limits of liability as set forth in Item 4. Before you explore any umbrella insurance policy its important to remember that youll need the underlying coverage first.

It is often used when the insured entityperson or businessbuys policies aside from the primary policy with additional policies that provide excess coverage. Its primary function and the reason why another insurance cannot pay the same coverage at the same time is to negate the possibility of a person gaining profit from insurance in. Underlying Premium The ceding companys premium written or earned to which the reinsurance premium rate is applied to produce the reinsurance premium.

Whatever coverage was provided by the primary or underlying insurance. This coverage is also known as commercial general liability insurance CGL. Of underlying insurance without having seen the underlying policies or in many cases without even knowing the name of the underlying insurer leaving such matters to be advised.

Many excess liability policies state that they are follow form except with respect to certain terms and conditions. The condition created by two or more policies covering the same loss exposure that do not have identical inception and expiration dates. Underlying insurance means the insurance coverage provided under policies shown in the Schedule of Underlying Insurance or any additional policies agreed to by us in writing.

Thus such policies variously state that. A list of the names of the insurance companies providing the insurance underlying an umbrella policy along with the promised limits and types of insurance. We will pay those sums the insured becomes legally obligated to pay as damages arising out of an Occurrence which are in excess of the Underlying Insurance stated in Schedule A of this policy.

An underlying policy is insurance that covers a particular risk first. The umbrella policy serves three purposes. Other insurance covering the same risk will only pay out once this insurance is exhausted.

Concurrent insurance refers to two or more policies that cover the same exposure or risk as well as having the same policy period and coverage triggers. What Is Covered Under a Commercial Umbrella Insurance Policy. Were here to help you understand.

Underlying Limits means the amount shown in the Declarations and the certificate of coverage as the Minimum Required Underlying Limit for each coverage provided by the required underlying insurance. Additional amounts are charged for by the. Basic Limits The minimum amounts of insurance for which it is the practice to quote premiums in liability insurance.

It seems obvious but before there can be an excess policy there must be a primary policy in existence3 Normally excess policies are less expensive for an insured to obtain because the risk of having to pay out a claim is lower since there is already one layer of primary. Excess insurance that is subject to all of the terms and conditions of the policy beneath it. In the event of a conflict it is the underlying policy provisions that take precedence.

The underlying also called primary coverage typically consists of. You can get GLI as a standalone policy or bundle it with other key coverages with a Business Owners Policy BOP. Nonconcurrency of an insureds umbrella policies and the liability policies required by the umbrella as underlying insurance is a problem because the nonconcurrent policy terms make it possible for a loss under an.

Except as may be otherwise provided by the terms and. Means the policy or policies of insurance or coverage documents as described in the Declarations and Schedule of Underlying Coverage forming a part of this Policy. With respect to any given policy of excess insurance the coverage in place on the same risk that will respond to loss before the excess policy is called on to pay any portion of the claim.

Personal Automobile Homeowners Recreational Vehicle Miscellaneous Personal Liability. Of the Declarations for all Underlying Insurance plus the applicable uninsured retention if any under the Primary Policy. The insurance carrier has the right according to the policy language to waive this requirement by providing an Underlying Insurance Waiver.

Underlying Coverage with respect to any given policy of excess insurance the coverage in place on the same risk that will respond to loss before the excess policy is. MAINTENANCE OF UNDERLYING INSURANCE. Underlying coverage a practice referred to as following form For example such a policy might provide as follows.

General liability insurance GLI can help cover claims that your business caused bodily injury or property damage. It includes any policy issued to replace one of those policies during the term of this insurance that provides. Besides listing the various policies an umbrella policy requires that a specific limit of insurance be assigned to.

What Is A Personal Umbrella Policy And When Do You Need It Allstate Umbrella Insurance Insurance Marketing Umbrella

Getting Health Insurance In Mexico As An Expat Costs Hippie In Heels

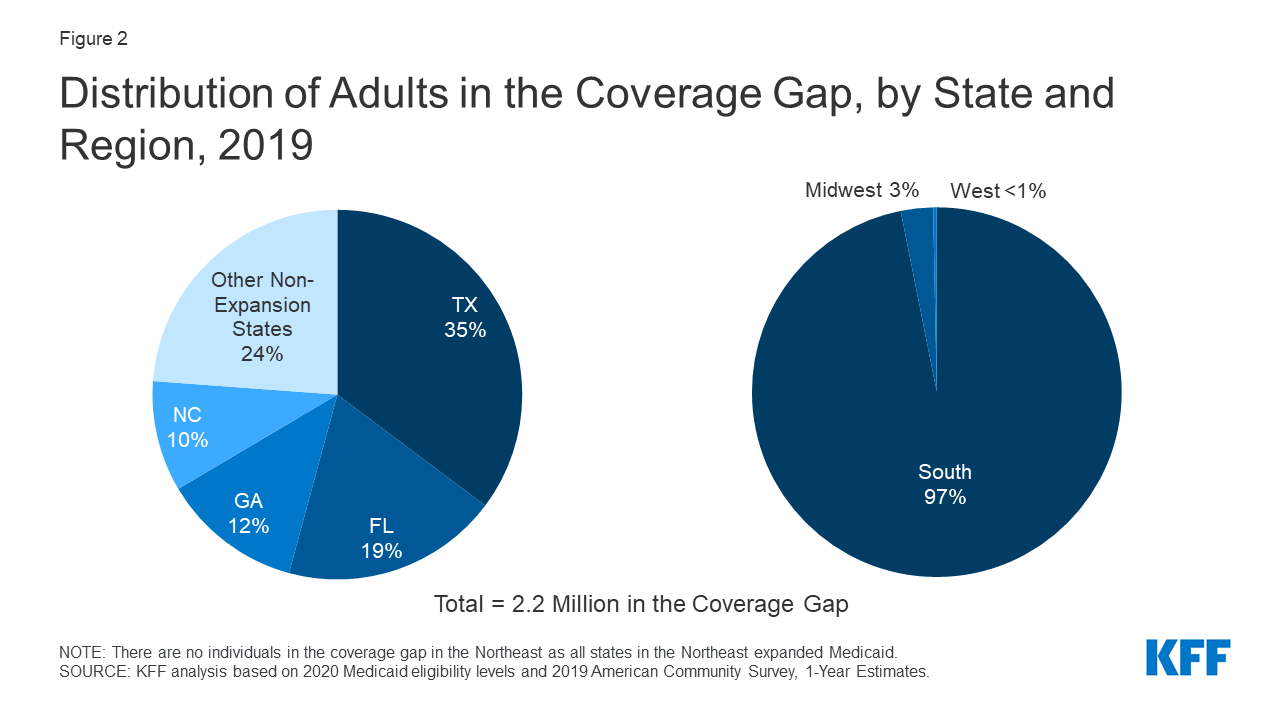

Is Covid 19 A Pre Existing Condition What Could Happen If The Aca Is Overturned Kff

Comparing Coverage Umbrella And Excess Liability

Limit Of Liability What You Should Know Insurance Dictionary By Lemonade

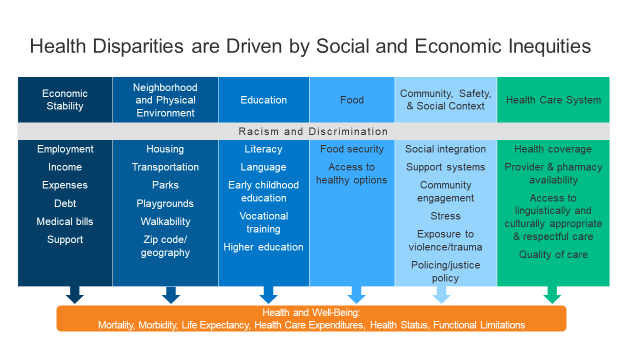

Disparities In Health And Health Care 5 Key Questions And Answers Kff

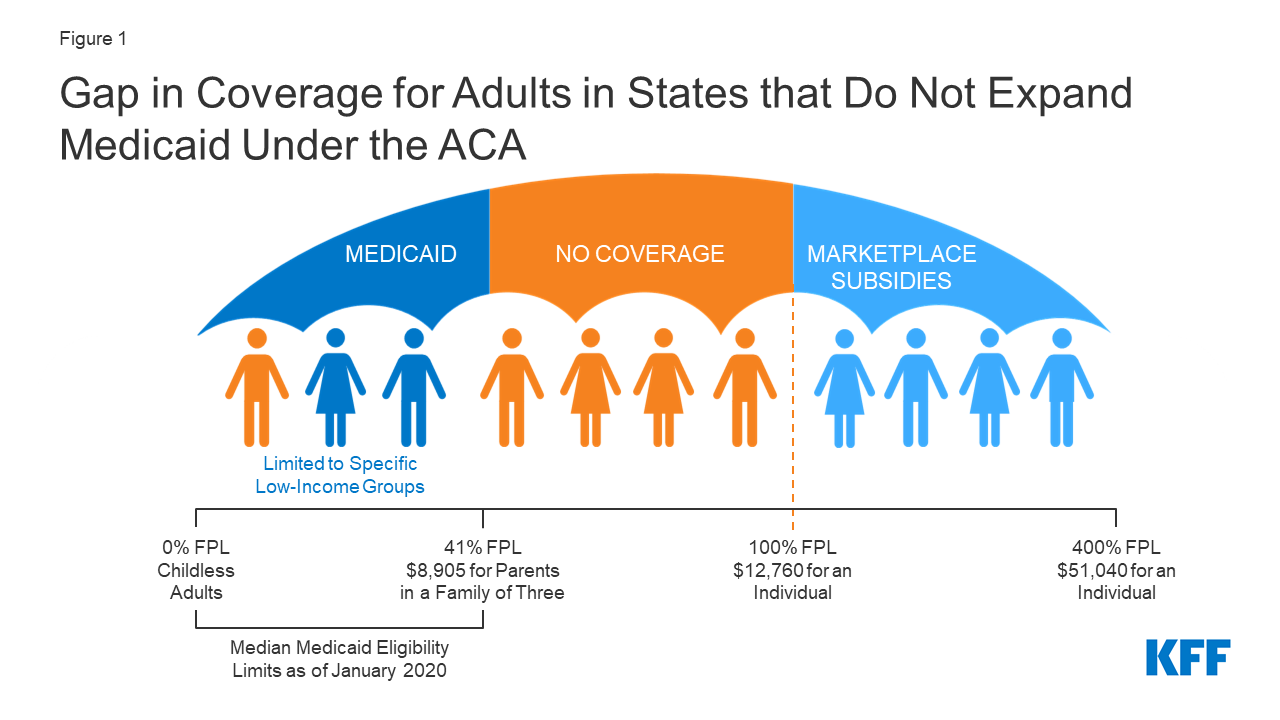

The Coverage Gap Uninsured Poor Adults In States That Do Not Expand Medicaid Kff

What Is The Difference Between Excess Liability And Umbrella Policies

Getting Health Insurance In Mexico As An Expat Costs Hippie In Heels

Third Party Vs Comprehensive Car Insurance 09 Oct 2021

What S The Difference Between Excess And Umbrella Insurance

The Coverage Gap Uninsured Poor Adults In States That Do Not Expand Medicaid Kff

Thanks To Our Teacher Satoshi Nakamoto For Teaching Us About Bitcoin Blockchain Helping Us To Move Forward In The Happy Teachers Day Teachers Day Teachers

Limit Of Liability What You Should Know Insurance Dictionary By Lemonade

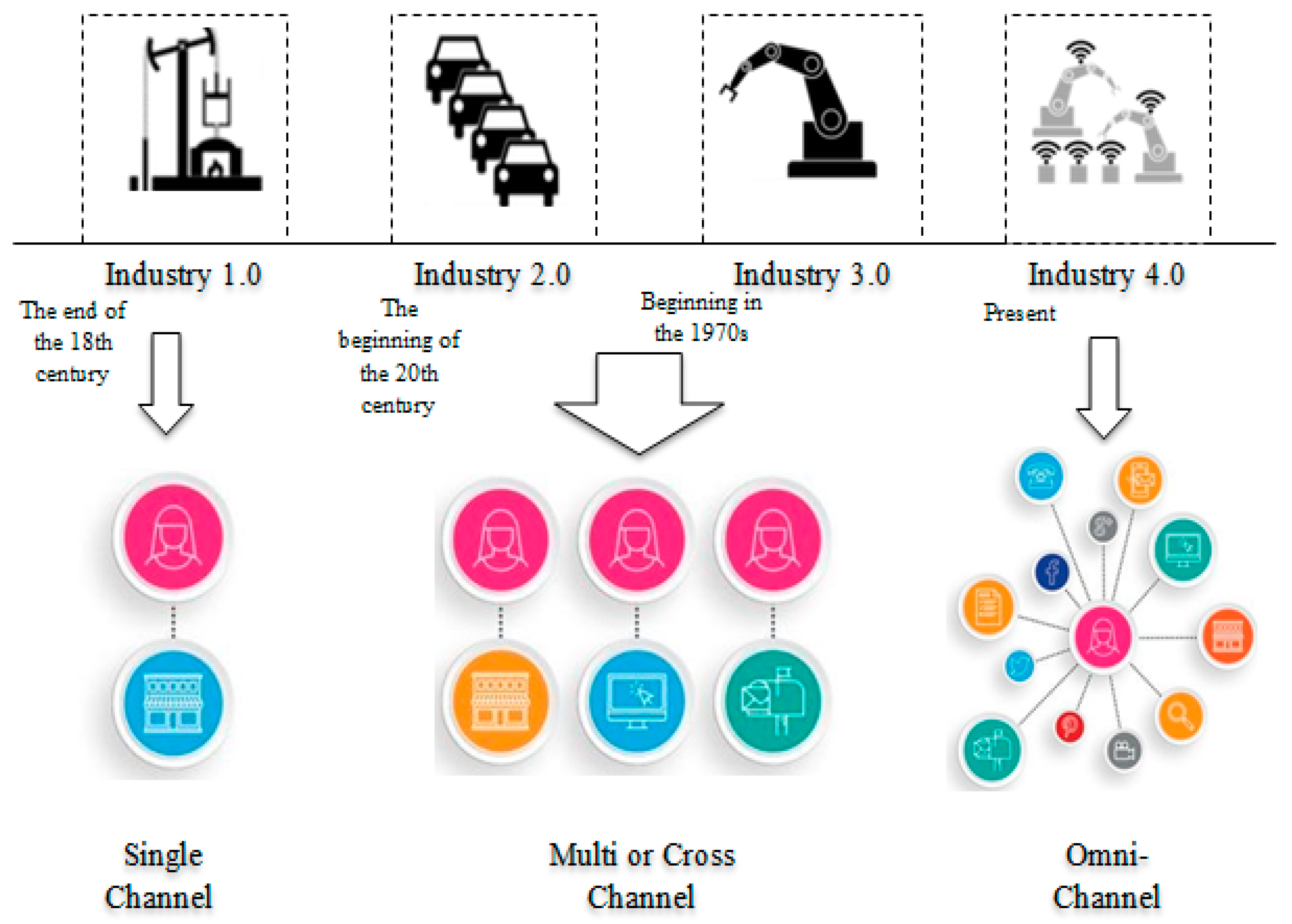

Ijfs Free Full Text Are We Ready For The Challenge Of Banks 4 0 Designing A Roadmap For Banking Systems In Industry 4 0 Html

The 8 Types Of Women You Absolutely Need In Your Friend Tribe For Her Types Of Women African Dating Philippine Women

Social Issues In Healthcare Maryville Online

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

Posting Komentar untuk "Underlying Coverage Meaning Insurance"