Insurance Policy Covering Covid 19

There are no federal requirements that specifically require coverage of COVID 19 treatment. Certain is cover for the additional accommodation and travel costs if you are forced to extend your holiday because of Covid-19.

Medical Travel Insurance For Pre Existing Conditions Staysure

Scheduled airline failure insurance SAFI To cover you if your airline goes bust.

Insurance policy covering covid 19. No insurance policy covers your. Therefore you need travel insurance policies that cover not only medical expenses while traveling but also unforeseen scenarios such as emergency medical evacuation trip cancellations or interruptions due to COVID19 besides other conditions covered under a travel insurance policy. This protects the family from any financial issue due to any unfortunate event because of coronavirus.

This coverage must be provided without consumer cost sharing. At the outset it must be stated that this Article will speak in general terms and that each insurance policy must be examined in its own light. Hence a term insurance policy that covers the Covid-19 claims is beneficial to have.

Through the release the insurance regulator said that as an acknowledgement of their contribution towards the fight against the deadly novel coronavirus doctors nurses and other health care workers will get a 5 discount on the premium through the Corona Kavach policy. Corona Kavach Policy is a standard coronavirus health insurance policy that covers hospitalization expenses home care treatment cost ambulance charges cost of PPE kits medicines gloves masks doctor fees ICU charges incurred during the treatment of COVID-19 pandemic. We want to reassure you that whilst we are all doing things slightly differently right now were doing everything we can to keep you updated on how coronavirus COVID-19 affects your insurance.

All this comes as Covid-19 uncertainty continues to make. Almost all health insurance policies now offer cover for the treatment of coronavirus in India. Typically policies with cover for COVID-19 disruption will offer cover for.

A free insurance policy that covers the main costs - of medical expenses transportation and extension of stay so that all you have to do is enjoy yourself. Many consumers are currently in a vulnerable position because of the coronavirus Covid-19 pandemic. Insurance and coronavirus Covid-19.

Our ratings will tell you how much Covid cover an insurer has. What COVID-19 risks can travel insurance cover. Most insurance policies now include cover for risks linked to Covid-19 should you need medical treatment for the virus or need to cut your holiday short due to a Covid-19-related issue.

We expect insurers given the unprecedented impact of coronavirus to be aware of. Cancellation if you or anyone covered by the policy gets coronavirus before you travel. The Corona Kavach is a COVID-19 specific standard health insurance policy which is available as an individual and family floater policy.

More and more insurance companies are covering COVID-19 whether through individual insurance products or their regular products. There are no guarantees that your existing insurance policy will cover Covid-19-related risks. Some policies do cover you if.

Medical costs if you or anyone covered by the policy gets coronavirus while youre abroad. Of the 40 insurance brands that participated in both surveys and are currently selling policies 16 40 improved their Covid-19 cover while the remaining 24 60 kept their cover the same. But those breaks will end possibly soon and lead to denials of coverage or higher rates for some survivors of the virus.

Coronavirus cancellation cover Youll need this if you want to be able to claim on insurance for refunds if Covid stops you travelling for any reason. Before you purchase any policy ensure to read all plan. If you already have a travel insurance contract your insurance company may have added an endorsement to it to clarify the conditions specific to COVID-19.

The first thing that one should examine is whether the insurance policy contains any general exclusions. Life Insurance with COVID-19 Cover supports the policyholder by covering hospitalisation costs of up to Rs 5 Lakh on minimum 24 consecutive hours of hospitalisation on the first-ever diagnosis of COVID-19 condition along with death benefit from the life cover. Check the details of your policy or contact your insurer for confirmation of the extent of cover.

In these testing times one never knows what lies ahead. Travel insurance providers should still include cover for COVID-19 even if you have pre-existing medical conditions as long as you declare the condition when you take out the policy. Health insurance plans to cover COVID-19 testing administration of the test and related items and services as defined by the acts.

Generally term plans only provide death benefit due to illness if the insured succumbs to critical ailments such as. Squaremouth recommends a minimum of 100000 in emergency medical and medical evacuation coverage in order to account for COVID-19 related medical care and evacuation expenses. A COVID-19 term insurance plan is essentially a traditional insurance plan that provides an additional financial cover against death due to COVID-19.

Our expectations of firms. Covid-19 health insurance policy is a customised health insurance aimed at covering hospitalisation pre-hospitalisation and post-hospitalisation expenses and other medical expenses arising due to the treatment of COVID-19. At the moment having had COVID-19 isnt a threat to getting life insurance or a reason to be charged more for a policy.

To help answer your questions weve pulled together some guidance below for each of our policies and continue to update these pages as things develop. This means youll have cover for cancellation or curtailment as well as emergency medical expenses if youre diagnosed with COVID-19 both at home and on your holiday. COVID-19 travel insurance policy Below you can find all the details of the insurance policy offered by the Canary Islands to tourists who visit the archipelago.

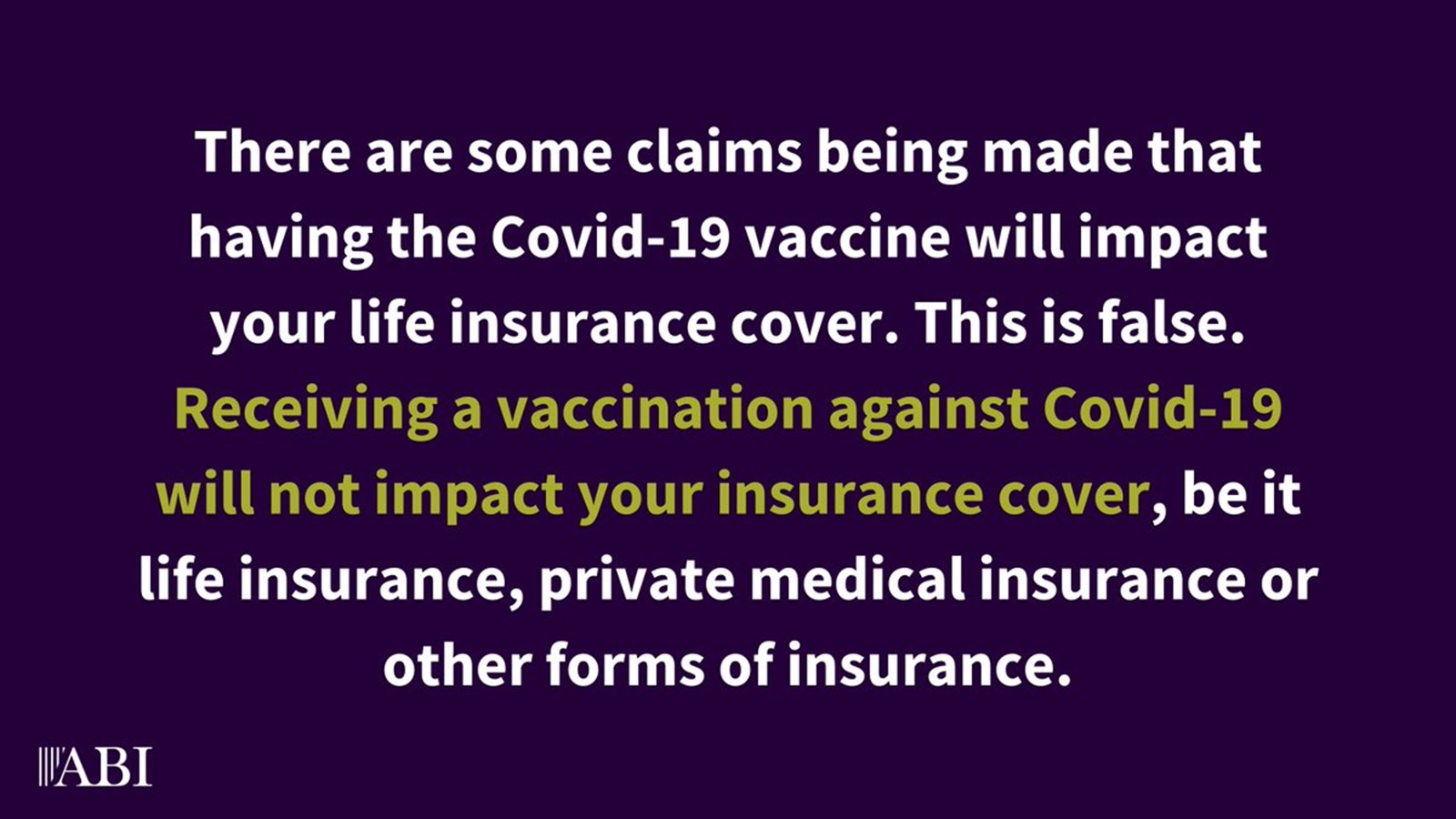

The public are unsure of how their various insurance policies deal with Covid-19. Travel Insurance With Covid Cover Money Saving Expert Tips for the pandemic travelerHowever some medical plans may coverWhether you are traveling to the usa or you are traveling outside the usa you can be covered if you get sick from coronavirus as long as you are infected after the effective date of the policyOur choice expert answers your questions.

Covid 19 Insurance Coronavirus Health Insurance Policy Starts 276 Mo

Travel Insurance And Covid 19 Insurance For Th Axa Thailand

Luma Covid 19 Insurance For Foreigners

Vaccine Coverage Pricing And Reimbursement In The U S Kff

Covid 19 Medical Plan Coverage Prudential Malaysia

Health Insurance For Covid Coronavirus Insurance Bajaj Allianz

Covid 19 Vaccine Is It Covered In Your Health Insurance Policy

Private Health Coverage Of Covid 19 Key Facts And Issues Kff

Covid Insurance For Foreigners In Thailand

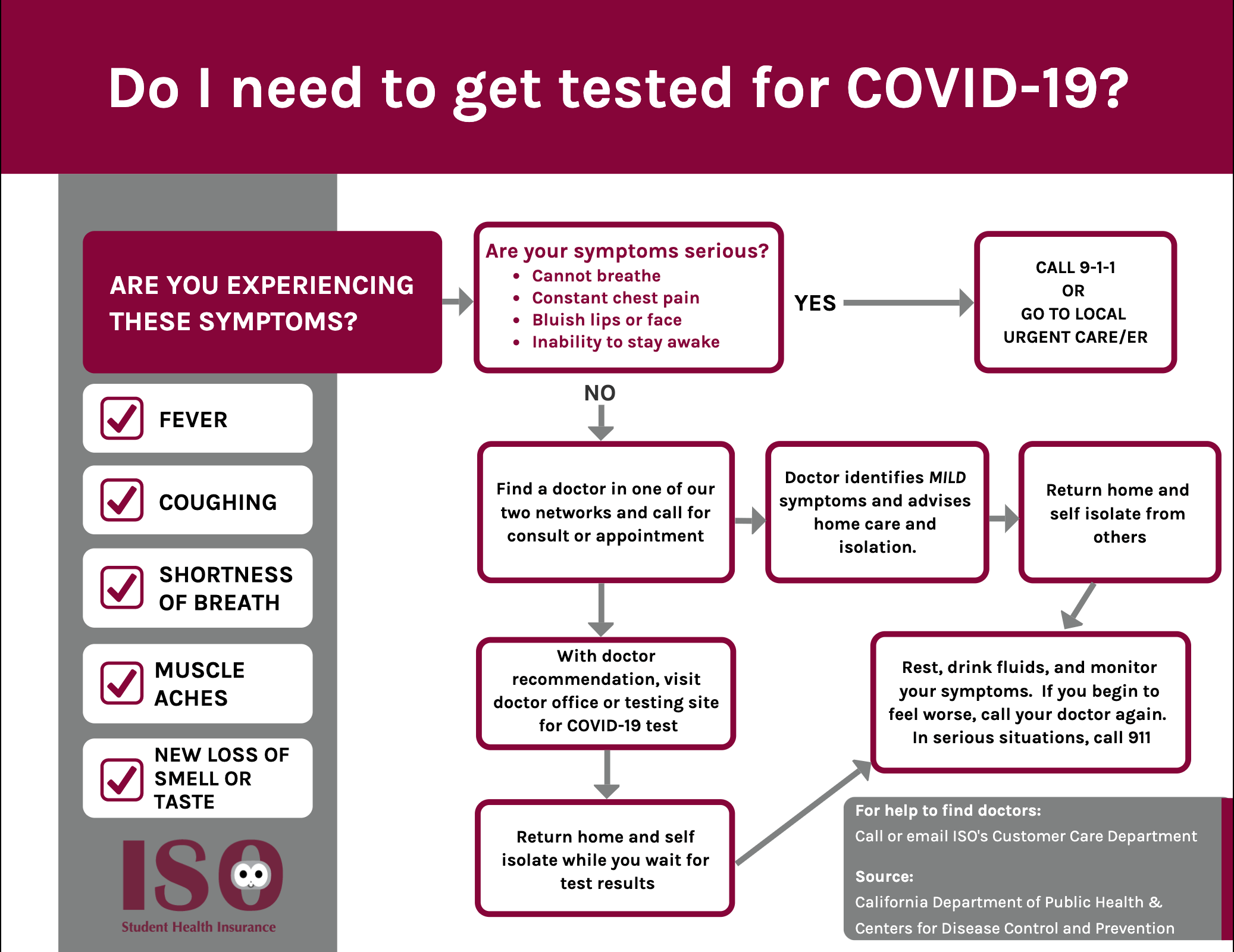

Iso International Student Insurance

Pharmacy Hours Online Services Coronavirus Updates City Market

Five Health Insurance Lessons From The Covid Pandemic

Misleading Marketing Of Short Term Health Plans Amid Covid 19

Covid Insurance For Foreigners In Thailand

Covid 19 Travel Insurance For Citizens Individual Tawuniya

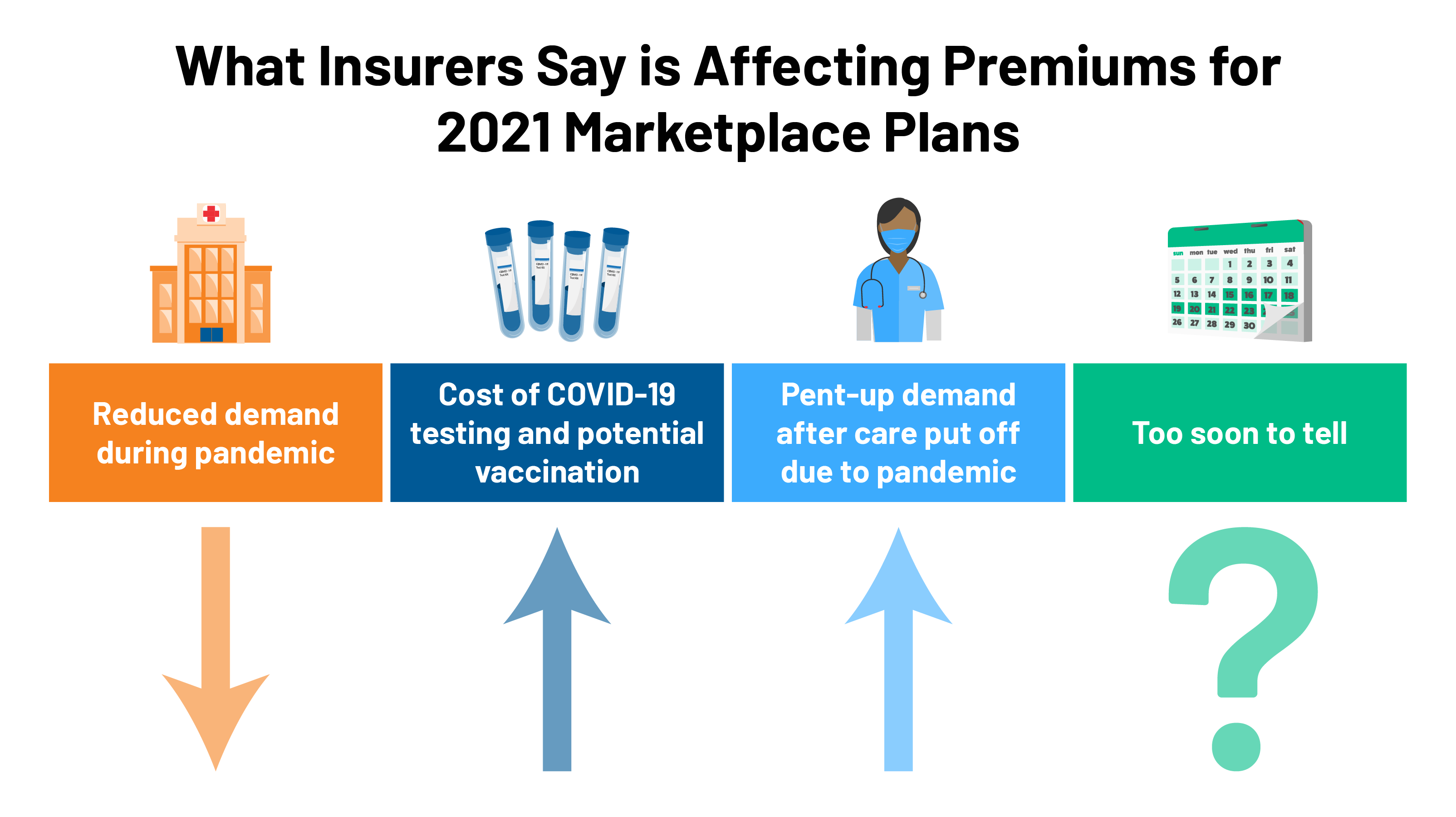

2021 Premium Changes On Aca Exchanges And The Impact Of Covid 19 On Rates Kff

Five Things To Know About The Cost Of Covid 19 Testing And Treatment Kff

Posting Komentar untuk "Insurance Policy Covering Covid 19"