Term Insurance Cover Covid Death

Traditional life insurance policies such as whole and term life likely cover deaths from COVID-19 according to spokespeople from industry research. Accidental Death Insurance does not cover death from disease or illness so it wont cover you for COVID-19.

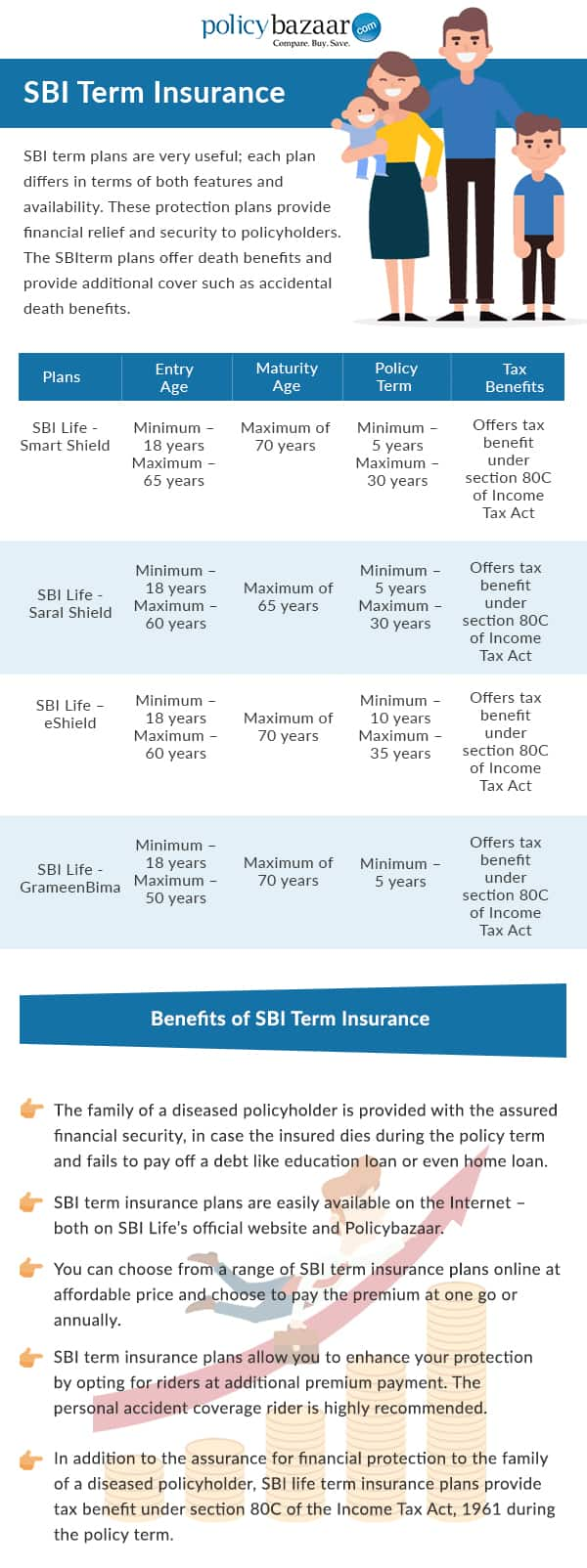

Sbi Term Insurance Compare Sbi Term Plans Online

It means death due to COVID.

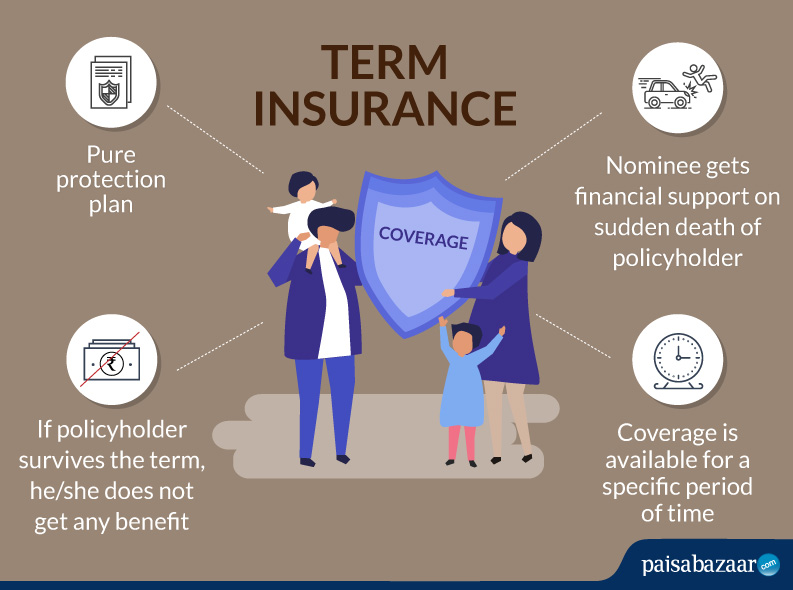

Term insurance cover covid death. A COVID-19 term insurance plan is essentially a traditional insurance plan that provides an additional financial cover against death due to COVID-19. If you die of a heart attack cancer an infection kidney failure stroke old age or some other natural cause your beneficiaries will receive. Term insurance protects your family from potential threats and provides adequate coverage for your loved ones after your demise.

The importance of this coronavirus insurance cannot be overlooked as the spread. A In a policy of insurance which covers death due to accident the peril insured against is an accident. At this point coronavirus term insurance essentially implies that in case of any eventuality caused due to the COVID-19 a life insurance policy will take care of you and your family.

We understand that thousands of Canadians have had their travel plans interrupted due to the COVID-19 pandemic. The truth about COVID-19 vaccination and insurance coverage Recently there has been misinformation circulating on social media raising concerns that getting vaccinated for COVID-19 could negatively affect a customers existing life insurance policies or valid Group Benefits coverage with Manulife or prevent Canadians from getting new life or health insurance coverage. Generally term plans only provide death benefit due to illness if the insured succumbs to critical ailments such as cancer stroke and heart disease.

Can I Get Life Insurance Now Despite the Emergence of COVID-19. Death benefit is the agreed amount of money sum assured payable by the insurer upon the death. While no one can replace the loss of a loved one a term insurance plan that covers COVID-19 life claims can offer grieving families financial security and protection.

We are working with each client to offer personalized advice and solutions while reviewing each travel claim. How RBC Insurance is supporting travel insurance clients. This means that when the insured person dies the death benefit is paid to the nominee or the beneficiary nominee after a valid life insurance claim is filed.

Life insurance covers death due to natural causes. The scheme is a one-year term insurance cover stretching from June 1 to May 31 renewable from year to year. The name of these types of Coronavirus insurance plans is to be kept uniform across the industry followed by the insurance companys name.

Term insurance plan covers health related death or natural death. The death can be due to diseases or a medical condition which ultimately results in the death of the policy. Term insurance is especially important at a time like this as it can help your loved ones move on with their lives with dignity.

As per policy terms and conditions. The Indian government aims to address the need for an insurance cover for COVID-19through two different types of COVID-19 insurance. It offers life insurance cover for death due to any cause.

The importance of such policies cannot be overstated in these trying times when the COVID-19 virus has swept the globe. As long as a life insurance policy is in good standing it will pay death benefits if the policyholder dies from COVID-19. The life insurance policy is for accidental death insurance ADD insurance.

Under such circumstances the nominee of the policy holder will be paid the sum assured of the term plan. Dread disease riders on life insurance policies only cover. An untoward happening or occurrence which is unforeseen and unexpected in the normal.

The Covid-19 pandemic is considered a once-in-a-lifetime event which has resulted in unprecedented death claims for our industry and yet life insurers are able to. Many insurers are still granting life insurance approval during the pandemic. In most cases people who have term or whole life insurance already will be covered which means insurance companies will pay out for deaths related to COVID-19.

The term insurance offered by Max Life Insurance offers a death benefit which provides a family with the sum insured amount in case the insured person passes due to contracting theCovid-19. COVID-19Coronavirus Travel Insurance Claims Process. An existing life insurance policy may cover coronavirus.

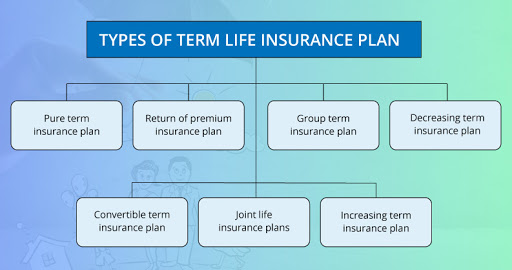

Term insurance policies are simple protection plans that provide financial stability to your family in the event of your death while the policy is in effect. Types of COVID-19 Insurance. However a local lawyer.

In case the policyholder dies due to any type of critical illness or medical condition the beneficiary of the policy will get the Sum Assured as the death benefit. In most cases life insurance policies will cover a person if they lose their life due to COVID-19. The natural death or death caused by health-related issues is covered by term life insurance plans.

What Happens In Term Vs Whole Life Insurance What Is Term Insurance What Is Whole Life Insurance What Are Thei Whole Life Insurance Term Life Life Insurance

Download Family Under Umbrella For Free Umbrella Insurance Life Insurance Facts Life Insurance Quotes

Benefits Of Term Insurance Plan Life Insurance Marketing Life Insurance Marketing Ideas Life Insurance Facts

Sbi Term Insurance Compare Sbi Term Plans Online

The Definition Of Term Insurance Term Is Limited Time Life Insurance Insurance Usua Life Insurance Quotes Permanent Life Insurance Universal Life Insurance

Term Insurance Compare Term Insurance Plans Online In India Oct 2021

Best Term Insurance Plans India 2021 Premiums Features

Term Insurance Compare Term Insurance Plans Online In India Oct 2021

Types Of Deaths Covered And Not Covered By Term Insurance

Term Insurance Compare Term Insurance Plans Online In India Oct 2021

2021 Guide To Term Life Vs Whole Life Insurance Definition Pros Cons

Term Insurance Coverage Claim Exclusions

Illustration Of Retirement Plan Free Image By Rawpixel Com Retirement Planning How To Plan Money Plan

Term Insurance Coverage Claim Exclusions

Insurance Cartoons Randy Glasbergen Today S Cartoon Life Insurance Affordable Life Insurance Marriage Cartoon

Insurancequotes En 2020 Finanzas Personales Seguro De Vida Finanzas

Posting Komentar untuk "Term Insurance Cover Covid Death"