Title Insurance Standard Coverage Owner's Policy

Coverage Description Standard Coverage Expanded Endorsement Extended Coverage CoverageOne. The inability to transfer ownership The.

Provided Purchaser approves or is deemed to have approved the status of title to a Property during the Title Review Period for such Property Seller shall cause Title Company t.

Title insurance standard coverage owner's policy. Lenders Policy Protects the lender from losses in the event that the propertys mortgage is invalid or unenforceable. It is purchased for a one-time fee at closing and is valid for as long as the owner or his heirs have an interest in the property. What is owners title insurance.

Someone owns an interest in your title. Some home buyers may not be aware of the risks to title that exist and thus not understand the explicit value of broader coverage. Standard ALTA Policy PROVIDING PEACE OF MIND Available coverages may vary by jurisdiction endorsement selection and exceptions in policy.

The present version of the policy was adopted on June 17 2006 by the American Land Title Association after extensive revisions suggested by real estate professionals in the industry and its partners. A standard owners policy will cover you against matters that are on the public record as well as against specific problems with deeds including. Eagle Owners Policy vs.

Only an Owners Policy fully protects the buyer should a covered title. The standard coverage provided by ALTA Owners policy covers you for defects and liens in the history of your title through the date and time your deed is recorded in public records. The ALTA Homeowners policy offers the highest level of protection for homeowners that exceeds the coverage of the Standard or Extended policies.

An owners policy sets a maximum amount of coverage. Any notice of claim and any other notice or statement in writing required to be given to the Company under this Policy must be given to the Company at the address shown in Section 18 of the Conditions. There are two basic types of policies that provide title insurance coverage to owners of real property.

Someone else who owns an interest in your title ExtendedStandard 2. The First American Eagle Owners Policy provides expanded title coverage for owners of one-to-four family residences including condominiums. Title insurance for property owners called an Owners Policy is usually issued in the amount of the real estate purchase.

The ALTA 2006 Owners Policy with Standard coverage and the ALTA 1987 Residential Owners Policy with Owners Extended coverage OEC for short or Plain Language coverage. There are two types of Owners title insurance policies certified by the American Land Title Association ALTA the Owners policy and the Homeowners policy. The ALTA Homeowners policy provides enhanced coverage protecting you from additional risks including some that might occur after the policy is issued.

Enhanced Title Insurance Coverage. Along with the basics that are in the standard policy enhanced coverage also protects you from things. A Standard Owners title insurance also referred to as basic or limited provides basic coverage to homeowners and lenders such as.

Enhanced title insurance covers everything in the standard policy and tons more. Eagle Owners Policy of Title Insurance. Basic Title Insurance vs.

When we talk about the difference compared to extended insurance we can say that this second option offers greater coverage of the shortcomings of the title. The Owners policy protects you from defects and liens in the history of your title through the date and time your deed is. Understanding the differences between basic title insurance coverage and the enhanced title insurance coverage available from some companies can help you determine which of.

This Owners Policy provides more than safeguards for the title to your propertyit provides you with peace of mind. Compare Extended Coverage Owners Policy to a Standard Owners Policy. Owners title insurance provides protection to the homeowner if someone sues and says they have a claim against the home from before the homeowner purchased it.

When you purchase your home you receive a document most often called a deed which shows the seller transferred their legal ownership or title to their home to you. Someone has rights affecting your title from leases contracts or options. Its the kitchen sink policy.

What is Title Insurance. Understanding the Owners Policy for Title Insurance The Owners Policy has its origins in a form of policy adopted by the American Land Title Association in 1970 and revised in 1984 and 1992. Any defect in or lien or encumbrance on the title Unmarketability of the title ie.

Defective recording of any document ExtendedStandard 5. ˈtī-təl in-ˈshur-ən ts Insurance against loss due to an unknown defect in a title or interest in real estate. Someone claims title rights arising out of forgery or impersonation.

By Heather Munro Comments. BLANK TITLE INSURANCE COMPANY. Forgery fraud duress in the chain of title ExtendedStandard 4.

In other words title insurance covers past title problems that come up after you buy or refinance a property. As with any insurance contract the insuring provisions express the coverage afforded by the title insurance policy. Standard title insurance also provides for the impossibility of selling or disposing of property as well as loan insurance due to intangible title.

It even covers some things post-policy. OWNERS POLICY OF TITLE INSURANCE. A document that is not properly signed ExtendedStandard 3.

Owners Policy Protects the property owner from various title-related losses that are listed in the insurance policy for as long as the property is owned. This policy is issued to the owners of either residential or. The ALTA 2006 Owners Policy with standard coverage.

An owners title insurance policy can cover the costs of paying off a previously undiscovered lien or defending against a lawsuit filed against you by.

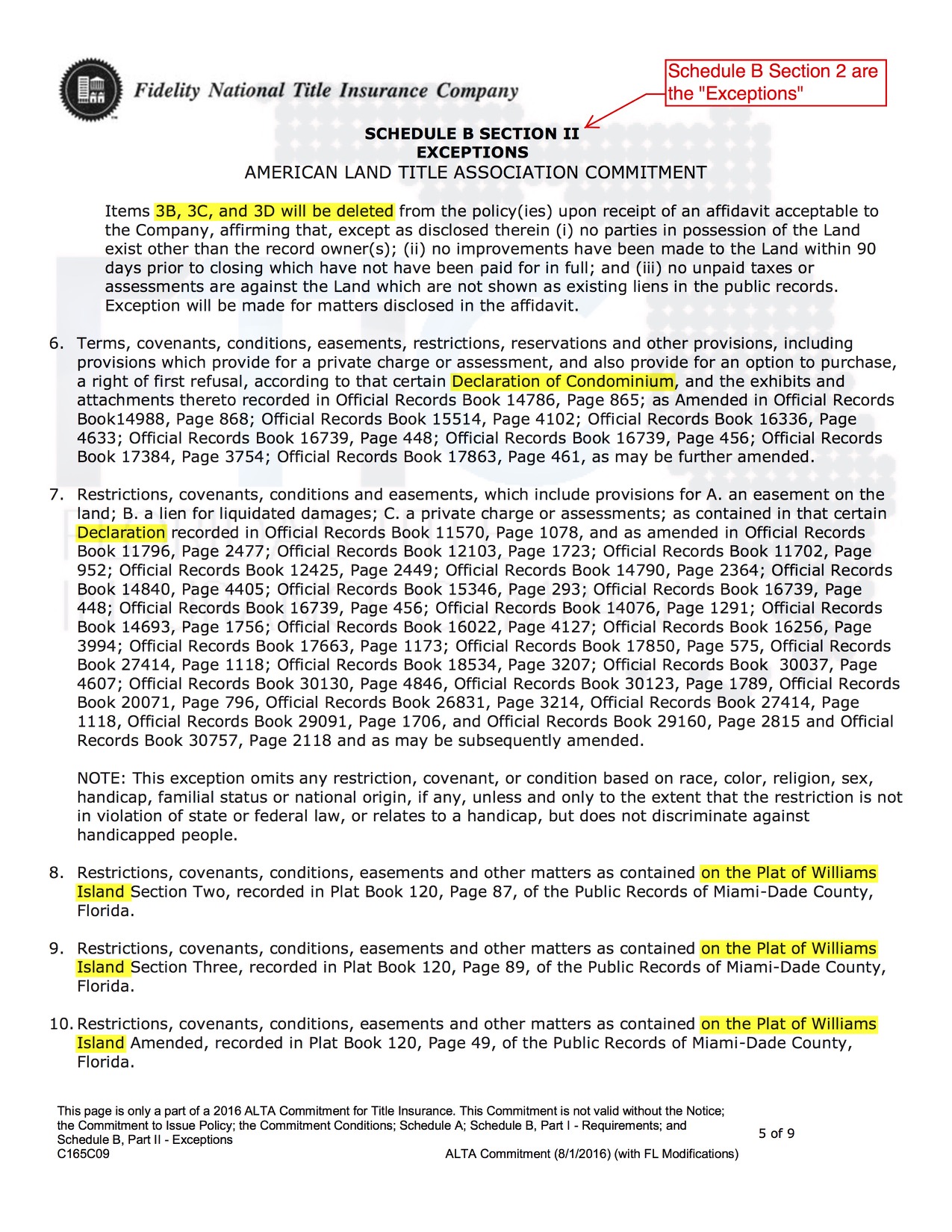

How To Read A Title Commitment Florida S Title Insurance Company

Parts Of A Title Policy Home Closing 101

Title Commitments Title Insurance Standard Exceptions To Coverage The Closing Agent

Home Buyers Cover Your Assets Choosing Between Standard And Extended Title Insurance Deeds Com

How To Read A Title Commitment Florida S Title Insurance Company

What Is A Title Commitment And How Do I Read It First Alliance Title Colorado

Parts Of A Title Policy Home Closing 101

How To Read A Title Commitment Florida S Title Insurance Company

What Is A Title Commitment And How Do I Read It First Alliance Title Colorado

How To Read A Title Commitment Florida S Title Insurance Company

Comparing The Two Types Of Owner S Title Insurance Policies Land Title Land Title Guarantee Company

What Is A Title Commitment And How Do I Read It First Alliance Title Colorado

The Difference Between A Clta And Alta Title Policy Schorr Law

Parts Of A Title Policy Home Closing 101

Parts Of A Title Policy Home Closing 101

Posting Komentar untuk "Title Insurance Standard Coverage Owner's Policy"